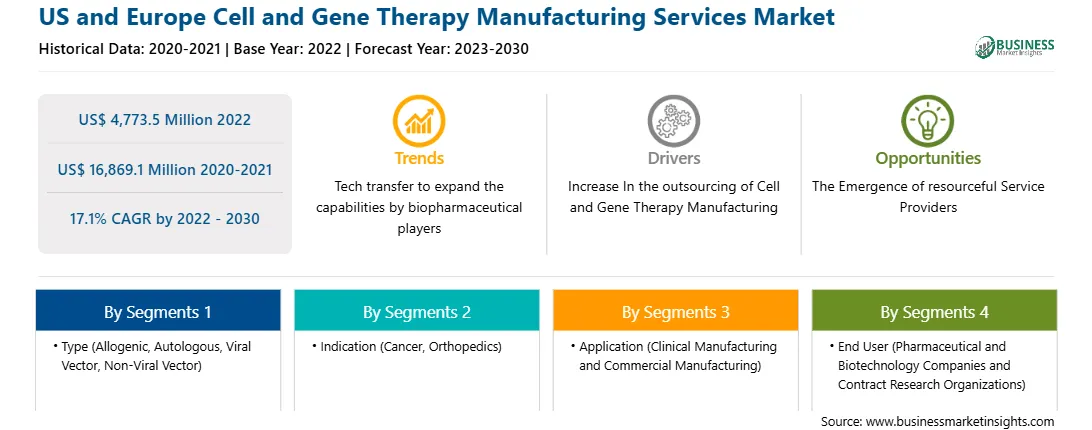

An increase in number of approvals of cell and gene therapies and increasing popularity of outsourcing cell and gene therapy manufacturing services are among the major contributing factors influencing the growth of US and Europe cell and gene therapy manufacturing services market size. However, high initial cost of cell and gene therapy manufacturing services hinders the growth of the US and Europe cell and gene therapy manufacturing services market.

Cell and gene therapy (CGT) programs are rapidly advancing from research & development to clinical trials and commercial approval. Establishing a robust, repeatable, and sustainable process help to accelerate the development, avoiding manufacturing transfer-related delays. Additionally, cell and gene therapy comprises the next generation of life-enhancing and curative therapies. With therapies experiencing new approvals, the demand for skilled professionals in cell and gene therapy manufacturing services will rise.

Cell and gene therapy manufacturing is a complex process, which makes the proper execution and overseeing of the operation crucial. Cell and gene therapy manufacturers have a limited number of qualified personnel who know biological and process engineering. Moreover, for experienced teams, managing the attempts to reach the first clinical trial using a manual, and open manufacturing method and then building a more commercially suitable process can be tricky. Therefore, these enterprises choose to work with contract development and manufacturing organizations (CDMOs) to accelerate their clinical studies and commercialization process. CDMOs provide product development, manufacturing, clinical trial support, and commercialization services to cell and gene therapy companies on a contract basis. Partnering with a CDMO enables scalability, speed to market, access to technical expertise without overhead costs, and cost efficiencies for cell and gene therapy manufacturers.

In January 2020, Deerfield Management Company and The Discovery Labs of MLP Ventures established the Center for Breakthrough Medicines in Pennsylvania, US. This new CDMO facility would occupy more than 40% of the campus created by The Discovery Labs. In that space, the CDMO would install 10 plasmid suites; 20 viral vector suites; 36 universal cell processing suites; and 20 current good manufacturing practice (cGMP) testing, process development, and cell banking suites. Deerfield Management Company and The Discovery Labs have invested US$ 1.1 billion to raise a technologically developed facility to support the manufacturing of cell and gene therapies. Further, in March 2020, Fujifilm Cellular Dynamics (FCDI) invested US$ 21 million in the cGMP-compliant production facility, which would be used for manufacturing FCDI’s pipeline of regenerative medicine therapies using induced pluripotent stem cells (iPSCs) and to provide CDMO services for production of iPSCs and iPSC-derived differentiated cells. In April 2022, ThermoGenesis established a CDMO facility in California, US to provide CDMO services to cell and gene therapy manufacturers, using its expertise in T-cell receptor (TCR), chimeric antigen receptor-T cell (CAR-T cell), tumor-infiltrating leukocyte (TIL), iPSC, natural killer cell (NK), and mesenchymal stem cell (MSC) manufacturing.

