Reprocessing is an important part of the medical device life cycle. Reprocessing of medical device is a process of cleaning, sterilizing, testing, remanufacturing, disinfecting, and wrapping as well as labelling of a used, expired, and undamaged medical device to make it patient-ready at a much-reduced cost. It is a special process or treatment in preparation for reuse of medical devices. Increasing hospital expenditures on medical devices and high amount of medical wastage is driving the growth of the market.

The report offers insights and in-depth analysis of the reprocessed medical devices market, emphasizing various parameters such as market trends, technological advancements, market dynamics, and competitive landscape analysis of leading market players worldwide. It also includes the impact of the COVID-19 pandemic on the market across all the regions. The pandemic has disrupted the socioeconomic conditions of various countries across the world. Presently, the US is the world's worst-affected country due to the COVID-19 outbreak with the highest number of confirmed cases and deaths, as per the recent WHO statistics. The high number of COVID-19 positive cases has negatively impacted the global economies. There has been a decline in overall business activities and growth of various industries operating all around the world.

Strategic Insights

The rapid spread of the COVID-19 has provided significant momentum to the reprocessed medical device industry in 2020. Following a severe shortage of medical supplies, regulatory agencies such as the Association of Medical Device Reprocessors (AMDR) promoted the reprocessing of healthcare equipment. According to AMDR, the expansion of reprocessing programmes could assist healthcare providers manage COVID-19-related costs, better regulate supply chains, and better plan for future hazards. While the COVID-19 pandemic continues to disrupt economies around the world, the growing volume of medical waste is a huge worry. This emphasizes the need of efficient reprocessing, which can not only help meet supply shortages but also enhance healthcare sustainability. However, with the onset of COVID-19 pandemic, physicians and patients became more concerned about their safety, hence, raising apprehensions about the reuse of medical devices. This negatively affected demand for reprocessed medical devices. Thus, to overcome these safety concerns, reassuring steps such as sterilization and microbial testing of reprocessed medical devices were made mandatory by various regulatory authorities in the region. Also, the risk of infection in surgeries and inappropriate sterilization of the medical devices can increase the potential outbreaks which hinders the market growth. In addition, the R&D of reprocessing services has put on hold due to diversion of professionals to satisfy the demand of pandemic related products. Thus, owing to the above–mentioned factors, the pandemic has shown negative impact on the reprocessed medical devices market.

Reprocessing is a common practice in the US, where hospitals prefer to reprocess single-use devices to minimize medical waste. About 45% of hospitals have reprocessing agreements with third-party reprocessing medical devices companies in the US.

According to studies, reusing medical devices are a greener initiative, as it produces less medical waste, which is beneficial to the environment. Medical waste clogs landfills and gets expensive to avail bio waste disposal services. In comparison to the disposal of conventional solid waste, regulated medical waste (RMW) costs about 5–10 times higher, resulting in an increase in expenditure. Various health care practitioners have noted that reusable and single-use devices are nearly comparable and proper device reprocessing has no negative consequences for consumers.

RMW, often known as "red bag waste," is a waste expense that typically costs hospitals 6–10 times more than conventional solid waste to dispose of the waste material. With growing initiatives, 95% of the devices are reprocessed annually rather than sent to landfills at the end of their life cycle. Stainless steel, aluminum, titanium, gold, polycarbonate, and polyurethane are among the other re-processable raw materials that end up in a hospital's RMW. Some hospitals have diverted more than 8,000 pounds of RMW from landfills each year by reprocessing, while bigger systems can recycle more than 50,000 pounds. Therefore, the rising importance of medical waste minimization is driving the growth of the US reprocessed medical devices market.

