South and Central America region for the estimating the market for the Medical Aesthetics consist of countries such as Brazil, Argentina, and rest of South and Central America. The region held smallest portion of the market in the global analysis. Growth in this market is mainly driven by the growing adoption of minimally invasive and non-invasive aesthetic procedures, rising adoption among geriatric individuals, increasing public awareness about cosmetic procedures, the availability of technologically advanced & user-friendly products, and the increasing demand for aesthetic treatments. The market is likely to propel in the forecasted period owing to the recent technological developments which have made a direct impact on the economy of Brazil that has advanced to a large extent. The cost savings advantage and higher work efficiencies achieved are cited as the major attracting points for manufacturing companies to establish bases in South America. Brazil has around 200 million inhabitants and is marked as the fifth largest country in the world. Brazil comprises 26 states, spread over 876,599 km², and has regions with both high (southeast) and lower population density (north). However, Brazil has the sixth-largest GDP in the world, the fourth highest population among the countries listed, and a fairly high growth rate of the over 60s over the next 15 years, suggesting a huge market potential for healthcare IT products and services. After the USA, Brazil only ranks second for the most cosmetic procedures in 2017. The impressive number of Brazilian cosmetic procedures underscores a profitable market that attracts business opportunities in this area. Hence, there is a need to analyze the risk and consequences of cosmetic surgery to physical and mental health as a hidden cost to beauty in Brazil and recommend areas for improvement to the cosmetic surgery industry in Brazil to address the problems of surgical failure in Brazil Country. The Risk and Scoring Matrix was introduced to analyze the risks and consequences of cosmetic surgery to patients' physical and mental health, and the cause and effect model was finally used to identify the possible causes for Brazilians who lost their lives for the risk the beauty. Brazil has a high number of plastic surgeries. It is one of the countries where this type of procedure is most widely practiced. With a very open-minded customer base, cosmetic surgery is booming in Brazil. According to statistics recently published by the International Society of Aesthetic Plastic Surgery (ISAPS), Brazilian plastic surgeons performed almost 7 surgeries per 1,000 people in 2016. After the USA, the country only ranks second for the most cosmetic procedures in 2017 (ISAP, 2018). The impressive number of Brazilian cosmetic procedures underscores a profitable market that attracts business opportunities into this area. In Brazil, no plastic surgery specialist qualification is required by law to perform the procedure. Article 20 of the current legislation 23 only provides that the professional to promote operations in each medical field or specialty must be registered with the Regional Council of Medicine (CRM). Regarding the plastic surgery field, the Conselho Federal de Medicina (CFM) decisions recommend that the physicians require specific training to perform the procedure that includes a mandatory pre-qualification in general surgery, among other recommendations and provisions set out in corresponding resolutions that are established. The market for medical aesthetic devices in Brazil has grown rapidly in recent years. According to the 2018 International Society of Aesthetic Plastic Surgery report, Brazil has the maximum non-surgical procedures globally. Obesity is one of the key factors in the growth of the market. In addition, advances in technology in this area have made devices and instruments more precise and safer. Medical tourism in South American countries has also increased, which has also helped market growth in Brazil. Body contouring surgeries can include panniculectomy (removal of excess skin in the lower abdomen), tummy tuck (tummy tuck), liposuction, and excisional body lifts such as lower body lift arm lift (Brachioplasty), inner thigh lift, or buttock augmentation. According to 2018 reports from the International Society of Aesthetic Plastic Surgery, liposuction is the most commonly performed operation in Brazil, and it is steadily increasing. These factors have helped the market grow. However, concerns and social stigma of these operations and poor reimbursement scenarios have slowed market growth

The COVID-19 outbreak has severely impacted medical care in South and Central America. Also, the nations are famous for medical tourism, which is also affected by the pandemic. The second wave of the outbreak affected Brazil, Argentina, Uruguay, Chile, Peru, and Colombia. Among which Brazil recorded the majority of deaths. The region is expected to impose a second lockdown that will eventually hamper the region's healthcare industry. Market participants and end-users are losing their businesses due to the temporary closure of companies in different countries. In this situation, there was the discontinuation of physiotherapy and other related treatments. However, the COVID-19 outbreak has had a critical impact on the flow of medical care in the region. During the COVID-19 pandemic, South and Central America witnessed the shortage of hospital beds.

