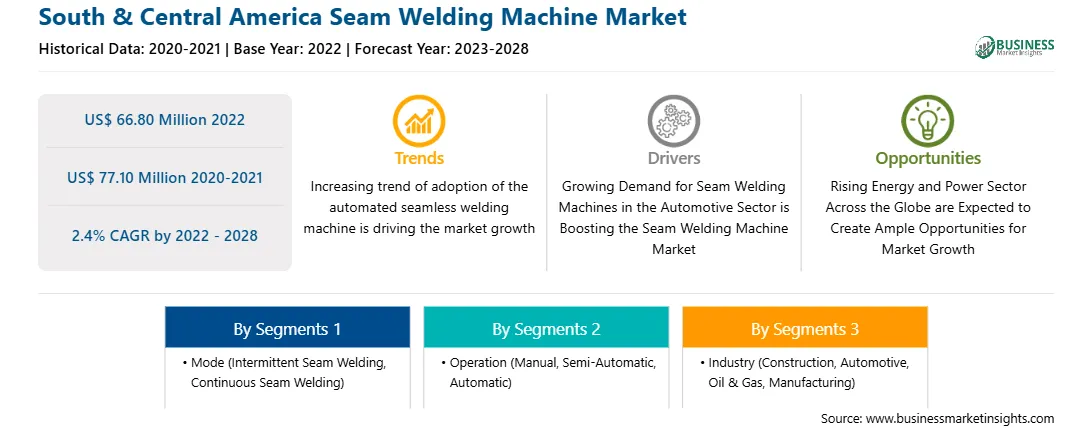

The seam welding machine market in South & Central America is expected to grow from US$ 66.80 million in 2022 to US$ 77.10 million by 2028. It is estimated to grow at a CAGR of 2.4% from 2022 to 2028.

Increase in Demand for Laser-Based Beam Welding

Laser- based welding technology provides a more precise and controlled environment. It can be used to weld smaller and delicate parts, without upsetting the original parts and with zero distortion in the original parts. Laser welding technology can be used for seam welding machines to weld all kinds of materials, particularly dissimilar materials. It can also be utilized well where conventional processes pose difficulties. Laser welding provides excellent quality and clean operation. Thus, increased demand for laser-based welding technologies is expected to offer lucrative growth opportunities for the seam welding machine market.

In addition, manufacturing and automotive industries are shifting toward laser welding technologies as it improves product quality and helps in reducing production costs. In automotive sector fast assembly line manufacturing process involves laser-based welding operations. Further, the growing trend of fiber laser welding, and semiconductor laser welding is also anticipated to provide new opportunities for the seam welding machine market. Fiber laser welding uses optical fiber for oscillations and semiconductor lasers. Further, the growing popularity of hybrid laser welding in automotive components manufacturing due to its fast-welding speeds and strong gap resistance is expected to contribute to market growth over the forecast period.

Market Overview

The seam welding machine market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America. A rise in urbanization and increase in construction activities over the past couple of years have bolstered the demand for welded products, propelling the seam welding machine market growth in SAM countries. After recording a surge in the sales of trucks in Brazil in 2021, Volvo announced an investment worth US$ 283.36 million in February 2022 to manufacture trucks. Also, in June 2022, Volkswagen Group approved an agreement for investment worth US$ 192.97 million to produce a new vehicle model, which is scheduled to commence in 2025. In Brazil, the government launched the new Casa Verde e Amarela housing program to serve 1.6 million low-income families with a housing financing scheme enabling lower interest rates by 2024. These factors boost the demand for welded products, further propelling seam welding machine demand in South & Central America.

The automotive sector accounts for a significant share of economic development in SAM. The demand for passenger cars has significantly increased with a rise in the standard of living across countries such as Brazil and Argentina. Additionally, government initiatives to promote the growth of the automotive parts industry by making several provisions to exempt investors from customs duty are further propelling the growth of the automotive sector in the region. According to the International Organization of Motor Vehicle Manufacturers, the sales of new vehicles in Chile increased from 258,835 units in 2020 to 415,582 units in 2021. In Colombia, the sales of new vehicles increased from 173,121 units in 2020 to 229,493 units in 2021. Thus, the rapidly growing demand for auto parts is positively influencing the growth of the SAM seam welding machine market.

South & Central America Seam Welding Machine Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the South & Central America Seam Welding Machine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Seam Welding Machine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Seam Welding Machine Strategic Insights

South & Central America Seam Welding Machine Report Scope

Report Attribute

Details

Market size in 2022

US$ 66.80 Million

Market Size by 2028

US$ 77.10 Million

Global CAGR (2022 - 2028)

2.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Mode

By Operation

By Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Seam Welding Machine Regional Insights

South & Central America Seam Welding Machine Market Segmentation

The South & Central America seam welding machine market is segmented into mode, operation, industry, and country.

Based on mode, the South & Central America seam welding machine market is segmented into intermittent seam welding and continuous seam welding segment. The continuous seam welding segment accounted for a larger share of the seam welding machine market in 2022.

Based on operation, the South & Central America seam welding machine market is segmented into manual, semi-automatic and automatic segment. The automatic segment accounted for the largest share of the seam welding machine market in 2022.

Based on industry, the South & Central America seam welding machine market is categorized into construction, automotive, oil and gas, manufacturing, and others. The construction segment accounted for the largest share of the seam welding machine market in 2022.

Based on country, the market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the market in 2022.

A.C.T Otomotiv Müh. Dan. San. Tic. Ltd. Şti.; Emerson Electric Co; KOIKE ARONSON, INC.; Schnelldorfer Maschinenbau GmbH; and SPIRO INTERNATIONAL are the leading companies operating in the seam welding machine market in the region.

The South & Central America Seam Welding Machine Market is valued at US$ 66.80 Million in 2022, it is projected to reach US$ 77.10 Million by 2028.

As per our report South & Central America Seam Welding Machine Market, the market size is valued at US$ 66.80 Million in 2022, projecting it to reach US$ 77.10 Million by 2028. This translates to a CAGR of approximately 2.4% during the forecast period.

The South & Central America Seam Welding Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Seam Welding Machine Market report:

The South & Central America Seam Welding Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Seam Welding Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Seam Welding Machine Market value chain can benefit from the information contained in a comprehensive market report.