The US ground support equipment market for military and business aviation is expected to witness growth during the forecast period. The growth in the business aviation sector is propelling the demand for ground support equipment. According to data by Cirium, in 2019, the US had an installed fleet of ~19,000 business jets and turboprops. The figure signifies that the country comprises over 60% of the total inventory of business jets worldwide. The company further stated that the US constantly accounts for over half of new business jet deliveries every year, with small and midsize aircraft category models contributing the majority of the output. Further, growing procurement of military aircraft fleet is driving the demand for ground support equipment (GSE). The US Department of Defense has numerous air bases across the world, and it continues to procure modern technologies to maintain the fleet. Ground support equipment is one of the key systems deployed by the US Department of Defense at various air bases worldwide.

Strategic insights for the US Ground Support Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

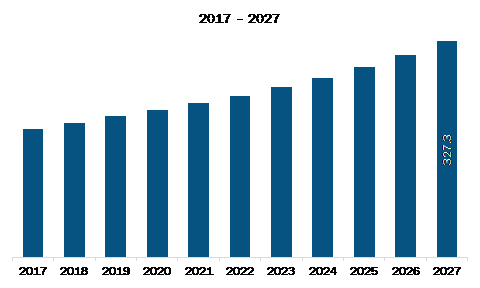

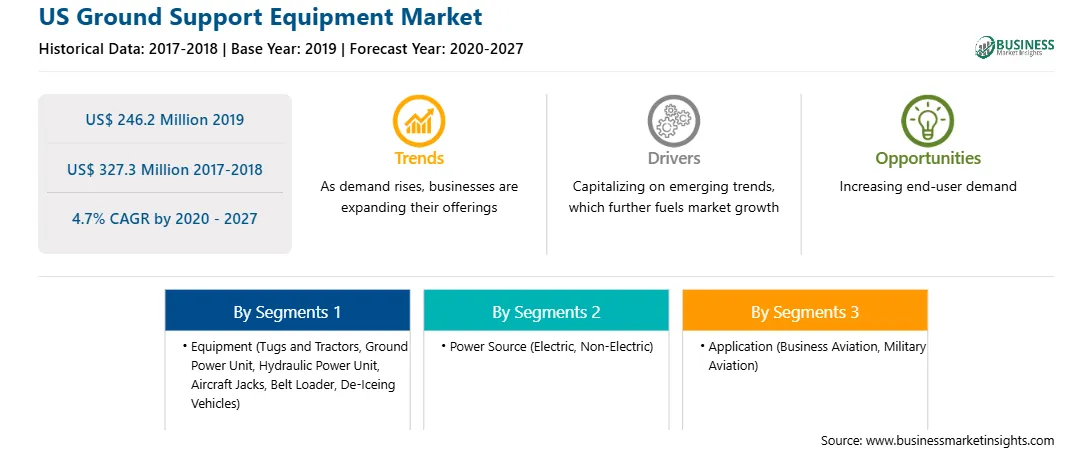

| Market size in 2019 | US$ 246.2 Million |

| Market Size by 2027 | US$ 327.3 Million |

| Global CAGR (2020 - 2027) | 4.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Equipment

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Ground Support Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US ground support equipment market was valued at US$ 246.2 million in 2019 and is projected to reach US$ 327.3 million by 2027; it is expected to grow at a CAGR of 4.7% from 2020 to 2027.

The availability of developed airport infrastructure significantly drives the growth of the business aviation sector. According to the President of the National Business Aviation Association, there are around 5,000 public service airports and additional 13,000 airfields, landing strips, and private sites situated across the US and serving businesses, including private owners and fly-in-fly-out mining companies. Another key factor driving the growth of the business aviation industry is the favorable tax legislation. According to legislation introduced in the Trump administration in 2017, a company can write off 100% of tax against capital expenditure, including a new or used business aircraft, in the first year of acquisition. Moreover, as per the Cirium fleets data published in September 2019, the US had 19,137 operational business jets and turboprops, signifying 61% of the total global share. The presence of the highly-developed business aviation sector in the US is boosting the demand for GSE.

The US is the worst-hit country due to the COVID-19 outbreak in North America. Thousands of infected individuals are facing severe health conditions across the country as well as continuous growth in the number of confirmed cases had led the government to impose lockdown across the nation’s borders in last few months. The airports across the country are experiencing deflation in revenue owing to the restrictions on air travelling for regular passengers. The adoption rate of technologies and equipment among airports is decent in the US, and its demand has shrunken to a drastic level owing to the closure of airports. This scenario is hindering the business aviation US ground support equipment market. The US military supply chain is also disrupted due to the COVID-19 pandemic. On the production end, ground support equipment manufacturing activities are slowed down.

In terms of equipment, the ground power unit segment accounted for the largest share of the US ground support equipment market in 2019. By power source, the non-electric segment held a larger market share in 2019. Based on application, the military aviation segment held a larger share of the market in 2019.

A few major primary and secondary sources referred to while preparing the report on the US ground support equipment market are company websites, annual reports, financial reports, national government documents, and statistical database. Mallaghan; AERO Specialties, Inc.; AGSE LLC; Aviation Ground Equipment Corp.; ITW GSE ApS.; JBT Corporation; Meyer Hydraulics Corporation; Textron Ground Support Equipment Inc.; Towflexx GmbH; and Tronair Inc. are among the major companies listed in the market report.

The US Ground Support Equipment Market is valued at US$ 246.2 Million in 2019, it is projected to reach US$ 327.3 Million by 2027.

As per our report US Ground Support Equipment Market, the market size is valued at US$ 246.2 Million in 2019, projecting it to reach US$ 327.3 Million by 2027. This translates to a CAGR of approximately 4.7% during the forecast period.

The US Ground Support Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Ground Support Equipment Market report:

The US Ground Support Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Ground Support Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Ground Support Equipment Market value chain can benefit from the information contained in a comprehensive market report.