亚太地区直接运营商计费市场至 2027 年 - Covid-19 影响和区域分析(按类型(有限 DCB、纯 DCB、MSISDN 转发和 PIN 或 MO 基本窗口)、平台(iOS、Android 和其他平台)、最终用户) (应用程序和游戏、在线媒体和其他最终用户)和国家/地区

No. of Pages: 110 | Report Code: TIPRE00012097 | Category: Technology, Media and Telecommunications

No. of Pages: 110 | Report Code: TIPRE00012097 | Category: Technology, Media and Telecommunications

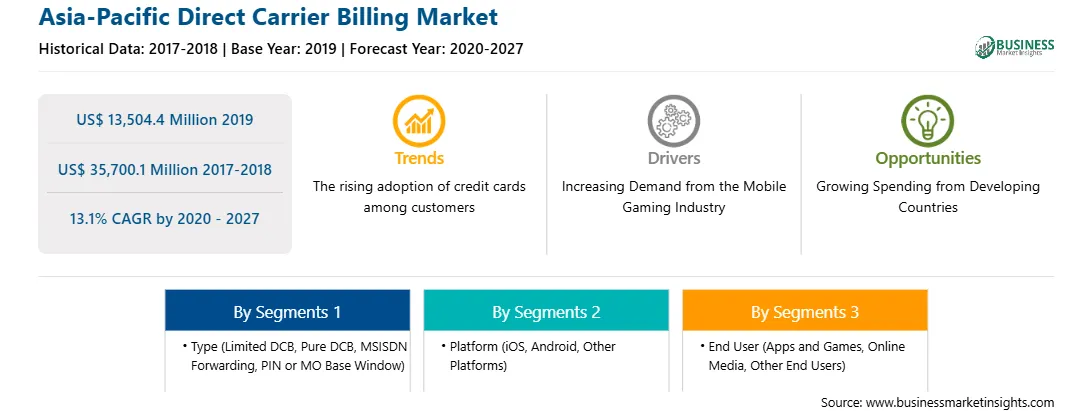

亚太地区运营商直接代扣市场预计将从 2019 年的 135.044 亿美元增长到 2027 年的 357.001 亿美元;预计 2020 年至 2027 年复合年增长率为 13.1%。

亚洲似乎对于直接运营商代扣公司来说,这是一个令人鼓舞的前景。手机正在成为享受内容的关键设备,而使用替代支付平台直接运营商扣费的可接受性正在影响亚洲市场的增长。韩国和日本是亚太地区运营商直接代扣的主要国家。这种计费方式已成为主流,并在这些国家被大量采用。电信公司正在认识到运营商直接计费的潜力,因此参与与 Appstore 建立盈利和战略合作伙伴关系。此外,Google Play、App Store、Spotify 和 Netflix 都是亚洲国家的主要 OTT 提供商,利用运营商直接扣费。印度尼西亚、台湾、马来西亚、泰国和菲律宾是少数几个见证上述 OTT 提供商与电信公司在运营商直接计费方面合作的国家。根据Fortumo针对亚洲市场的运营商计费报告,服务提供商在对各种数字服务进行收费时,面临着银行卡持有量低的问题。 2020年5月,移动互联网支付公司Bango扩大在亚洲市场的印记。其在 Google Play 商店中的直接运营商计费功能已被允许用于香港 Sun Mobile 等新运营商。这使得香港移动商务集团能够通过 Bango Platform 为 Google Play 中的服务和内容付费。

有了新功能和技术,供应商可以吸引新客户并扩大其在新兴市场的足迹。这一因素可能会推动运营商直接扣费市场的发展。亚太直接运营商代扣市场预计在预测期内将以良好的复合年增长率增长。

亚太直通运营商计费市场细分

亚太地区运营商直接计费市场,按类型

亚太地区直接运营商代扣市场,按平台划分

亚太地区直接运营商代扣市场,按最终用户划分

< span>

亚洲-太平洋直接运营商计费市场——提及的公司

Strategic insights for Asia-Pacific Direct Carrier Billing involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 13,504.4 Million |

| Market Size by 2027 | US$ 35,700.1 Million |

| Global CAGR (2020 - 2027) | 13.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By 类型

|

| Regions and Countries Covered | 亚太地区

|

| Market leaders and key company profiles |

The regional scope of Asia-Pacific Direct Carrier Billing refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The List of Companies - Asia-Pacific Direct Carrier Billing Market

The Asia-Pacific Direct Carrier Billing Market is valued at US$ 13,504.4 Million in 2019, it is projected to reach US$ 35,700.1 Million by 2027.

As per our report Asia-Pacific Direct Carrier Billing Market, the market size is valued at US$ 13,504.4 Million in 2019, projecting it to reach US$ 35,700.1 Million by 2027. This translates to a CAGR of approximately 13.1% during the forecast period.

The Asia-Pacific Direct Carrier Billing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Direct Carrier Billing Market report:

The Asia-Pacific Direct Carrier Billing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Direct Carrier Billing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Direct Carrier Billing Market value chain can benefit from the information contained in a comprehensive market report.