北美投资者 ESG 软件市场至 2030 年预测 – 区域分析 – 按组成部分 [软件和服务(培训市场、集成市场和其他服务市场)] 和企业规模(大型企业和中小企业)

No. of Pages: 65 | Report Code: TIPRE00023471 | Category: Technology, Media and Telecommunications

No. of Pages: 65 | Report Code: TIPRE00023471 | Category: Technology, Media and Telecommunications

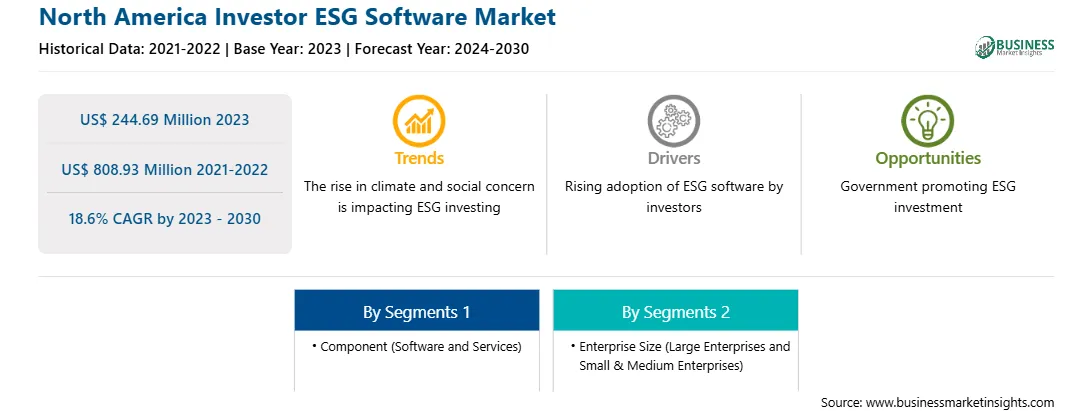

约 90% 的气候科学家们一致认为,气候变化正在迅速发生,而人类活动被认为是其主要原因。许多发展中国家应对气候变化的努力受到一些政治和实际障碍的阻碍。此外,气候变化为 ESG 投资者提供了受益的机会,同时仍然支持他们所信仰的事业。此外,根据一些立法者和倡导者的说法,美国女性的收入仍然仅为男性从事相同工作的 78%。其他人则对得出这一数字的方法提出质疑。许多 ESG 投资者都担心高管薪酬。各大公司因将高管薪酬降低至更公平的水平而成为头条新闻,为属于这一阵营的投资者提供福利。因此,全球日益增长的环境和社会问题正在影响 ESG 投资者,从而有助于采用投资者 ESG 软件进行更好的数据分析和跟踪。

美国、加拿大和墨西哥是北美投资者 ESG 软件市场的主要贡献者。美国是全球最大的技术投资者,但在环境、社会和治理(ESG)投资方面落后于欧洲。根据可持续投资联盟的数据,2018年美国的全球可持续资产为11.9万亿美元,而欧洲为14万亿美元。根据可持续和责任投资平台美国SIF的数据,可持续投资目前占其管理资产的25%。滞后的原因并不是对 ESG 缺乏兴趣。资产管理公司施罗德的一项调查显示,超过60%的美国人认为投资基金应该考虑可持续性因素。然而,只有 15% 的人声称他们将资金投入到可持续主题的投资中。根据 Natixis 对 401,000 名计划参与者的年度调查,70% 的千禧一代表示,如果他们能够获得可持续投资选择,他们将首次参与计划或提高缴款率。可持续投资于 1994 年获得美国劳工部 (DoL) 批准,将其定位为两个其他方面相同的基金之间的决胜局。

北美投资者 ESG 软件市场细分为组件、企业规模和国家/地区。

根据组成部分,北美投资者 ESG 软件市场分为软件和服务。 2023年,软件细分市场在北美投资者ESG软件市场中占据较大份额。

根据企业规模,北美投资者ESG软件市场分为中小企业和大型企业。 2023 年,大型企业细分市场在北美投资者 ESG 软件市场中占据较大份额。

按国家/地区划分,北美投资者 ESG 软件市场分为美国、加拿大和墨西哥。 2023 年,美国在北美投资者 ESG 软件市场中占据主导地位。

Conservice, LLC;绿石+有限公司;路孚特有限公司; Collibra(自己的分析);阿拉伯式花纹组;数据马兰;清晰度人工智能;和 S&P Global Inc 是北美投资者 ESG 软件市场上的一些领先公司。

Strategic insights for North America Investor ESG Software involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 244.69 Million |

| Market Size by 2030 | US$ 808.93 Million |

| Global CAGR (2023 - 2030) | 18.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By 组件

|

| Regions and Countries Covered | 北美

|

| Market leaders and key company profiles |

The regional scope of North America Investor ESG Software refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The North America Investor ESG Software Market is valued at US$ 244.69 Million in 2023, it is projected to reach US$ 808.93 Million by 2030.

As per our report North America Investor ESG Software Market, the market size is valued at US$ 244.69 Million in 2023, projecting it to reach US$ 808.93 Million by 2030. This translates to a CAGR of approximately 18.6% during the forecast period.

The North America Investor ESG Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Investor ESG Software Market report:

The North America Investor ESG Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Investor ESG Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Investor ESG Software Market value chain can benefit from the information contained in a comprehensive market report.