South & Central America Uninterrupted Power Supply Market

No. of Pages: 100 | Report Code: BMIRE00031122 | Category: Electronics and Semiconductor

No. of Pages: 100 | Report Code: BMIRE00031122 | Category: Electronics and Semiconductor

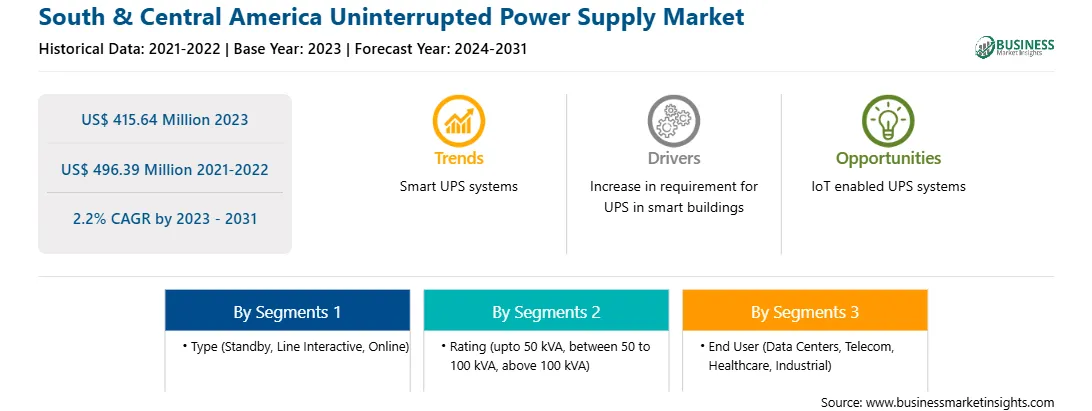

The South & Central America uninterrupted power supply market was valued at US$ 415.64 million in 2023 and is expected to reach US$ 496.39 million by 2031; it is estimated to register a CAGR of 2.2% from 2023 to 2031.

IoT is revolutionizing UPS by enabling better monitoring and remote administration. IoT-enabled UPS systems have sensors that capture real-time data on battery status, load levels, temperature, and humidity. They submit this data to a cloud-based platform for complete analysis, which enables the necessary steps. This enables proactive monitoring and maintenance of UPS systems, resulting in early detection of possible issues and reduced downtime. For example, if a UPS system detects that the battery is getting low, it can instantly notify specific workers, allowing them to act. Furthermore, IoT-enabled UPS systems can be remotely managed and controlled, offering greater flexibility and convenience. UPS systems can be easily monitored and managed using web-based and mobile applications. This allows for remote settings and configurations, such as modifying battery runtime, changing shutdown parameters, or running diagnostics. This is done without physical access to the UPS system, saving time and effort and allowing for more efficient control of several UPS systems in various locations, making it perfect for large-scale deployments. Another key advantage of connecting IoT and UPS systems is predictive maintenance. IoT-enabled UPS systems can use data analytics and machine learning algorithms to analyze historical and real-time data to discover patterns and trends that may indicate prospective equipment breakdowns. For example, if the system detects a progressive drop in battery performance over time, it can estimate the battery's remaining lifespan. It can also plan battery replacement before an outage occurs. This helps prevent unexpected failures and extends the lifespan of the UPS system, resulting in increased reliability and lower maintenance costs.

The South & Central America uninterrupted power supply market is segmented into Brazil, Argentina, and the Rest of South America. The market growth in South America can be attributed to the expansion of the manufacturing sector. South America is a significant emerging market for smart grid technologies because of its rapid growth. There is a growing need to reduce industrial and commercial energy losses, as well as increase service reliability and quality, across the region. All these factors drive the demand for uninterrupted power supply systems in the region.

Strategic insights for the South & Central America Uninterrupted Power Supply provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Uninterrupted Power Supply refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Uninterrupted Power Supply Strategic Insights

South & Central America Uninterrupted Power Supply Report Scope

Report Attribute

Details

Market size in 2023

US$ 415.64 Million

Market Size by 2031

US$ 496.39 Million

Global CAGR (2023 - 2031)

2.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Rating

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Uninterrupted Power Supply Regional Insights

The South & Central America uninterrupted power supply market is categorized into type, rating, end user, and country.

Based on type, the South & Central America uninterrupted power supply market is segmented into standby, line interactive, and online. The online segment held the largest market share in 2023.

In terms of rating, the South & Central America uninterrupted power supply market is categorized into upto 50 kVA, between 50 to 100 kVA, and above 100 kVA. The above 100 kVA segment held the largest market share in 2023.

By end user, the South & Central America uninterrupted power supply market is segmented into data centers, telecom, healthcare, industrial, and others. The data centers segment held the largest market share in 2023.

Based on country, the South & Central America uninterrupted power supply market is segmented into Brazil, Argentina, and the Rest of South & Central America. Argentina dominated the South & Central America uninterrupted power supply market share in 2023.

Schneider Electric SE, ABB Ltd, Toshiba Corp, Cyber Power Systems (USA) Inc, Eaton Corp Plc, Emerson Electric Co, Delta Electronics Inc, Legrand SA, Mitsubishi Electric Corp, and Kehua Data Co Ltd. are some of the leading companies operating in the South & Central America uninterrupted power supply market.

The South & Central America Uninterrupted Power Supply Market is valued at US$ 415.64 Million in 2023, it is projected to reach US$ 496.39 Million by 2031.

As per our report South & Central America Uninterrupted Power Supply Market, the market size is valued at US$ 415.64 Million in 2023, projecting it to reach US$ 496.39 Million by 2031. This translates to a CAGR of approximately 2.2% during the forecast period.

The South & Central America Uninterrupted Power Supply Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Uninterrupted Power Supply Market report:

The South & Central America Uninterrupted Power Supply Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Uninterrupted Power Supply Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Uninterrupted Power Supply Market value chain can benefit from the information contained in a comprehensive market report.