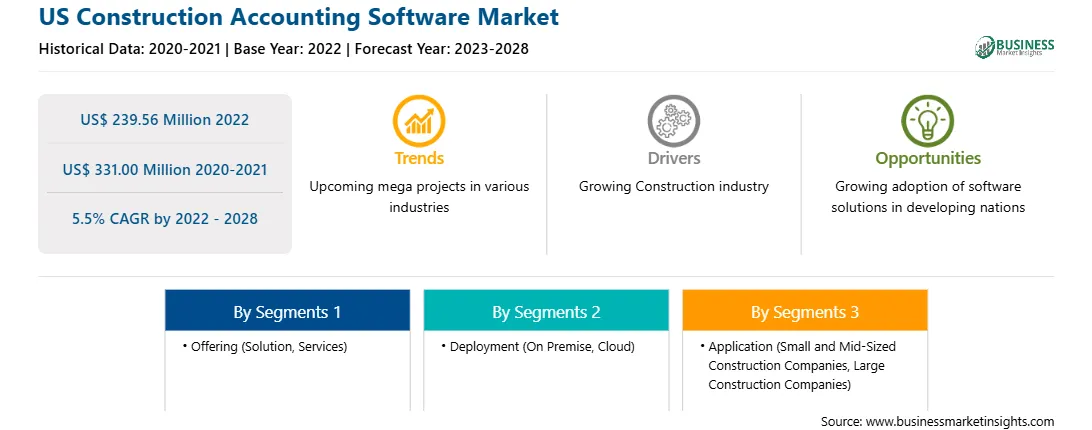

US Construction Accounting Software Market

No. of Pages: 101 | Report Code: BMIRE00027748 | Category: Technology, Media and Telecommunications

No. of Pages: 101 | Report Code: BMIRE00027748 | Category: Technology, Media and Telecommunications

Accounting software is vital to operate all construction companies efficiently. Companies of all sizes continuously deal with numerous subcontractors, contractors, and temporary construction teams. The deals can complicate procurement, payroll, and other accounting functions. In such scenarios, reliable software is required to guarantee everything from purchase orders to inventory, and to ensure the equipment are tracked, utilized, and replenished accordingly. Construction accounting software offers several financial management tools such as payroll, general ledger, job costing, audit reporting, and accounts payable and receivable (AP/AR) for small and large construction activities. Certain construction accounting software solutions are developed and focused for specific financial information, while others offer accounting insights into the organization. The deployment of construction accounting software helps builders and contractors enhance project performance by offering all the relevant information to the project managers and minimizing the risk of manual financial calculation error.

Construction is one of the important industries growing exponentially in the US. The government of the US is investing heavily in developing commercial infrastructures, including airports, hotels, hospitals, universities, and office buildings. With a growing number of infrastructural projects, construction companies emphasize advanced technologies by using construction accounting software. The growing construction industry and the rising ERP module penetration in the industry are among the key factors driving the US construction accounting software market growth. However, the availability of free construction accounting software for some applications may hinder the US construction accounting software market growth.

US Construction Accounting Software Market Overview and Dynamics

The US construction accounting software market is projected to grow from US$ 239.56 million in 2022 to US$ 331.00 million by 2028; it is estimated to record a CAGR of 5.5% from 2022 to 2028. The construction industry is a major contributor to the US economy. As of 2020, the industry has more than 680,000 employers with ~7 million employees. Also, it creates nearly US$ 1.3 trillion worth of structures each year. The US economy has increased spending on the construction industry. In 2019, a few topmost construction spenders in the US were Texas (US$ 45.4 billion), New York (US$ 32.1 billion), California (US$ 24.8 billion), Florida (US$ 23 billion), and Pennsylvania (US$ 12.6 billion). Moreover, increasing residential permits within the country contribute to the growth of the construction industry. Further, public investment in affordable housing is supporting the residential building construction industry. All mentioned aspects about the construction of commercial and residential buildings in the US are projected to increase the penetration of construction accounting software in the coming years. Also, the presence of construction accounting software providers such as Sage, Xero Limited, and Quickbooks would drive the US construction accounting software market growth during the forecast period.

Key Market Segments

The US construction accounting software market, by offering, is bifurcated into solution and services. In 2021, the solution segment accounted for a larger market share. The software developers provide web-based construction accounting software, mobile-based construction accounting software, and automatic construction accounting software. These types of construction accounting software are increasingly gaining popularity among end users. The systems are integrated with robust software, allowing the entire system to function substantially and shortening the accounting. The construction accounting software developing companies invests substantial amounts and human resources in designing advanced features and expanding their feature portfolio on the systems. This factor attracts several construction accounting software developers, integrating the same on their systems. This facilitates the hardware/system manufacturers to attract customers, catalyzing the US construction accounting software market growth.

The US construction accounting software market, based on application, is bifurcated into small and mid-sized construction companies and large construction companies. In 2021, the large construction companies segment accounted for a larger share of the US construction accounting software market. Large construction companies can make huge investments in high-end software to increase productivity. As accounts play a vital role in managing financial transactions, large and well-established companies invest significantly in proper financial software to prevent the risk of malpractice. The accounting software in large-scale construction firms ensures 100% documented financial transactions and funds allocation. It is a cost-efficient and profitable solution for large businesses. Increasing investment in construction accounting software by large construction companies is driving the US construction accounting software market growth in the large construction companies segment.

Major Sources and Companies Listed

A few major primary and secondary sources referred to while preparing the report on the US construction accounting software market are company websites, annual reports, financial reports, national government documents, and statistical databases. Major companies listed in the US construction accounting software market report consist of Deltek Inc.; Sage Group; Xero Limited; Viewpoint Inc.; and Intuit Inc. are the five key market players operating in the US construction accounting software market. Acclivity Group LLC; Chetu Inc.; Corecon Technologies Inc.; Freshbook; and Foundation Software, LLC.

Strategic insights for the US Construction Accounting Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 239.56 Million |

| Market Size by 2028 | US$ 331.00 Million |

| Global CAGR (2022 - 2028) | 5.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Construction Accounting Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US Construction Accounting Software Market is valued at US$ 239.56 Million in 2022, it is projected to reach US$ 331.00 Million by 2028.

As per our report US Construction Accounting Software Market, the market size is valued at US$ 239.56 Million in 2022, projecting it to reach US$ 331.00 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The US Construction Accounting Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Construction Accounting Software Market report:

The US Construction Accounting Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Construction Accounting Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Construction Accounting Software Market value chain can benefit from the information contained in a comprehensive market report.