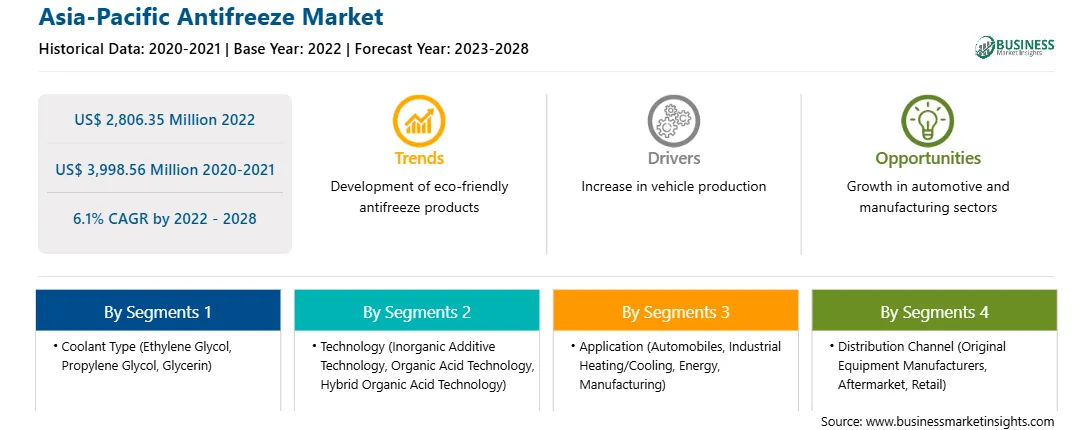

2028年亚太地区防冻剂市场预测 - 按冷却剂类型(乙二醇、丙二醇和甘油等)、技术(无机添加剂技术、有机酸技术和混合有机酸技术等)划分的COVID-19影响和区域分析、应用(汽车、工业加热/冷却、能源和制造等)和分销渠道 [原始设备制造商 (OEM)、售后市场、零售等]

No. of Pages: 158 | Report Code: TIPRE00020087 | Category: Chemicals and Materials

No. of Pages: 158 | Report Code: TIPRE00020087 | Category: Chemicals and Materials

市场参与者对研发和计划的投资

防冻剂市场的市场参与者正专注于研发投资,以扩大产品组合并获得竞争优势。新产品开发、战略联盟和增强产品格局是防冻液市场的关键举措。例如,2019年1月,道达尔公司推出了一款先进的润滑脂STATERMIC X400,该润滑脂不易燃,使用寿命长,专为高温纺织应用而设计。此外,2021年4月,XING Mobility与嘉实多合作,丰富其产品线并巩固其市场地位。此外,匹克还宣布推出匹克防冻冷却液,有助于延长汽车的使用寿命。该产品由阻垢抑制剂和有机酸缓蚀剂制成,可在产品的整个使用寿命内提供防腐蚀保护。巴斯夫公司、雪佛龙公司和陶氏化学等公司在市场上占据主导地位。这些公司致力于开发更具成本效益的防冻剂,这有助于减少碳足迹。因此,市场参与者对研发的持续投资和举措预计将推动市场增长。

市场概览

亚太地区包括澳大利亚、中国、印度、日本、韩国以及亚太地区其他地区。由于高性能车辆需求的增加以及高质量技术先进添加剂的使用增加,该地区的防冻剂市场正在蓬勃发展。产量和产量有所增加该地区内燃机汽车的销售,导致防冻剂的需求增加。汽车制造的不断升级以及个人对汽车的需求不断增长,正在推动预测期内对防冻剂的需求。此外,汽车和飞机制造商对防腐蚀和防冻保护的需求不断增长,以及对有效散热的要求也有助于推动防冻剂市场的增长。此外,建筑设备销量的增长、对暖通空调系统的需求增长、对保护汽车发动机和散热器免受冷冻、过热和腐蚀的关注日益增加、航空航天业产品应用的增加以及对乘用车和轻型商用车的需求不断增长也促进了该地区防冻剂市场的增长。

亚太地区防冻液市场细分

亚太地区防冻液市场根据冷却剂类型、技术、应用、分销渠道和国家/地区进行细分。

基于按冷却液类型,亚太地区防冻液市场分为乙二醇、丙二醇和甘油等。乙二醇细分市场在2022年占据最大的市场份额。根据技术,亚太地区防冻剂市场分为无机添加剂技术、有机酸技术和混合有机酸技术等。 2022年,有机酸技术领域占据最大的市场份额。根据应用,亚太地区防冻剂市场分为汽车、工业加热/冷却、能源和制造业等。 2022年,汽车细分市场占据最大的市场份额。根据分销渠道,亚太地区防冻液市场分为原始设备制造商(OEM)、售后市场和零售等。 2022年,售后市场占据最大的市场份额。按国家划分,亚太地区防冻液市场分为中国、印度、日本、韩国、澳大利亚和亚太地区其他地区。我们的区域分析表明,2022 年中国将占据市场份额。巴斯夫股份公司、CCI 公司、雪佛龙公司、陶氏公司、埃克森美孚公司、旧世界工业公司、普雷斯顿产品公司、壳牌公司、胜牌有限责任公司和瓦克化学公司是亚太地区防冻剂市场的领先公司。

Strategic insights for Asia-Pacific Antifreeze involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,806.35 Million |

| Market Size by 2028 | US$ 3,998.56 Million |

| Global CAGR (2022 - 2028) | 6.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By 冷却剂类型

|

| Regions and Countries Covered | 亚太地区

|

| Market leaders and key company profiles |

The regional scope of Asia-Pacific Antifreeze refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The Asia-Pacific Antifreeze Market is valued at US$ 2,806.35 Million in 2022, it is projected to reach US$ 3,998.56 Million by 2028.

As per our report Asia-Pacific Antifreeze Market, the market size is valued at US$ 2,806.35 Million in 2022, projecting it to reach US$ 3,998.56 Million by 2028. This translates to a CAGR of approximately 6.1% during the forecast period.

The Asia-Pacific Antifreeze Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Antifreeze Market report:

The Asia-Pacific Antifreeze Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Antifreeze Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Antifreeze Market value chain can benefit from the information contained in a comprehensive market report.