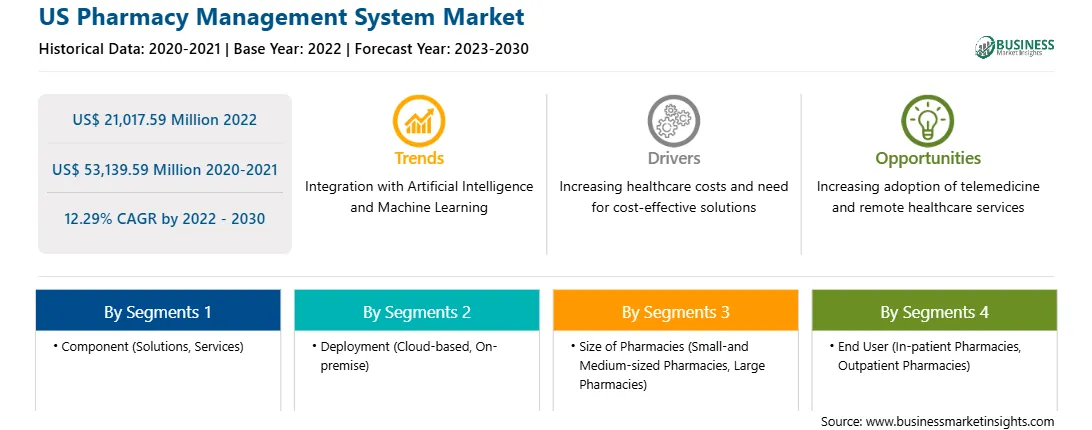

According to our new research study on " US Pharmacy Management System Market Forecasts (2020 - 2030), Country Share, Trends, and Growth Opportunity Analysis - by Component, Deployment, Size of Pharmacies, and End User," the market was valued at US$ 21,017.59 million in 2022 and is expected to reach US$ 53,139.59 million by 2030. It is estimated to register a CAGR of 12.29% during 2022-2030.

A pharmacy management software is any system used in a pharmacy that helps to automate the workflow. It includes making drug orders and controlling the inventory, reviewing physician orders and preparing medications, handling insurance and billing, identifying incompatibilities, providing counseling, and others while following the legal protocols and compliances. An inclination toward automated processes with surging complexity of pharmacy operations and the rising number of independent pharmacies focused on pharmacy management drive the growth of the procedure trays market. Also, diversification of retail pharmacies is expected to fuel pharmacy management system market growth in the coming years.

In the US, retail pharmacies are important retail businesses in the healthcare sector as they hold the trust and responsibility of customers. Retail pharmacy software, an innovative POS system, can optimize inventory, manage customer loyalty programs, and provide accurate reporting. With data becoming the most important part of retail pharmacy and increasing focus on mapping customers' behavior, this advanced technology would replace most traditional manual pharmacy methods in the coming years. Retail pharmacy software is also likely to provide a combination of precise insights and assessments, which would help end users make better clinical, financial, and operational decisions.

Payers, providers, and biopharma companies are introducing initiatives to address health disparities. Retail pharmacies are closer to communities, making it easy for them to provide more equitable care. In a study conducted in cooperation with the Harris Poll, ZS found that patients without health insurance are most likely to choose a pharmacy for primary care in the US. Also, the US retail pharmacy industry lags behind other countries in terms of the adoption of e-commerce. Nevertheless, it experienced a surge in consumer preference for in-home pharmacy care during the COVID-19 pandemic, and the trend is likely to continue in the coming years. For instance, in the US, Amazon allows customers to buy prescription medications online using cash or insurance coverage. Thus, evolving retail pharmacy would lead to new trends in the US pharmacy management system market in the coming years.

By Deployment, US Pharmacy Management System Market-Based Insights

Based on deployment, the US pharmacy management system market is segmented into cloud-based and on-premise. The cloud-based segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 13.06% during 2022-2030. Cloud-based deployment offers a safer and more standardized information system to manage patient data. Cloud-based pharmacy management systems can be connected to computers via the internet and web browser, which enables access to the data anytime and anywhere, on different devices. These systems offer a standardized way to help commercial and academic institutions manage laboratory data generated from sample testing, instrument usage, automation, and report generation. Moreover, they are easy to manage and helps users access real-time information regarding drug inventory, administrative staff, doctor's prescriptions, medical stock refills, etc.

By Size of Pharmacies, Pharmacy Management System Market -Based Insights

Based on the size of pharmacies, the US pharmacy management system market is segmented into small- and medium-sized pharmacies, and large pharmacies. The large pharmacies segment held a larger market share in 2022, and the small- and medium-sized pharmacies segment is anticipated to register a higher CAGR of 13.22% during 2022-2030. Rapid changes in healthcare systems and consumer behavior propel pharmacies to evolve from small medical dispensaries to well-being centers. Digitalization has played a major role in eliminating manual tasks, allowing pharmacies to invest resources into improving their businesses by incorporating innovative strategies that benefit customers and drug suppliers. A customer management system has proven to be a vital solution in small and medium-sized pharmacy businesses. It has an attractive, user-friendly interface. The system also provides easy navigation and automatically refreshes the patient's list. Additionally, it allows pharmacists to access information and manage numerous patient profiles at their fingertips.

The World Health Organization (WHO), National Council for Prescription Drug Programs, Centers for Disease Control and Prevention (CDC) are a few of the major primary and secondary sources referred to while preparing the report on the US pharmacy management system market.

Strategic insights for the US Pharmacy Management System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 21,017.59 Million |

| Market Size by 2030 | US$ 53,139.59 Million |

| Global CAGR (2022 - 2030) | 12.29% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Pharmacy Management System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies - US Pharmacy Management System Market

- McKesson Corp.

- Becton Dickinson and Co.

- Allscripts Healthcare LLC.

- Epicor Software Corp

- Swisslog Healthcare AG

- Omnicell Inc

- CPS Solutions LLC

- RedSail Technologies LLC

- Micro Merchant Systems Inc

- Oracle Corp

The US Pharmacy Management System Market is valued at US$ 21,017.59 Million in 2022, it is projected to reach US$ 53,139.59 Million by 2030.

As per our report US Pharmacy Management System Market, the market size is valued at US$ 21,017.59 Million in 2022, projecting it to reach US$ 53,139.59 Million by 2030. This translates to a CAGR of approximately 12.29% during the forecast period.

The US Pharmacy Management System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Pharmacy Management System Market report:

The US Pharmacy Management System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Pharmacy Management System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Pharmacy Management System Market value chain can benefit from the information contained in a comprehensive market report.