Outsourcing cell and gene therapy manufacturing to CDMOs proves cost-effective for manufacturers. Moreover, they gain access to the technologically advanced infrastructure and expertise of CDMOs. CDMOs employ proper, mapped processes for manufacturing cell and gene therapies. Thus, the increasing preference for outsourcing growing cell and gene therapy manufacturing to CDMOs fuels the US and Europe cell and gene therapy manufacturing services market growth.

Based on end user, the market is segmented into pharmaceutical and biotechnology companies and contract research organizations (CROs). The pharmaceutical and biotechnology companies segment held a larger share of the market in 2022 and the same segment is anticipated to register a higher CAGR in the market during the forecast period. Major US-based pharmaceutical and biotechnology companies committed to offering CGTs intended to treat acute and rare conditions, which are unresponsive to traditional approaches, include ElevateBio and Discovery Labs. These companies are focused on creating a completely new branch of pharmaceutical contract development and manufacturing organizations (CDMOs). They would compete with one another and with a handful of giant services firms by investing in CGTs. The aforementioned factors will be responsible for influential segmental growth thereby dominating the US and Europe cell and gene therapy manufacturing services market growth during 2022-2030.

Based on indication, the US and Europe cell and gene therapy manufacturing services market is divided into cancer, orthopedics, and others. The cancer segment held the largest share of the market in 2022 and same segment is expected to grow at the highest CAGR during the forecast period.

Based on type, the cell and gene therapy manufacturing services market is segmented cell therapy and gene therapy. Cell therapy is segmented as autologous and allogenic. Further, gene therapy is bifurcated into viral vector and non-viral vector. Cell therapy helps treat disorders and diseases by restoring or changing certain groups of cells or providing cells to carry therapy through the body. Cell therapy forms or modifies cells outside the body before introducing into the patient. The cells may derive from the patient (autologous cells) or a donor (allogeneic cells). The growth of the cell therapy segment is attributed to the increasing number of products entering the market, the potential application of cell therapies in the treatment of autoimmune diseases, cancer, and infectious diseases, and the high number of ongoing clinical trials. More than 360 clinical trials focusing on CAR-T cell therapies and other cell-based therapies are being studied to interpret the potential of these therapies for treating various disease indications. Therefore, the demand for advanced therapy manufacturing services is anticipated to increase in the coming years.

A few of the major primary and secondary sources referred to while preparing the report on the US and Europe cell and gene therapy manufacturing services market are the Foundation for the National Institutes of Health, National Health Services, and Medicines and Healthcare Products Regulatory Agency.

Strategic insights for the US and Europe Cell and Gene Therapy Manufacturing Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,773.5 Million |

| Market Size by 2030 | US$ 16,869.1 Million |

| Global CAGR (2022 - 2030) | 17.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the US and Europe Cell and Gene Therapy Manufacturing Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US and Europe Cell and Gene Therapy Manufacturing Services Market is valued at US$ 4,773.5 Million in 2022, it is projected to reach US$ 16,869.1 Million by 2030.

As per our report US and Europe Cell and Gene Therapy Manufacturing Services Market, the market size is valued at US$ 4,773.5 Million in 2022, projecting it to reach US$ 16,869.1 Million by 2030. This translates to a CAGR of approximately 17.1% during the forecast period.

The US and Europe Cell and Gene Therapy Manufacturing Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US and Europe Cell and Gene Therapy Manufacturing Services Market report:

The US and Europe Cell and Gene Therapy Manufacturing Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US and Europe Cell and Gene Therapy Manufacturing Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US and Europe Cell and Gene Therapy Manufacturing Services Market value chain can benefit from the information contained in a comprehensive market report.