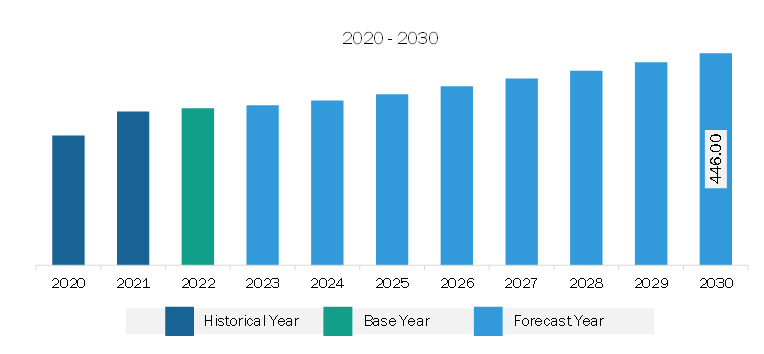

The South & Central America talc market is expected to grow from US$ 330.11 million in 2022 to US$ 446.00 million by 2030. It is estimated to grow at a CAGR of 3.8% from 2022 to 2030.

Growing Demand for Plastics in Automotive Industry Fuels South & Central America Talc Market

As per data by the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global car and vehicle production reached over 85 million in 2022, indicating a 6% increase from the previous year. South America recorded production of over 2.7 million commercial and passenger cars in 2021, which increased by 9% rate and registered production of around 2.9 million in 2022. The automotive industry in SAM is going through a transitional shift toward electric vehicle mobility. The government has played a substantial role in developing the automotive industry. The increase in commercial and passenger vehicle sales in Brazil over the past decade was primarily driven by national economic growth, favorable consumer credit policies, and fiscal incentives offered by the government. The growing production capabilities of electric vehicles from leading players are creating potential opportunities for market growth. For instance, Daimler Truck Holding AG, a German automotive manufacturer, started manufacturing its first Mercedes-Benz electric bus in Brazil between November and December 2022. The company projected that the demand for electric buses in Brazil would reach 1,000 buses in 2023 and 3,000 buses by 2024. As per a report by the Automotive Association of Peru (AAP), in 2021, the sales of hybrid and electric vehicles in Peru exceeded the sales in 2020 by 151.7%, the highest level yet recorded. Plastics have improved the performance, structure, and safety of automobiles. Plastic use helps reduce the weight of vehicle parts, which increases fuel efficiency and lowers greenhouse gas emissions. Spurred by rigorous regulations, especially regarding fuel efficiency, plastics are key material in manufacturing and designing automotive vehicles. Materials such as polypropylene (PP) and other engineering thermoplastics are extensively used for automotive interiors, exteriors, and under-the-hood applications and replacing the usage of metal parts. Talc is added to polypropylene to enhance its performance and durability. Vehicle's interior parts such as instrument panels, door panels, pillar covers, seat backs, consoles, and headliners are commonly made of talc-filled polypropylene. Thus, the increasing investments by major automobile manufacturers and surging production of automotive vehicles would propel the demand for automotive plastics, which is expected to boost the talc market growth during the forecast period.

South & Central America Talc Market Overview

The talc market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America. South & Central America is one of the largest producers of pulp and paper due to the wide availability of raw materials. Talc is widely used to reduce pitch-related deposits during pulp, paper, and board production and improve machine performance. According to the Indústria Brasileira de Árvores (Ibá) and Food and Agriculture Organization (FAO), Brazil held 11.3%, and Chile held 2.8% of global pulp production in 2020. Thus, the large quantity of pulp and paper production in the region is anticipated to drive the demand for talc. Further, according to the International Organization of Motor Vehicle Manufacturers (OICA), the total number of vehicles produced in South & Central America grew from ~2.3 million in 2020 to 2.7 million in 2021, registering an increase of 18%. In addition, rising car ownership due to increased spending power and higher living standards is expected to boost the market for automotive refinishes. This growing production of vehicles is boosting the demand for talc in the region.

South & Central America Talc Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the South & Central America Talc provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Talc refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Talc Strategic Insights

South & Central America Talc Report Scope

Report Attribute

Details

Market size in 2022

US$ 330.11 Million

Market Size by 2030

US$ 446.00 Million

Global CAGR (2022 - 2030)

3.8%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Deposit Type

By End-Use Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Talc Regional Insights

South & Central America Talc Market Segmentation

The South & Central America talc market is segmented into type, application, and country.

Based on type, the South & Central America talc market is bifurcated into talc chlorite and talc carbonate. The talc carbonate segment held a larger share of the South & Central America talc market in 2022.

In terms of application, the South & Central America talc market is segmented into plastics, pulp and paper, ceramics, paints and coatings, rubber, pharmaceuticals, food, and others. The pulp and paper segment held the largest share of the South & Central America talc market in 2022.

By country, the South & Central America talc market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America talc market in 2022.

Elementis Plc, Golcha Minerals Pvt Ltd, Imerys SA, Liaoning Aihai Talc Co Ltd, Minerals Technologies Inc, and SCR-Sibelco NV are some of the leading companies operating in the South & Central America talc market.

1. Elementis Plc

2. Golcha Minerals Pvt Ltd

3. Imerys SA

4. Liaoning Aihai Talc Co Ltd

5. Minerals Technologies Inc

6. SCR-Sibelco NV

The South & Central America Talc Market is valued at US$ 330.11 Million in 2022, it is projected to reach US$ 446.00 Million by 2030.

As per our report South & Central America Talc Market, the market size is valued at US$ 330.11 Million in 2022, projecting it to reach US$ 446.00 Million by 2030. This translates to a CAGR of approximately 3.8% during the forecast period.

The South & Central America Talc Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Talc Market report:

The South & Central America Talc Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Talc Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Talc Market value chain can benefit from the information contained in a comprehensive market report.