South & Central America SMT Equipment Market

No. of Pages: 101 | Report Code: BMIRE00031033 | Category: Electronics and Semiconductor

No. of Pages: 101 | Report Code: BMIRE00031033 | Category: Electronics and Semiconductor

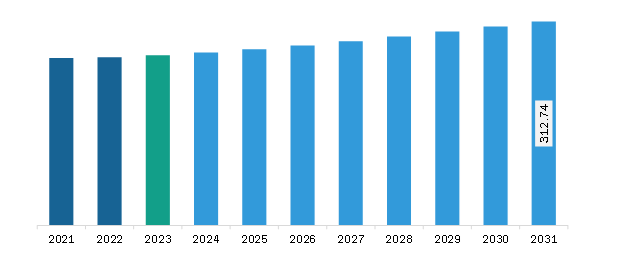

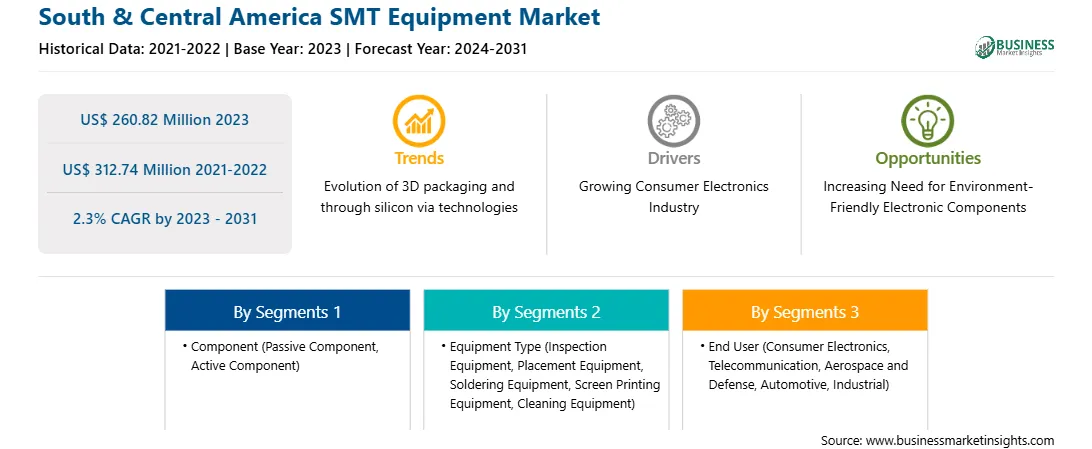

The South & Central America SMT equipment market was valued at US$ 260.82 million in 2023 and is projected to reach US$ 312.74 million by 2031; it is estimated to record a CAGR of 2.3% from 2023 to 2031.

One of the most significant environmental initiatives in SMT assembly is the transition to lead-free soldering. Traditional solder alloys containing lead pose significant health and environmental risks due to their toxicity. To mitigate these risks, the electronics industry has widely adopted lead-free solder alloys, such as tin-silver-copper (SAC) and tin-copper (SnCu), which are more environmentally friendly and comply with various global regulations. There are various government laws and regulations regarding restricting the use of certain hazardous substances in electrical and electronic equipment.

SMT assembly processes, particularly reflow soldering, can be energy-intensive. However, advancements in equipment design and process optimization have led to more energy-efficient SMT assembly lines. Modern reflow ovens and other machinery are designed to minimize energy consumption while maintaining precise process control, reducing the overall environmental footprint of SMT manufacturing. SMT equipment can progress in addressing environmental concerns. Efforts can be taken to improve sustainability practices further. This includes exploring more eco-friendly materials, implementing closed-loop recycling systems, and adopting renewable energy sources to power SMT assembly lines. Thus, the growing need for environmentally friendly electronic components is expected to create an opportunity for the growth of the South & Central America SMT equipment market.

The South & Central America SMT equipment market is segmented into Brazil, Argentina, and the Rest of South & Central America. The electronics industry in SAM is still developing, and it faces several barriers, such as low levels of innovation, limited access to financing, and dependence on imports. Governments across the region are taking initiatives in the development of the semiconductor chip industry; for example, in February 2024, Brazil's Ministry of Science, Technology and Innovation allocated US$ 20 million in nonrefundable subsidies to local chip firms as part of its Mais Inovação program. The Semiconductors Scheme is intended to stimulate development projects in semiconductor design, production, and testing. It is part of a larger industrial stimulus program that includes 11 subsidy notifications for various industries totaling US$ 400 million. Moreover, the region witnesses the manufacturing of various electronic products such as smartphones and smartwatches. For example, in February 2023, Chinese tech giant Xiaomi established a production base in Tierra del Fuego, Argentina. Xiaomi will produce smartphones in this country. The establishment of electronic manufacturing facilities across the region creates the need for the growth of SMT equipment. The SMT equipment contributes to the fabrication of sleek and aesthetically pleasing electronic components. Thus, the growing electronic production in the region is propelling the growth of the South & Central America SMT equipment market.

Strategic insights for the South & Central America SMT Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America SMT Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America SMT Equipment Strategic Insights

South & Central America SMT Equipment Report Scope

Report Attribute

Details

Market size in 2023

US$ 260.82 Million

Market Size by 2031

US$ 312.74 Million

Global CAGR (2023 - 2031)

2.3%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By Equipment Type

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America SMT Equipment Regional Insights

South & Central America SMT Equipment Market Segmentation

The South & Central America SMT equipment market is categorized into component, equipment type, end user, and country.

Based on component, the South & Central America SMT equipment market is bifurcated into passive component and active component. The active component segment held a larger market share in 2023.

In terms of equipment type, the South & Central America SMT equipment market is categorized into inspection equipment, placement equipment, soldering equipment, screen printing equipment, cleaning equipment, and others. The placement equipment segment held the largest market share in 2023.

By end user, the South & Central America SMT equipment market is segmented into consumer electronics, telecommunication, aerospace and defense, automotive, industrial, and others. The consumer electronics segment held the largest market share in 2023.

By country, the South & Central America SMT equipment market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America SMT equipment market share in 2023.

FUJI CORPORATION; Hitachi High-Tech Corp; JUKI CORPORATION; KLA Corp; Mycronic; Nordson Corp; SAKI CORPORATION; Viscom AG; and Yamaha Motor Co., Ltd, are some of the leading companies operating in the South & Central America SMT equipment market.

The South & Central America SMT Equipment Market is valued at US$ 260.82 Million in 2023, it is projected to reach US$ 312.74 Million by 2031.

As per our report South & Central America SMT Equipment Market, the market size is valued at US$ 260.82 Million in 2023, projecting it to reach US$ 312.74 Million by 2031. This translates to a CAGR of approximately 2.3% during the forecast period.

The South & Central America SMT Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America SMT Equipment Market report:

The South & Central America SMT Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America SMT Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America SMT Equipment Market value chain can benefit from the information contained in a comprehensive market report.