US electronic security systems

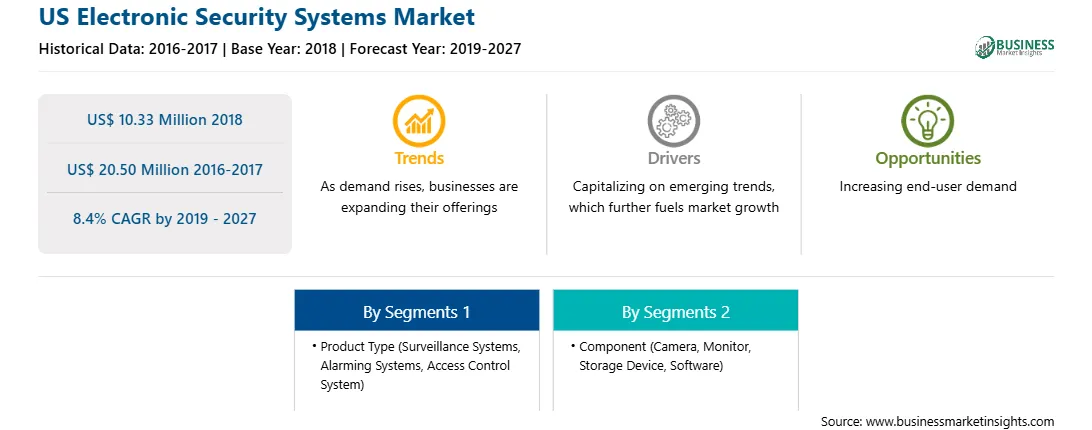

market was valued at US$ 10.33 Mn in 2018, and is calculated to reach US$ 20.50 Mn by 2027, growing at a CAGR of 8.4% from 2019 – 2027

.

The US electronic security systems market is anticipated to grow at a higher pace during the forecast period, mainly due to a large number of vendors coming forward and offering electronic security systems to the federal, state and local government agencies throughout the US. The leading players are involved in designing, developing, installation, and maintenance of technically complex integrated electronic security systems for federal government customers. There are number of agencies and associations in the United States working for the development of security systems, such as, Department of Homeland Security (DHS), Department of Defense, Department of Transportation, Department of Health and Human Services, US States Security Licensing Guide, Department of Energy, National Security Agency (NSA), General Services Administration (GSA), and Electronic Security Association (ESA), among others.

The electronic security systems market players are experiencing significant demand for their products and solutions in recent years as the buyer’s base is at a constant rise. The buyers of electronic security systems include the Federal Government verticals. The demand for electronic security systems differs among end-users; for instance, the Department of Homeland Security (DHS) demands for access control systems such as biometrics systems, network management support service; intrusion detection system among other. Alike to DHS, the Department of Defense (DoD) also demands biometrics and intrusion detection, the DoD also procures card readers, video surveillance systems, electronic locks. On the other hand, the Department of Transportation (DoT) majorly adopts smart card readers and video surveillance cameras. The mixed demand for different system types is throttling the growth of the electronic security systems market. Pertaining to the factors as mentioned above, the bargaining power of buyers is expected to remain high throughout the forecast period.

Market Insights

Rise in Adoption of AI in Video Surveillance Cameras

There is a massive demand for the incorporation of artificial intelligence (AI) in video surveillance systems. The incorporation of Artificial Intelligence (AI) in video surveillance systems to assist in video, Big Data, and the Internet of Things (IoT) analytics is attributed to reduce the analysis timing and improve decision-making capabilities. The video analytics software also enhances the capabilities of IP cameras and enables them to function intelligently and efficiently. AI assists in effective monitoring, followed by feeding captured imageries and alerting the guards in case of suspicious activities in and around the workstations. This factor helps the surveillance teams to enhance security, and save human efforts and time. Moreover, AI in video surveillance systems facilitate a wide range features such as facial recognition, motion detection, and license plate reading. The processing power of modern video surveillance cameras has increased to a greater extent with the incorporation of AI, which in turn has increased the hosting power of cameras for various analytics tools, thereby enhancing the reliability of IP camera. Thus, the incorporation of AI in video surveillance systems is fueling the electronic security systems market and is anticipated to bolster the market in the future.

