US Pediatric Cardiology Market

No. of Pages: 129 | Report Code: BMIRE00030965 | Category: Life Sciences

No. of Pages: 129 | Report Code: BMIRE00030965 | Category: Life Sciences

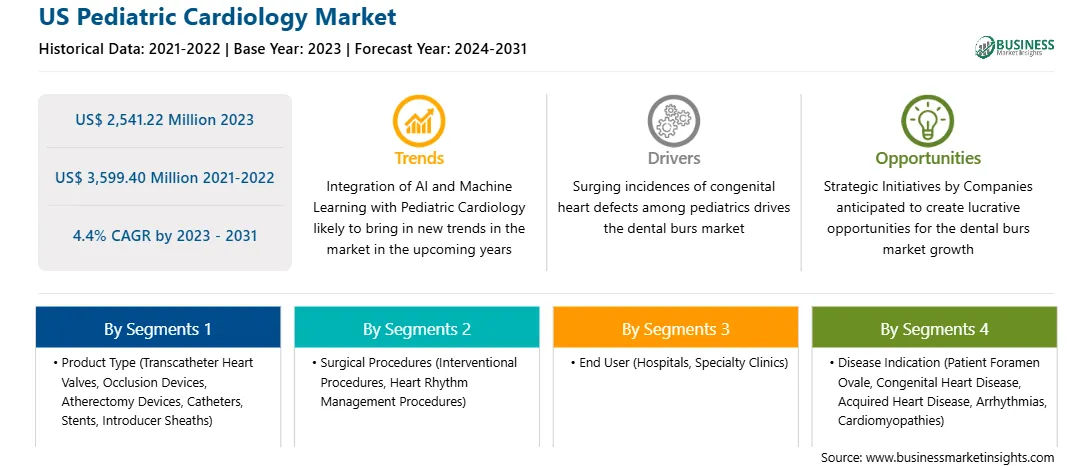

The US pediatric cardiology market size is projected to reach US$ 3,599.40 million by 2031 from US$ 2,541.22 million in 2023. The market is expected to register a CAGR of 4.4% during 2023–2031.

Pediatric cardiology is a specialized branch of medicine that focuses on diagnosing, treating, and managing heart conditions in infants, children, and adolescents. This field addresses a range of congenital (present at birth) and acquired heart defects, including conditions like ventricular septal defects, atrial septal defects, and more complex issues requiring surgical intervention.

Companies operating in the US pediatric cardiology market constantly focus on strategic developments such as product approvals, collaborations, funding, agreements, and new product launches, which help them boost their sales, geographic reach, and capacities to cater to a wide customer base. A few strategic initiatives taken by key players operating in the US pediatric cardiology market are mentioned below:

• In January 2024, Occlutech received the United States Food and Drug Administration (FDA) for Occlutech Pistol Pusher and Occlutech ASD Occluder for the treatment of atrial septal defects (ASD). With this approval, Occlutech will immediately commence commercialization in an exclusive partnership with distributor B. Braun Interventional Systems Inc. The Occlutech ASD occluder is a nitinol, self-expanding, double-disc occlusion device that comprises two umbrella-shaped flexible discs with a waist in the middle connecting the two discs.

• In February 2023, Medtronic relaunched its Harmony Transcatheter Pulmonary Valve (TPV) System, a minimally invasive alternative to open-heart surgery for congenital heart disease patients with native or surgically repaired right ventricular outflow tract (RVOT). The system was designed for patients suffering from RVOT anomalies who also develop severe pulmonary valve regurgitation, a condition where blood leaks into the right lower chamber of the heart after being pumped into the lungs.

• In May 2022, Occlutech signed an exclusive distribution agreement with B. Braun Interventional Systems Inc (BIS). BIS will initiate the US commercialization activities for Occlutech's Flex II ASD Occluder with the support of the global Occlutech team. Through this collaboration, Occlutech records success in the strategically important US market, which is characterized as a premier and commercially attractive healthcare system. Also, BIS increases its portfolio’s relevancy through strong congenital and structural heart focus.

