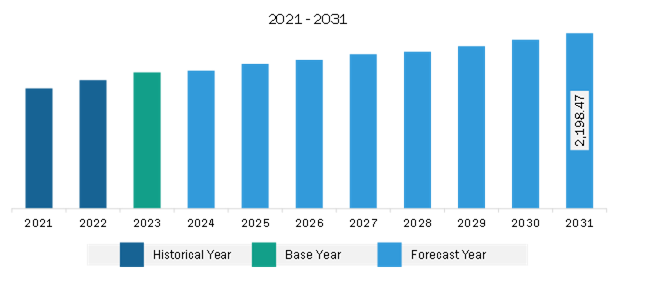

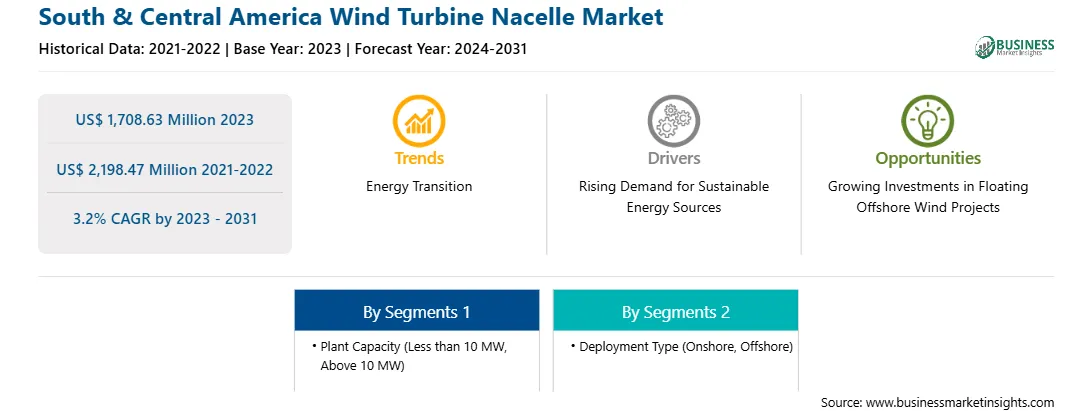

The South & Central America wind turbine nacelle market was valued at US$ 1,708.63 million in 2023 and is expected to reach US$ 2,198.47 million by 2031; it is estimated to register a CAGR of 3.2% from 2023 to 2031.

Offshore wind farms are thought to be more efficient than onshore wind farms due to higher wind speeds, greater consistency, and a lack of physical interference from land or man-made things. Offshore wind speeds are typically higher than that of land. Small changes in wind speed result in substantial gains in energy production: a turbine operating in a 15-mph wind can produce twice as much energy as a turbine operating in a 12-mph wind. Faster offshore wind speeds mean that significantly more energy can be generated. Offshore wind speeds are more consistent than on land. A more consistent supply of wind means a more dependable source of energy. Investments in offshore wind farms are increasing owing to higher efficiency compared to onshore wind farms.

In 2023, Petrobras revealed plans to build offshore wind farms in Brazil with a potential capacity of up to 23 GW, in addition to a floating wind project in Rio de Janeiro. In addition, in June 2022, Equinor collaborated with Technip Energies to develop floating wind steel semi substructures that accelerate technology development for floating offshore wind. Such investments are expected to fuel the demand for offshore wind farms in the future, ultimately generating lucrative opportunities for the wind turbine nacelle market.

South & Central America is anticipated to grow at a faster pace in the coming years owing to favorable government policies and increasing investment in wind power projects. Brazil is leading the market for wind turbine nacelle in South America. According to the Brazilian Wind Power Association, the country's potential for generating wind power is estimated at 30 GW. In addition, in April 2022, 15 MW offshore wind project was announced in Brazil, which is planned to be commissioned by 2024. There are 65 onshore wind projects planned over the next five years, with a total investment of US$ 23 billion. According to GWEC, in the coming five years, onshore wind installations in South & Central America are expected to increase by 26.5 GW, with the main contributors being Brazil, Chile, and Colombia.

Strategic insights for the South & Central America Wind Turbine Nacelle provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Wind Turbine Nacelle refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Wind Turbine Nacelle Strategic Insights

South & Central America Wind Turbine Nacelle Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,708.63 Million

Market Size by 2031

US$ 2,198.47 Million

Global CAGR (2023 - 2031)

3.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Plant Capacity

By Deployment Type

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Wind Turbine Nacelle Regional Insights

The South & Central America wind turbine nacelle market is categorized into plant capacity, deployment type, and country.

Based on plant capacity, the South & Central America wind turbine nacelle market is segmented into less than 10 MW and above 10 MW. The above 10 MW segment held a larger market share in 2023.

Based on deployment type, the South & Central America wind turbine nacelle market is segmented into onshore and offshore. The onshore segment held a larger market share in 2023.

By country, the South & Central America wind turbine nacelle market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America wind turbine nacelle market share in 2023.

BFG International Group, ENERCON GmbH, General Electric Co, Hitachi Energy Ltd, Nordex SE, Siemens Gamesa Renewable Energy SA, Suzlon Energy Ltd, Vestas Wind Systems AS, and Xinjiang Goldwind Science & Technology Co Ltd are some of the leading companies operating in the South & Central America wind turbine nacelle market.

The South & Central America Wind Turbine Nacelle Market is valued at US$ 1,708.63 Million in 2023, it is projected to reach US$ 2,198.47 Million by 2031.

As per our report South & Central America Wind Turbine Nacelle Market, the market size is valued at US$ 1,708.63 Million in 2023, projecting it to reach US$ 2,198.47 Million by 2031. This translates to a CAGR of approximately 3.2% during the forecast period.

The South & Central America Wind Turbine Nacelle Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Wind Turbine Nacelle Market report:

The South & Central America Wind Turbine Nacelle Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Wind Turbine Nacelle Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Wind Turbine Nacelle Market value chain can benefit from the information contained in a comprehensive market report.