北美财富管理平台市场预测至 2028 年 - COVID-19 影响和区域分析(按咨询模型(人工咨询、机器人咨询和混合)、业务功能(绩效管理、风险与合规管理、投资组合会计和交易管理、财务)建议管理、报告等)、部署类型(云和本地)和最终用户(投资管理公司、贸易和交易所公司、银行、经纪公司等)

No. of Pages: 140 | Report Code: TIPRE00029199 | Category: Technology, Media and Telecommunications

No. of Pages: 140 | Report Code: TIPRE00029199 | Category: Technology, Media and Telecommunications

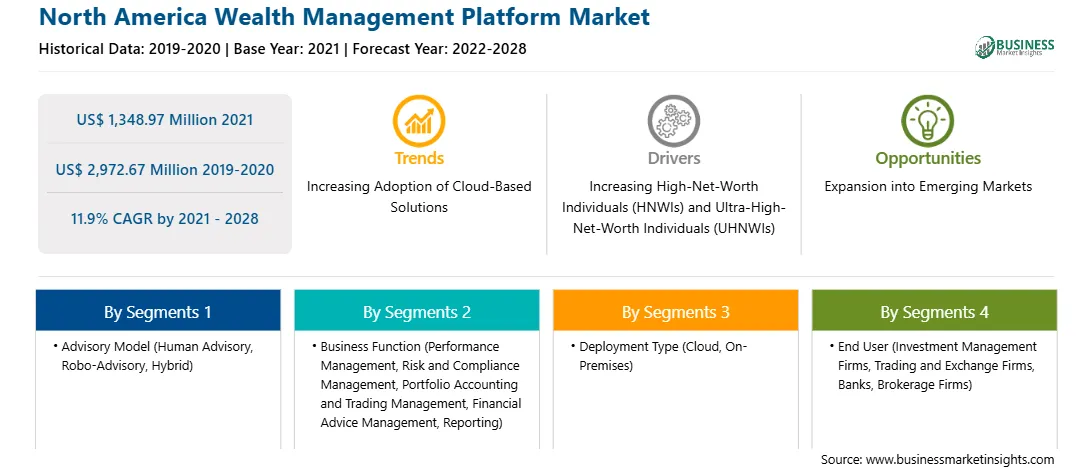

美国、加拿大和墨西哥是北美主要经济体。金融部门不断采用先进技术,以更便宜、更高效的方式提供金融服务。这些先进的创新技术在2007年至2008年的全球金融危机期间引起了人们的关注,当时对传统银行实施了严格的规定,而IT行业的创新则增加了非银行和科技型金融企业扩张的动力。例如,金融领域的一些技术革命包括移动支付、ATM(自动柜员机)和使用区块链的贸易融资。财富管理服务中的技术中断包括机器人顾问和自动化财务顾问,旨在与人类顾问竞争。机器人顾问为实现目标的各种投资技巧提供建议,例如为重大开支、退休以及维持收入流以有效处理开支进行储蓄。与涉及人工咨询的传统服务相比,机器人咨询管理财富服务的优势在于易于获取、价格实惠,并且能够为客户提供随时随地获取财务建议和处理投资的选择,互联网连接。机器人咨询允许财富管理公司以低廉的费用提供服务,从而使他们能够扩展到目标市场。北美是第一个引入自动化财务顾问(机器人咨询)的地区。美国的财富管理机构和银行已经实施了机器人顾问服务,以提供全面、有效、高效的服务。导致该技术在该地区早期接受的关键原因是成本和可及性的增加,以及互联网普及率不断提高和廉价的财政援助费用的支持。这些因素促进了北美财富管理平台市场的增长。

凭借新功能和技术,供应商可以吸引新的客户客户并扩大其在新兴市场的足迹。这一因素可能会推动北美财富管理平台市场的发展。预计该市场在预测期内将以良好的复合年增长率增长。

北美财富管理平台市场细分

北美财富管理平台市场细分为咨询模型、业务功能、部署类型、最终用户和国家/地区的基础。根据咨询模式,市场分为人工咨询、机器人咨询和混合咨询。 2020年,人力咨询细分市场占据最大的市场份额。北美财富管理平台市场按业务功能细分为绩效管理、风险与合规管理、投资组合会计和交易管理、财务咨询管理、报告等。投资组合会计和交易管理领域在 2020 年占据了最大的市场份额。根据部署类型,市场分为云和本地。基于云的细分市场在 2020 年占据了更大的市场份额。北美财富管理平台市场按最终用户划分,分为交易和交易所公司、银行、经纪公司、投资管理公司等。 2020 年,投资管理公司细分市场占据最大市场份额。按国家/地区划分,北美财富管理平台市场分为美国、加拿大和墨西哥。 2020 年,美国占据最大市场份额。 Broadridge Financial Solutions, Inc.;科马奇 SA; FIS 全球;费瑟夫公司;投资云;投资边缘公司;配置文件软件 SA; SEI 投资开发公司; SS&C 技术公司;和 Temenosquarters SA 是市场上的领先公司。

Strategic insights for North America Wealth Management Platform involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,348.97 Million |

| Market Size by 2028 | US$ 2,972.67 Million |

| Global CAGR (2021 - 2028) | 11.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By 咨询模式

|

| Regions and Countries Covered | 北美

|

| Market leaders and key company profiles |

The regional scope of North America Wealth Management Platform refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The North America Wealth Management Platform Market is valued at US$ 1,348.97 Million in 2021, it is projected to reach US$ 2,972.67 Million by 2028.

As per our report North America Wealth Management Platform Market, the market size is valued at US$ 1,348.97 Million in 2021, projecting it to reach US$ 2,972.67 Million by 2028. This translates to a CAGR of approximately 11.9% during the forecast period.

The North America Wealth Management Platform Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Wealth Management Platform Market report:

The North America Wealth Management Platform Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Wealth Management Platform Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Wealth Management Platform Market value chain can benefit from the information contained in a comprehensive market report.