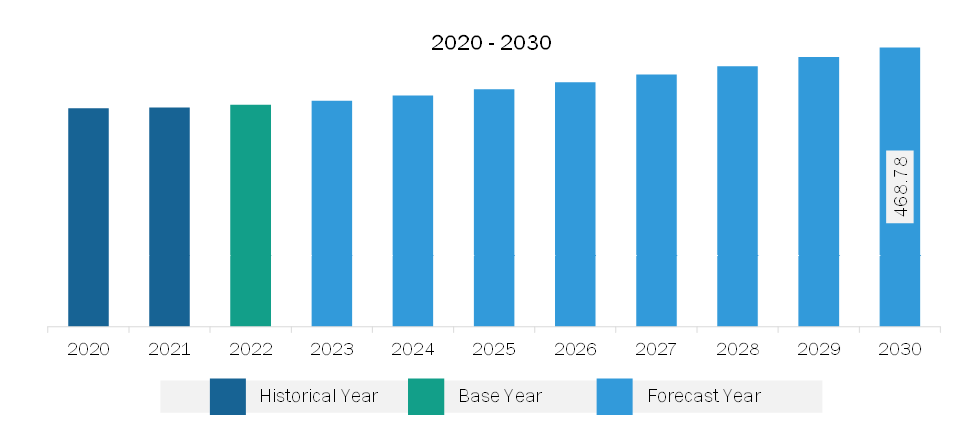

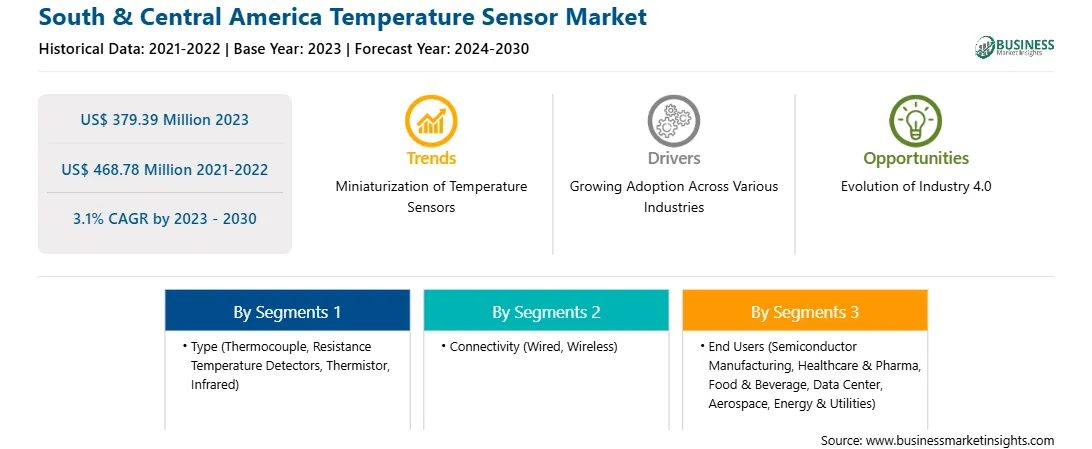

The South & Central America temperature sensor market was valued at US$ 379.39 million in 2023 and is expected to reach US$ 468.78 million by 2030; it is estimated to register a CAGR of 3.1% from 2023 to 2030.

The introduction of Industry 4.0 brings several advances in the efficiency and productivity of industrial processes. Several industries use temperature sensors for generating real-time data based on temperature variation. Industries use this data for process optimization, predictive maintenance, and quality control, which further leads to a reduction in downtime, creating opportunities in the market. Temperature sensors are deployed to monitor complex industrial instruments and machines for monitoring their temperature range to maintain operational efficiency. The evolution of Industry 4.0 encourages technological advancements in nations, which creates opportunities for market growth.