Strategic insights for the South & Central America Medical Aesthetics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

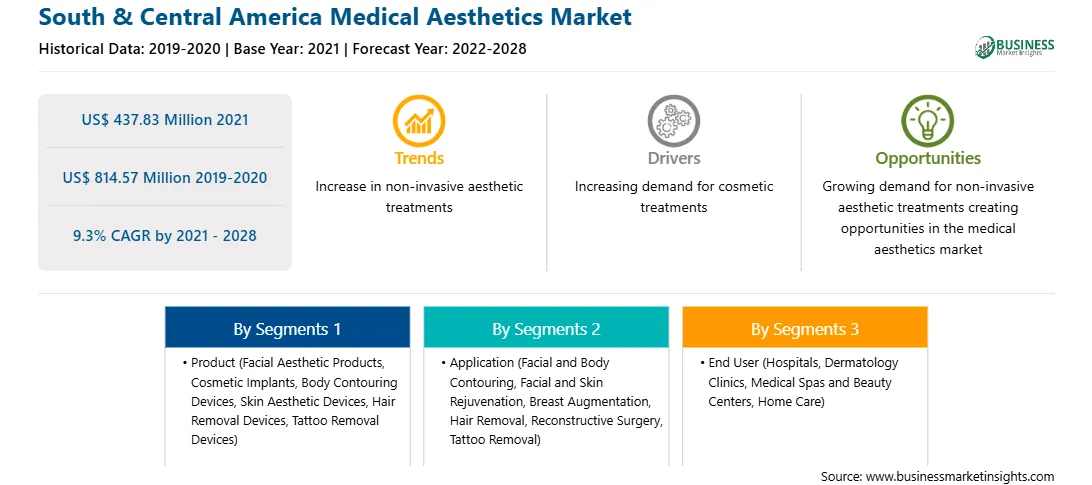

| Market size in 2021 | US$ 437.83 Million |

| Market Size by 2028 | US$ 814.57 Million |

| Global CAGR (2021 - 2028) | 9.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Medical Aesthetics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The medical aesthetics market in SCAM is expected to grow from US$ 437.83 million in 2021 to US$ 814.57 million by 2028; it is estimated to grow at a CAGR of 9.3% from 2021 to 2028. Increasing use of dermal fillers and botulinum toxin for enhancing facial aesthetics; over the past two decades, there has been an unprecedented surge in the popularity of elective aesthetic procedures. Moreover, there is an increasing demand for less invasive aesthetic procedures such as dermal fillings and botulinum toxin A (BoNTA). The global statistics of the International Society of Aesthetic Plastic Surgery indicates the rise in the aesthetic applications of BoNTA and dermal filling implants by 7% and 18%, respectively, during 2015–2016. Nonsurgical facial rejuvenation using botulinum toxin and hyaluronic acid has become highly popular in the Middle East and other parts of the world in the last 10 years. The correction of facial rhythm and loss of volume is the basic principle of aesthetic rejuvenation of the face. Botulinum toxin injections are primarily indicated to correct dynamic rhytides, while dermal fillers aim to increase volume and improve static rhytides. Botulinum toxin, a powerful neurotoxin, causes chemodenervation of muscles. Dermal fillers is a non-energy-based procedure that adds volume and fullness to a person's skin. The cost efficiency and increasing aging population are the key factors driving the demand for dermal fillers. Further, surge in demand for superior materials and techniques required for dental aesthetics procedures has spurred research into the same. However, nonsurgical facial aesthetic procedures received less attention from the dental community until chemicals such as hyaluronic acid fillers and botulinum toxin were requested by patients, which led dental manufacturers to add these materials to their catalogs and advertisements. The increasing number of accredited basic and advanced hands-on training courses in the use of such materials has been advertised in most dental journals and journals that are currently available. Facial rejuvenation has become a major issue of psychosocial wellbeing in this era of fashion, beauty, and trends. Thus, the increasing use of dermal fillers and botulinum toxin for enhancing facial aesthetics is fueling the medical aesthetics market growth.

Based on product market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, tattoo removal devices and others. In 2020, the facial aesthetic products segment held the largest share of the market, by product. Based on the application market was segmented into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal and others. In 2020, the facial and body contouring segment held the largest share of the market, by application. Based on the end user market was segmented into hospitals, dermatology clinics, medical spas and beauty centers and home care. In 2020, the hospitals segment held the largest share of the market, by end user.

A few major primary and secondary sources referred to for preparing this report on the medical aesthetics market in SCAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allergan Plc, Alma Lasers, Galderma, Hologic, Inc., and Mentor Worldwide, LLC among others.

The South & Central America Medical Aesthetics Market is valued at US$ 437.83 Million in 2021, it is projected to reach US$ 814.57 Million by 2028.

As per our report South & Central America Medical Aesthetics Market, the market size is valued at US$ 437.83 Million in 2021, projecting it to reach US$ 814.57 Million by 2028. This translates to a CAGR of approximately 9.3% during the forecast period.

The South & Central America Medical Aesthetics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Medical Aesthetics Market report:

The South & Central America Medical Aesthetics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Medical Aesthetics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Medical Aesthetics Market value chain can benefit from the information contained in a comprehensive market report.