Upsurge in online purchase of prescription medicines during the COVID-19 pandemic and an increasing inclination toward online platforms are a few factors driving the US digital pharmacy market growth.

Monitoring blood sugar is a vital part of diabetes management. A glucometer or blood sugar meter is commonly used for blood glucose monitoring. It involves taking a small drop of blood, usually by pricking the fingertip and placing it on the test strip in a glucometer. Blood sugar levels are measured in milligrams per deciliter (mg/dl), with standard guidelines for safe blood sugar ranging from 70 to 180 mg/dl.

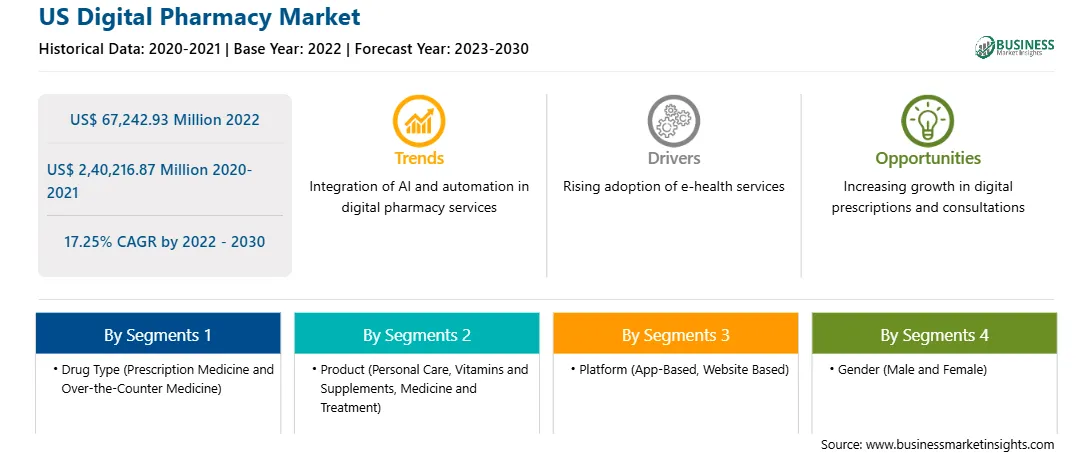

Upsurge in Online Purchase of Prescription Medicines During COVID-19 Pandemic Propels US Digital Pharmacy Market

According to a report published by the ASOP Global Foundation in 2020, nearly 50% of the American population purchased medicines online due to convenience and cost benefits. As per another survey conducted by Abacus Data on 1,500 American consumers, 4 in 10 Americans (42%) purchased medicines online in 2020, recording a 7% rise in the number of online buyers of medicines from 2020 to 2021. Moreover, purchase trends in the US indicate Americans buy an array of prescription drugs online, ranging from products prescribed against chronic and ongoing conditions (23% for all purchases), including high blood pressure, asthma, and diabetes, to specialty prescriptions such as cancer and hormone replacement therapy drugs (each accounting 11% of all purchases). Additionally, 64% of the individuals purchased medicines online for the first time in 2021, with intentions to continue buying online medicine even after the pandemic ends. The preference for online buying of medicines is mainly due to the convenience of buying, accessibility to products, and reduced cost of prescription medication (discounts, special offers, etc.). According to a survey conducted by healthinsurance.com, there was a 340% increase in telemedicine usage among Medicare recipients in the US in 2021. 33% of the increased users revealed that they preferred ordering prescription medicines through an online pharmacy during the COVID-19 pandemic. Thus, an increase in the number of digital pharmacists along with online purchases of prescription medicines, coupled with the rapidly spurring e-commerce industry and a massive shift in consumer behavior toward online purchases, favors the US digital pharmacy market growth.

Integrated Web-Based Online Pharmacy Interface Emerges as Key Trend

Integrated e-healthcare systems incorporated with web-based pharmacy interfaces that are accessible to pharmacists and patients are likely to emerge as new trends in the US digital pharmacy market in the coming years. Programs made available by online pharmacies to provide online support to people buying medicines are a notable example of such interfaces. For instance, patients administered with statins as a part of their treatments are likely to discontinue or show irregularities in taking medicines. Reminders and live chat with a pharmacy team member trained in providing adherence support to people consuming statin-based prescribed medicines can help avoid the discontinuation of doses.

In terms of platform, the US digital pharmacy market is categorized into app-based and website-based. The app-based is further segmented into telehealth pharmacy apps, medication management apps, health and wellness apps, compounding pharmacy apps, and others. The app-based segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.60% during the forecast period. Telehealth pharmacy apps are expected to account for a maximum share of the market for the app-based segment during 2022-2030. Virtual healthcare can be accessed through telehealth apps from anywhere. According to CDC data published in 2021, 37.0% of adults used telemedicine in 2020, including provider visits, online prescriptions, and mental health services. The best telehealth apps can be downloaded free of cost and are easy to use, and they often completely cover insurance services. A few examples of telehealth pharmacy apps are Hims & Hers, GoodRx, K Health, and Doctor on Demand. GoodRx offers services such as low-cost visits, easy prescription refills via mail, and visits without health insurance.

Based on drug type, the US digital pharmacy market is bifurcated into prescription medicine and over-the-counter medicine. The prescription medicine segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.83% during the forecast period. Based on product, the US digital pharmacy market is segmented into personal care, vitamins & supplements, medicines & treatments, and other products. The medicine & treatments segment is further segregated as sexual health, neurological disorders, heartcare, diabetes, weight loss, and others. The medicine and treatment segment held a larger market share in 2022, and the segment is anticipated to register a higher CAGR of 17.87% during the forecast period. In terms of platform, the US digital pharmacy market is categorized into app-based and website-based. The app-based is further segmented into telehealth pharmacy apps, medication management apps, health and wellness apps, compounding pharmacy apps, and others. The app-based segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.60% during the forecast period. By gender, the market is bifurcated into males and females. The females segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.64% during the forecast period.

Strategic insights for the US Digital Pharmacy provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 67,242.93 Million |

| Market Size by 2030 | US$ 2,40,216.87 Million |

| Global CAGR (2022 - 2030) | 17.25% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Drug Type

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Digital Pharmacy refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US Digital Pharmacy Market is valued at US$ 67,242.93 Million in 2022, it is projected to reach US$ 2,40,216.87 Million by 2030.

As per our report US Digital Pharmacy Market, the market size is valued at US$ 67,242.93 Million in 2022, projecting it to reach US$ 2,40,216.87 Million by 2030. This translates to a CAGR of approximately 17.25% during the forecast period.

The US Digital Pharmacy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Digital Pharmacy Market report:

The US Digital Pharmacy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Digital Pharmacy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Digital Pharmacy Market value chain can benefit from the information contained in a comprehensive market report.