Therefore, strategic initiatives by various companies focusing on the development of pediatric cardiology devices are likely to offer growth opportunities to the US pediatric cardiology market in the coming years.

However, the dearth of skilled pediatric cardiologists is impacting the availability and quality of care for children with cardiovascular conditions. As the incidence of congenital heart defects and other cardiac diseases continues to rise, the demand for specialized cardiology services is outpacing the supply of trained professionals. In addition, there is increasing awareness about preventive cardiology care to address long-term pediatric cardiology disorders immediately after birth. According to the American Academy of Pediatrics, there is a notable shortage of pediatric cardiologists, particularly in rural and underserved areas in the US, where access to specialized care is often limited. Based on the American Board of Pediatrics (ABP) data through June 2023, 4,117 pediatric cardiologists have ever been board-certified, of which 3,096 (75%) were actively enrolled in Maintenance of Certification (MOC). When the workforce is limited to the US, there was an average of 57.3 board-certified pediatric cardiologists per state (range 0–329) in 2023, which accounts for 4 cardiologists per 100,000 children aged to 17 years (range 0.0–25.4) across the US. There was wide variability in the distribution of pediatric cardiologists within states, with most concentrated in urban settings and few in rural areas. The shortage of pediatric cardiologists also contributes to increased pressure on existing practitioners, leading to burnout and job dissatisfaction. This situation can ultimately affect patient outcomes, as overworked specialists might not be able to provide the comprehensive care needed for complex cases. Thus, the dearth of skilled pediatric cardiologists hampers the market growth.

Based on end users, the pediatric cardiology market is categorized into hospitals, specialty clinics, and others. The hospitals segment dominated the market in 2023. In the US pediatric cardiology market, the hospitals segment is significant in terms of delivering specialized care to children suffering from cardiovascular disorders. The increasing cases of congenital heart defects and other heart diseases have elevated pediatric cardiac centers with modern technologies and multidisciplinary teams for comprehensive treatment. Boston Children's Hospital, Texas Children’s Hospital, Seattle Children’s Hospital, and the Children's Hospital of Philadelphia are among the acknowledged leaders, boasting state-of-the-art facilities and innovative approaches to pediatric cardiology—including minimally invasive surgical techniques and interventional procedures. These hospitals emphasize collaborative care, where a cardiologist works with other surgeons, anesthesiologists, and nursing staff to ensure optimized treatment results. Seattle Children’s Hospital performed ~570 pediatric heart surgeries in 2023. Recent investments in telemedicine and remote monitoring technologies further enhance patient management, with constant care and follow-up, highly necessary for patients located in rural areas. Access to specialized care and treatment protocols enhanced in health systems ensures growth in the hospitals segment and advancements in pediatric cardiology, which will improve the quality of life for young patients suffering from cardiovascular problems.

American College of Cardiology, Children's Heart Foundation, Centers for Disease Control and Prevention, United States Food and Drug Administration, and American Academy of Pediatrics are among the primary and secondary sources referred to while preparing the US pediatric cardiology market report.

Strategic insights for the US Pediatric Cardiology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,541.22 Million |

| Market Size by 2031 | US$ 3,599.40 Million |

| Global CAGR (2023 - 2031) | 4.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Pediatric Cardiology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US Pediatric Cardiology Market is valued at US$ 2,541.22 Million in 2023, it is projected to reach US$ 3,599.40 Million by 2031.

As per our report US Pediatric Cardiology Market, the market size is valued at US$ 2,541.22 Million in 2023, projecting it to reach US$ 3,599.40 Million by 2031. This translates to a CAGR of approximately 4.4% during the forecast period.

The US Pediatric Cardiology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Pediatric Cardiology Market report:

The US Pediatric Cardiology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Pediatric Cardiology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Pediatric Cardiology Market value chain can benefit from the information contained in a comprehensive market report.