US Fire Alarm System Contractor Market

No. of Pages: 88 | Report Code: BMIRE00031047 | Category: Electronics and Semiconductor

No. of Pages: 88 | Report Code: BMIRE00031047 | Category: Electronics and Semiconductor

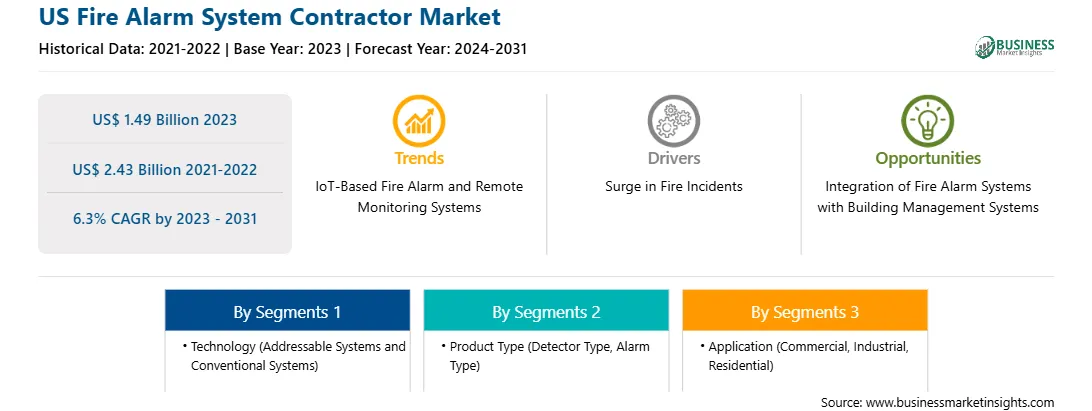

The US Fire Alarm System Contractor Market size was valued at US$ 1.49 billion in 2023 and is expected to reach US$ 2.43 billion by 2031. The US Fire Alarm System Contractor Market is estimated to record a CAGR of 6.3% from 2023 to 2031.

The Internet of Things (IoT) will play a critical role in the future of fire safety. IoT fire alarm systems operate on a network of interconnected sensors and devices that communicate with one another, as well as cloud-based platforms. Various companies are providing cloud-based fire alarm systems. For instance, in September 2024, Johnson Controls announced the release of SafeLINC. This cloud-based data-hosting infrastructure allows users to remotely access and gather actionable data from the entire suite of fire alarm control panels. SafeLINC provides users with a cloud-connected gateway and a cloud application platform accessible via web browsers and native iOS and Android mobile apps. This arrangement provides real-time data collecting, analysis, and response, making fire alarms more intelligent and efficient. IoT systems can monitor a variety of environmental parameters, predict potential fire threats, and automate emergency responses, making them an invaluable tool in modern fire safety management. In addition, video smoke detection systems, for example, employ cameras to detect smoke's visual signature, delivering an early warning before smoke levels increase dramatically. Also, multi-criteria detectors combine inputs from smoke, heat, and carbon monoxide sensors, thereby increasing detection accuracy while decreasing the likelihood of false alarms. These technologies enable fire alarms to respond more accurately to actual fire conditions, reducing disturbances caused by false alarms.

Remote control and monitoring fire alarm systems can transform fire safety management. Facility managers can monitor fire alarm systems from a central location using remote access, regardless of the size or complexity of the facility. This capability is especially valuable for large facilities or campuses with several buildings because it enables centralized monitoring and faster reaction times. Remote monitoring also allows for real-time diagnosis and maintenance, ensuring that fire alarm systems are operational and effective at all times. Thus, a rise in technological advancements in fire alarm systems is expected to propel the US Fire Alarm System Contractor Market growth in the coming years.

Based on application, the US Fire Alarm System Contractor Market is segmented into commercial, industrial, and residential. The commercial segment held the largest US Fire Alarm System Contractor Market share in 2023. Fire alarms in commercial facilities are typically larger and more complex than those used in domestic settings, necessitating substantial planning and a fire risk assessment prior to professional installation. Commercial property includes various types of office buildings, garages, restaurants, and retail establishments, including shopping malls and pubs, theaters, hotels, and hospitals. Due to the varied nature of commercial properties, the type of fire alarm system utilized is impacted by parameters such as the size of the premises, the number of employees, the type of business, etc. Fire alarms must provide complete coverage of the main area and placed depending on the size of the property, and be interconnected via a central control panel that allows the alarm to quickly detect smoke and notify the residents of any danger.

Western States Fire Protection (API Integrators); Everon, LLC; Emcor Group Inc; Pye-Barker Fire & Safety, LLC; Cintas Corp; Summit Fire Protection Co; Johnson Controls International Plc; The Hiller Companies, LLC.; Convergint Technologies LLC; Koorsen Fire & Security, Inc.; Encore Fire Protection LLC; and Thompson Safety are among the prominent players profiled in the US Fire Alarm System Contractor Market report. Several other major players were also studied and analyzed in the US Fire Alarm System Contractor Market report to get a holistic view of the market and its ecosystem.

The overall US Fire Alarm System Contractor Market share has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the US Fire Alarm System Contractor Market. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the US Fire Alarm System Contractor Market.

Strategic insights for the US Fire Alarm System Contractor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.49 Billion |

| Market Size by 2031 | US$ 2.43 Billion |

| Global CAGR (2023 - 2031) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Fire Alarm System Contractor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US Fire Alarm System Contractor Market is valued at US$ 1.49 Billion in 2023, it is projected to reach US$ 2.43 Billion by 2031.

As per our report US Fire Alarm System Contractor Market, the market size is valued at US$ 1.49 Billion in 2023, projecting it to reach US$ 2.43 Billion by 2031. This translates to a CAGR of approximately 6.3% during the forecast period.

The US Fire Alarm System Contractor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Fire Alarm System Contractor Market report:

The US Fire Alarm System Contractor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Fire Alarm System Contractor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Fire Alarm System Contractor Market value chain can benefit from the information contained in a comprehensive market report.