Electronic security systems Market - Product Type Insights

The US electronic security systems market by product type is segmented into surveillance systems, alarming systems, and access control. The surveillance systems segment dominated the electronic security systems market heavily and is projected to continue its dominance throughout the forecast period from 2019 – 2027. The access control system segment is the anticipated to surge at a prime rate during the forecast period.

Surveillance Systems Insights

Surveillance security systems are available in both wired and wireless configurations and can be further segmented into: camera, video management, and IP video recording. These systems continuously monitor buildings such as governmental buildings, federal office buildings, or governmental infrastructures. The output of surveillance systems can be used remotely viewed on smartphones, tablets, and computers for recording any illegal activities. It helps the building owners in monitoring the tasks when remotely. The US Federal Governmental buildings and infrastructures are challenged with severe levels of threat from various illicit groups. Thus, with an objective to secure the building or infrastructure premises from any unlawful entrance, the Federal Government is undertaking significant strides to adopt technologically advanced surveillance systems, which is boosting the surveillance systems market, which in turn is catalyzing the growth of the US electronic security systems market.

Access Control Systems Insights

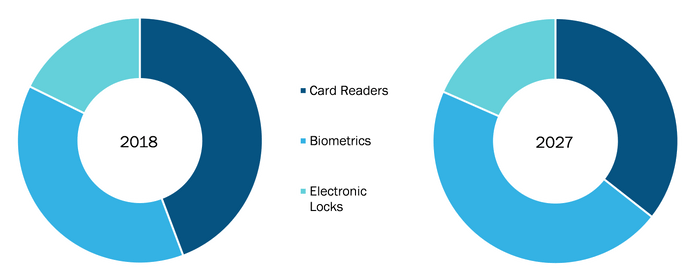

The US governmental buildings, transportation systems, border areas, airports, seaports, and various other infrastructures have experienced illegal entrance which has led to significant loss in terms of monetary funds and data. This factor has escalated the demand for access control systems across the country, thereby, driving the electronic security systems market in the US. The card readers are by far the most attractive access control systems across verticals of Federal Government, however, higher demand for biometrics is being experienced in the current scenario. In the current technologically advanced market scenario, the card readers are easily breach-able, which is again a potential threat to various security-prone infrastructures. On the other hand, biometrics systems are highly secured as the same records and access an individual’s biological characteristics. These factors are attracting the customers which is propelling the electronic security systems market in the US.

Strategic insights for the US Electronic Security Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 10.33 Million |

| Market Size by 2027 | US$ 20.50 Million |

| Global CAGR (2019 - 2027) | 8.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Electronic Security Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic Insights

Mergers and acquisition and acquiring contracts are the two most prominent strategies adopted by companies to enhance the product portfolio and meet the growing demand. The players present in the electronic security systems market also adopt the strategy of expansion and investment in research and development to enlarge customer base in the US and worldwide, which also permits the players to maintain their brand name globally.

US Electronic security systems Market, by

Product Type

US Electronic security systems Market, by Component

Electronic security systems Market - Company Profiles

The List of Companies - US Electronic Security Systems Market

The US Electronic Security Systems Market is valued at US$ 10.33 Million in 2018, it is projected to reach US$ 20.50 Million by 2027.

As per our report US Electronic Security Systems Market, the market size is valued at US$ 10.33 Million in 2018, projecting it to reach US$ 20.50 Million by 2027. This translates to a CAGR of approximately 8.4% during the forecast period.

The US Electronic Security Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Electronic Security Systems Market report:

The US Electronic Security Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Electronic Security Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Electronic Security Systems Market value chain can benefit from the information contained in a comprehensive market report.