South & Central America Tax Software Market

No. of Pages: 96 | Report Code: BMIRE00030083 | Category: Technology, Media and Telecommunications

No. of Pages: 96 | Report Code: BMIRE00030083 | Category: Technology, Media and Telecommunications

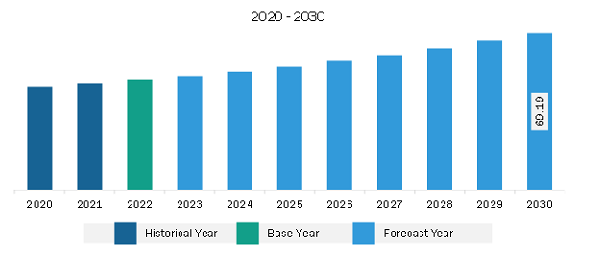

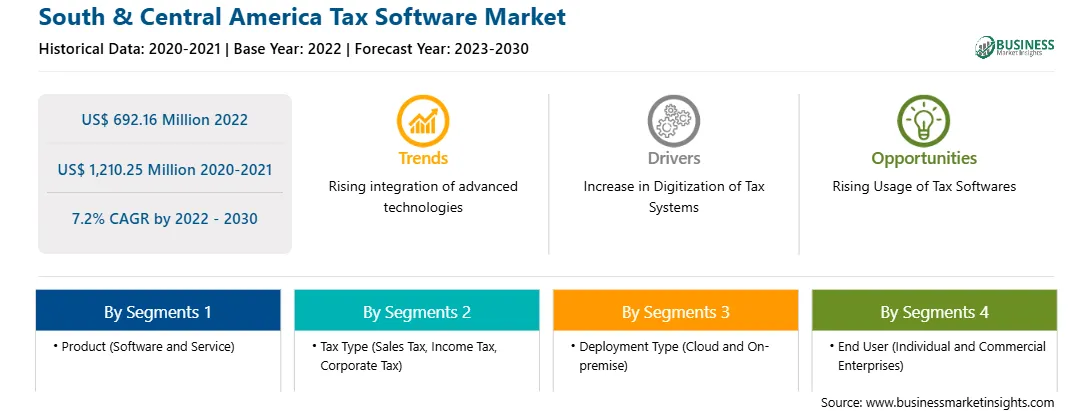

The South & Central America tax software market is expected to grow from US$ 692.16 million in 2022 to US$ 1,210.25 million by 2030. It is estimated to grow at a CAGR of 7.2% from 2022 to 2030.

Rising Integration of Advanced Technologies Fuels South & Central America Tax Software Market

The accountancy sector is growing at a fast pace, increasing the need for advanced technologies to streamline tax processes. Cloud accountancy has widely transformed how accountants work regularly and communicate with their customers. Cloud-based solutions enable accountants to run accounting tasks from any location. According to Xero Corporation, accounting firms using cloud accounting have reported a 15% growth in year-over-year revenue. Also, the accounting practices using cloud accounting have managed to gather and serve five times more customers than those who do not use this process. The use of AI technology by accounting firms is increasing to boost productivity and flourish the accounting industry. Using advanced tools to increase productivity and make more informed decisions are expected to gain more traction in the coming years. The use of technologies such as AI will help accounting firms generate more insight and reduce expenditures. According to the Sage Group, 55% of accountants are likely to leverage AI in the coming years. AI helps improve services such as automated tax filing and helps educate taxpayers through the procedure of tax filing. Moreover, AI can be implemented for identifying tax evasion, extracting key data from tax documents, and automatically feeding information into accounting software, lowering the load on tax professionals. In the coming years, automation of business processes for making labor-intensive activities such as tax preparation, banking, audits, and payroll less time-consuming is expected to gain strong momentum. Using automation would allow accounting firms to reduce the overall time required to complete processes and lower the number of errors. Thus, automation and cloud technologies are expected to be the most significant trends in the accounting industry, thereby positively favoring market growth.

Based on geography, the South America tax software market is segmented into Brazil, Argentina, and the Rest of South America. According to the World Population Review, the population of South America is 440.71 million in October 2023. Brazil is the fifth most populous country in the world, with a population of 210 million, which is further expected to reach 218 million by 2060. The rise in population can be due to people moving to countries with several low-cost benefits. Global companies are expanding their businesses in the region as it offers low labor costs and benefits in taxes. As the region is marching toward development, several global players see it as an opportunity to grow their business in the emerging potential countries. The rise in population, coupled with the growing digitalization across regions, catalyzes the tax software market growth in South America.

Countries such as Brazil, Argentina, Chile, and Colombia are focusing on taxing digital services such as games, streaming services, music, and image downloads, which have been a driver for the adoption of tax software solutions as they keep individuals and businesses updated regarding the reforms in the tax regime. Tax software speeds up the tax filing process through automated, location-precise reporting. It provides summarized reports that can be filed in any countries where a business is registered to collect tax. Thus, such benefits offered by the tax software led to its adoption by several industry verticals such as retail, government, BFSI, and healthcare. Thus, the growth and expansion of these regional industries generate the demand for effective tax software solutions. The market players are launching advanced solutions that foster the region's tax software market. For example, in May 2020, LatamReady launched a new tax compliance solution to help international businesses running NetSuite drive growth and revenue in 18+ Latin American countries.

Strategic insights for the South & Central America Tax Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 692.16 Million |

| Market Size by 2030 | US$ 1,210.25 Million |

| Global CAGR (2022 - 2030) | 7.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Tax Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America tax software market is segmented into product, deployment type, tax type, end user, and country.

Based on product, the South & Central America tax software market is bifurcated into software and services. The software segment held a larger share of the South & Central America tax software market in 2022.

In terms of deployment type, the South & Central America tax software market is bifurcated into cloud and on-premise. The cloud segment held a larger share of the South & Central America tax software market in 2022.

Based on tax type, the South & Central America tax software market is segmented into sales tax, income tax, corporate tax, and others. The sales tax segment held the largest share of the South & Central America tax software market in 2022.

Based on end user, the South & Central America tax software market is bifurcated into commercial enterprises and individual. The commercial enterprises segment held a larger share of the South & Central America tax software market in 2022. Further, commercial enterprises segment is categorized into enterprise size (large enterprises, medium enterprises, and small enterprises) and vertical (IT & Telecom, retail, BFSI, government, healthcare, and others).

Based on country, the South & Central America tax software market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America tax software market in 2022.

market Sage Group Plc, Thomson Reuters Corp, Wolters Kluwer NV, Intuit Inc, and SAP SE are some of the leading companies operating in the South & Central America tax software market.

1. Sage Group Plc

2. Thomson Reuters Corp

3. Wolters Kluwer NV

4. Intuit Inc

5. SAP SE

The South & Central America Tax Software Market is valued at US$ 692.16 Million in 2022, it is projected to reach US$ 1,210.25 Million by 2030.

As per our report South & Central America Tax Software Market, the market size is valued at US$ 692.16 Million in 2022, projecting it to reach US$ 1,210.25 Million by 2030. This translates to a CAGR of approximately 7.2% during the forecast period.

The South & Central America Tax Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Tax Software Market report:

The South & Central America Tax Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Tax Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Tax Software Market value chain can benefit from the information contained in a comprehensive market report.