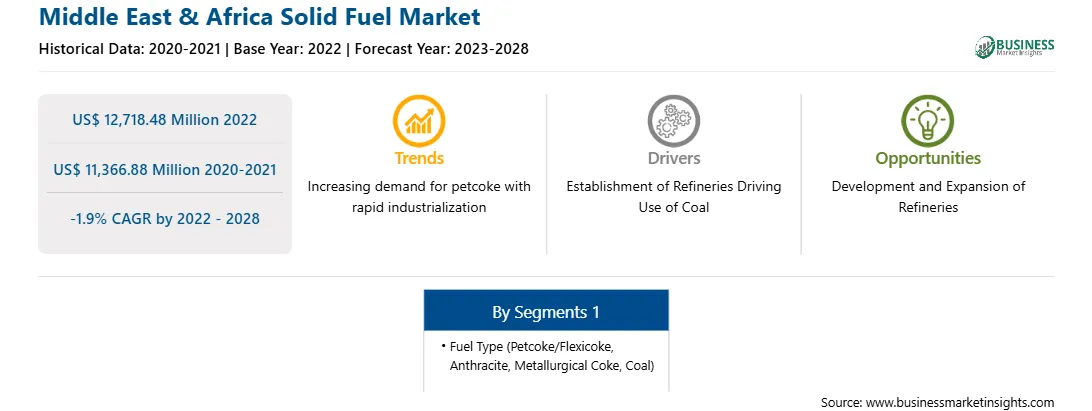

中东和非洲固体燃料市场预测至 2028 年 - COVID-19 影响和按燃料类型(石油焦/灵活焦、无烟煤、冶金焦和煤炭)进行的区域分析

No. of Pages: 97 | Report Code: BMIRE00028478 | Category: Energy and Power

No. of Pages: 97 | Report Code: BMIRE00028478 | Category: Energy and Power

中东和中东地区2022年非洲固体燃料市场价值为127.1848亿美元,预计到2028年将达到113.6688亿美元;预计2022年至2028年复合年增长率为-1.9%。

炼油厂的发展和扩张正在推动中产阶级的发展东&非洲固体燃料市场

2022年6月,IEA石油市场报告预测,2023年全球净炼油能力将额外增加160万桶/日。扩建或新炼油产能增长包括正在进行的各种高产能炼油项目,特别是在中东和中国。上述地区和国家未来两年新增产能有望超过400万桶/日。 2021年,中东炼油厂产能大幅扩张。在沙特阿拉伯,日产能40万桶的Jizan炼油厂于2021年底投产,并于2022年初开始出口石油产品。

因此,炼油厂的扩张将增加固体燃料的使用,预计这将在预测期内为固体燃料市场提供利润丰厚的机会。

中东和中东地区非洲固体燃料市场概况

该地区拥有丰富的石油储量、煤炭生产和炼油厂。由于阿联酋、伊拉克、阿曼和沙特阿拉伯的新炼油厂项目已启动,预计到 2023 年底,石油产品销量将达到 8-900 万桶/日。就能源领域的煤炭使用量而言,最大的硬煤市场是亚太地区,占全球统计数据的54%。此外,中东对煤炭能源也很感兴趣。中国是该地区煤炭使用量最大的商业伙伴。阿联酋、摩洛哥和以色列等国家以煤炭使用量高而闻名。

该地区三大石油生产国是伊拉克、伊朗和沙特阿拉伯。阿曼、卡塔尔、科威特和阿联酋是区域石油联盟中的下一个国家。然而,巴林和也门的总产量接近 100 万桶/天。 2021 年,该地区有 13 个国家拥有活跃的炼油厂,总炼油能力为 12,145 mbd。主要活跃炼油厂有 Ras Tanura、Ruwais、Jubail II、Bandar Abbas II 和 Mina Abdullah。此外,预计该地区将有 18 家新炼油厂开始运营。 Al-Zour(科威特)、Siraf 和 Bandar Jask(伊朗)以及 Duqm I(阿曼)是该地区即将建设的炼油厂,预计将于 2026 年启动。预计该地区新炼油厂的投产将带来机遇用于固体燃料。

中东和中东地区非洲

固体燃料

到2028年的市场收入和预测(百万美元)

中东和中东地区非洲固体燃料市场细分

中东和非洲非洲固体燃料市场分为燃料类型和国家。

根据燃料类型,中东和非洲。非洲固体燃料市场分为石油焦/灵活焦、无烟煤、冶金焦和煤炭。 2022 年,冶金焦炭领域占据最大的市场份额。

基于国家、中东和非洲地区。非洲固体燃料市场分为南非、沙特阿拉伯、阿联酋以及中东和非洲其他地区。非洲。南非市场将在 2022 年占据主导地位。

印度石油公司 (Indian Oil Corp Ltd);埃萨全球基金有限公司;英国石油公司;和卢克石油公司是在中东和中东地区运营的领先公司。非洲固体燃料市场。

Strategic insights for Middle East & Africa Solid Fuel involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 12,718.48 Million |

| Market Size by 2028 | US$ 11,366.88 Million |

| Global CAGR (2022 - 2028) | -1.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By 燃料类型

|

| Regions and Countries Covered | 中东和非洲

|

| Market leaders and key company profiles |

The regional scope of Middle East & Africa Solid Fuel refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The Middle East & Africa Solid Fuel Market is valued at US$ 12,718.48 Million in 2022, it is projected to reach US$ 11,366.88 Million by 2028.

As per our report Middle East & Africa Solid Fuel Market, the market size is valued at US$ 12,718.48 Million in 2022, projecting it to reach US$ 11,366.88 Million by 2028. This translates to a CAGR of approximately -1.9% during the forecast period.

The Middle East & Africa Solid Fuel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Solid Fuel Market report:

The Middle East & Africa Solid Fuel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Solid Fuel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Solid Fuel Market value chain can benefit from the information contained in a comprehensive market report.