Factors such as advantages of RTLS in healthcare and increasing adoption of RTLS in healthcare are the major enablers of the growth US RTLS for Healthcare market. However, the data security and privacy concerns associated with RTLS is the major factor hindering its market growth.

Strategic insights for the US RTLS for Healthcare provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

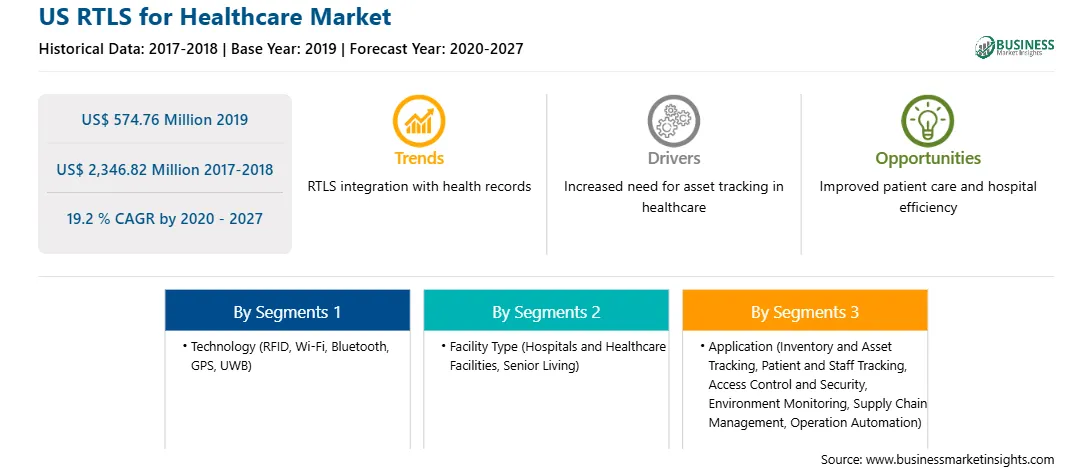

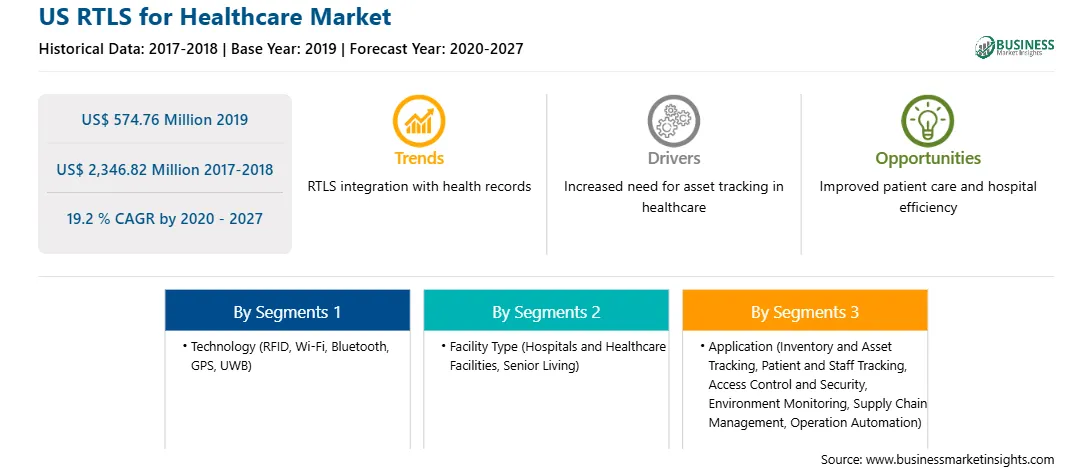

| Market size in 2019 | US$ 574.76 Million |

| Market Size by 2027 | US$ 2,346.82 Million |

| Global CAGR (2020 - 2027) | 19.2 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US RTLS for Healthcare refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The implementation of RTLS in the facility centers has allowed reducing the cost of assets required in the hospitals. It has also enhanced work efficiencies right from clinical management to nursing staff. The two major applications, such as asset tracking and patient tracking, have provided maximum value to hospitals in tracking patients, staff, inventories, equipment, and other such factors. The automated tracking through RTLS has enabled to save costs and time for hospitals and outpatients clinics. For instance, in October 2019, a Florida-based hospital has saved more than US$ 250 000 by leveraging asset Wi-Fi RTLS that assist in locating equipment and medical device by reducing rental costs and create value for future RTLS expansion. In addition, the real-time tracking facility helps in streamlining the processes more efficiently. The functions such as Bluetooth, LTE, UWB, and Zigbee have added better value additions in their current businesses. For instance, in January 2018, CenTrak has updated its Bluetooth Low Energy (BLE) beacon technology to its next-generation Enterprise Location Services for healthcare infrastructures. The updating of its services has allowed better interoperability, reliability, extreme battery life, and scalability and has enhanced their service offerings. Thus, such advantages offered by the RTLS to healthcare are likely to drive the market's growth during the forecast period.

In terms of technology, the US RTLS for healthcare market is segmented into RFID, Wi-Fi, UWB, bluetooth, GPS, and others. In 2019, the RFID segment held the largest share of the market, and is expected to remain dominant during the forecast period. Moreover, UWB is expected to grow faster over the forecasted years.

Strategic insights for the US RTLS for Healthcare provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 574.76 Million |

| Market Size by 2027 | US$ 2,346.82 Million |

| Global CAGR (2020 - 2027) | 19.2 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US RTLS for Healthcare refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Based on Facility Type, the US RTLS for healthcare market is segmented into hospitals and healthcare facilities, and senior living. The hospitals and healthcare facilities segment held the largest share of the market in 2019 and is expected to grow at the highest CAGR during the forecast period.

Based on application, market is segmented as inventory and asset tracking, patient and staff tracking, access control and security, environment monitoring, supply chain management and operation automation, others. In 2019, inventory and asset tracking held the largest market share in the forecasted year.

Product launches and approvals are commonly adopted strategies by companies to expand their footprint worldwide and meet the growing demand. The players operating in the US RTLS for healthcare market adopt the expansion, collaboration, and product launch strategies to enlarge customer base across the world. These strategies allow the players to maintain their brand name globally. For instance, in July 2019, TeleTracking Technologies, Inc. entered into a collaboration with B. Braun Medical Inc. for the combination of their Space Infusion Pump Systems with TeleTracking. RTLS Asset Tracking solution. This interoperability is intended to improve workflow and optimize pump utilization.

The List Companies - US RTLS for Healthcare Market

The US RTLS for Healthcare Market is valued at US$ 574.76 Million in 2019, it is projected to reach US$ 2,346.82 Million by 2027.

As per our report US RTLS for Healthcare Market, the market size is valued at US$ 574.76 Million in 2019, projecting it to reach US$ 2,346.82 Million by 2027. This translates to a CAGR of approximately 19.2 % during the forecast period.

The US RTLS for Healthcare Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US RTLS for Healthcare Market report:

The US RTLS for Healthcare Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US RTLS for Healthcare Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US RTLS for Healthcare Market value chain can benefit from the information contained in a comprehensive market report.