Temperature sensors are crucial for smart factories and Industry 4.0 for enabling advanced automation, smart manufacturing, and data-driven decision-making activities. Temperature sensors are essential for measuring the temperature of various components, including motors, engines, and machines in smart factories. Temperature sensor enables continuous monitoring, which allows smart factories to identify deviations or inefficiencies in the processes by allowing real-time adjustments to improve productivity and reduce energy consumption. Temperature sensors are primarily used in Industry 4.0 and smart manufacturing. It helps in detecting overheating and abnormal temperature in the machinery and equipment by ensuing efficient operations and automation within modern industrial facilities. Thus, the growth in the smart manufacturing process is creating opportunities in the market.

Rising investment in smart city projects and growing city management initiatives further generate opportunities for market growth. This data helps urban planners in the designing of green roofs, reflective pavement, and urban forests to combat rising temperatures, which is expected to create opportunities in the market during the forecast period.

South America has been experiencing significant growth in its industrial and infrastructure sectors. Industries such as energy, oil & gas, and agriculture are prevalent in the region. South America is rich in natural resources such as oil, gas, minerals, and agriculture. According to the International Association of Oil & Gas Producers, the total energy supply in the region was 26,912,417 TJ in 2021. Industries involved in resource extraction often operate in challenging environments, such as offshore oil rigs or remote mining sites, where temperature sensors are necessary to ensure the temperature. Also, the wind energy industry is growing significantly in SAM. According to the Global Wind Energy Council, 3.7 GW of onshore wind was installed in the region in 2019, with 51% by Brazil and 13% by Argentina. In total, there was close to 26 GW of onshore wind installed in Latin America, of which 57% was in Brazil. Temperature sensors are vital in the oil & gas and energy sectors for ensuring the safety and efficiency of operations, monitoring critical equipment, and optimizing various processes involved in the exploration, production, and utilization of energy resources. Therefore, the temperature sensor market is growing in SAM.

Strategic insights for the South & Central America Temperature Sensor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Temperature Sensor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Temperature Sensor Strategic Insights

South & Central America Temperature Sensor Report Scope

Report Attribute

Details

Market size in 2023

US$ 379.39 Million

Market Size by 2030

US$ 468.78 Million

Global CAGR (2023 - 2030)

3.1%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Connectivity

By End Users

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Temperature Sensor Regional Insights

The South & Central America temperature sensor market is categorized into type, connectivity, end user, and country.

Based on type, the South & Central America temperature sensor market is segmented into thermocouple, resistance temperature detectors (RTD), thermistor, infrared, and others. The thermocouple segment held the largest share of South & Central America temperature sensor market share in 2023.

In terms of connectivity, the South & Central America temperature sensor market is bifurcated into wired and wireless. The wired segment held a larger share of South & Central America temperature sensor market in 2023.

By end users, the South & Central America temperature sensor market is segmented into semiconductor manufacturing, healthcare & pharma, food and beverage, data center, aerospace, energy & utilities, and others. The others segment held the largest share of South & Central America temperature sensor market in 2023.

By country, the South & Central America temperature sensor market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America temperature sensor market share in 2023.

Texas Instruments Inc.; Siemens Ltd.; TE Connectivity Ltd.; Amphenol LTW Ltd.; Analog Devices Inc.; Emerson Electric Co.; Panasonic Corporation; Microchip Technology, Inc; Honeywell International, Inc.; and NXP Semiconductors N.V are some of the leading companies operating in the South & Central America temperature sensor market.

The South & Central America Temperature Sensor Market is valued at US$ 379.39 Million in 2023, it is projected to reach US$ 468.78 Million by 2030.

As per our report South & Central America Temperature Sensor Market, the market size is valued at US$ 379.39 Million in 2023, projecting it to reach US$ 468.78 Million by 2030. This translates to a CAGR of approximately 3.1% during the forecast period.

The South & Central America Temperature Sensor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Temperature Sensor Market report:

The South & Central America Temperature Sensor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Temperature Sensor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Temperature Sensor Market value chain can benefit from the information contained in a comprehensive market report.