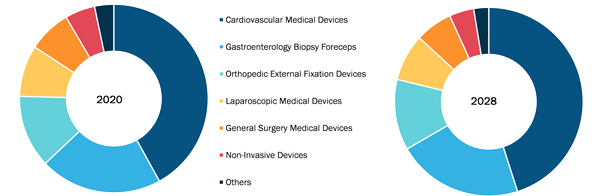

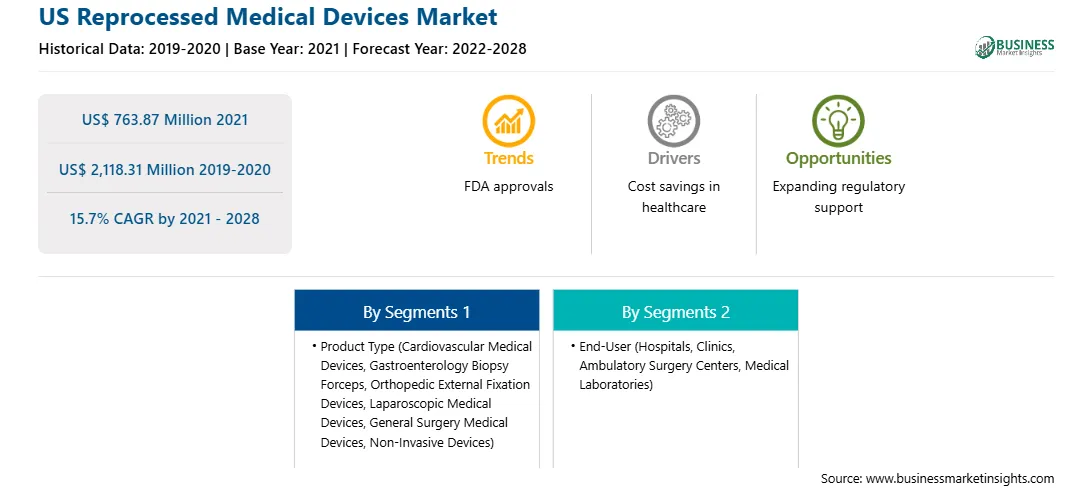

Based on product, the reprocessed medical devices market is segmented into cardiovascular medical devices, gastroenterology biopsy forceps, orthopedic external fixation devices, laparoscopic medical devices, general surgery medical devices, non-invasive devices, and others. In 2021, the cardiovascular medical device segment accounted for a larger share of the market. Moreover, the cardiovascular device segment is anticipated to register the highest CAGR in the market during the forecast period, owing to the growing burden of various coronary heart disease for instance stroke and cardiomyopathy.

Strategic insights for the US Reprocessed Medical Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the US Reprocessed Medical Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

US Reprocessed Medical Devices Strategic Insights

US Reprocessed Medical Devices Report Scope

Report Attribute

Details

Market size in 2021

US$ 763.87 Million

Market Size by 2028

US$ 2,118.31 Million

Global CAGR (2021 - 2028)

15.7%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Product Type

By End-User

Regions and Countries Covered

United States

Market leaders and key company profiles

US Reprocessed Medical Devices Regional Insights

End User-Based Insights

Based on end user, the reprocessed medical devices market is segmented into hospitals and clinics, ambulatory surgical centers, medical laboratories, and others. The hospitals and clinics segment held the largest share of the market in 2021, and the same segment is anticipated to register the highest CAGR of 16.9% of the market during the forecast period.

The reprocessed medical devices market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide and meet the growing demand.

The US Reprocessed Medical Devices Market is valued at US$ 763.87 Million in 2021, it is projected to reach US$ 2,118.31 Million by 2028.

As per our report US Reprocessed Medical Devices Market, the market size is valued at US$ 763.87 Million in 2021, projecting it to reach US$ 2,118.31 Million by 2028. This translates to a CAGR of approximately 15.7% during the forecast period.

The US Reprocessed Medical Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Reprocessed Medical Devices Market report:

The US Reprocessed Medical Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Reprocessed Medical Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Reprocessed Medical Devices Market value chain can benefit from the information contained in a comprehensive market report.