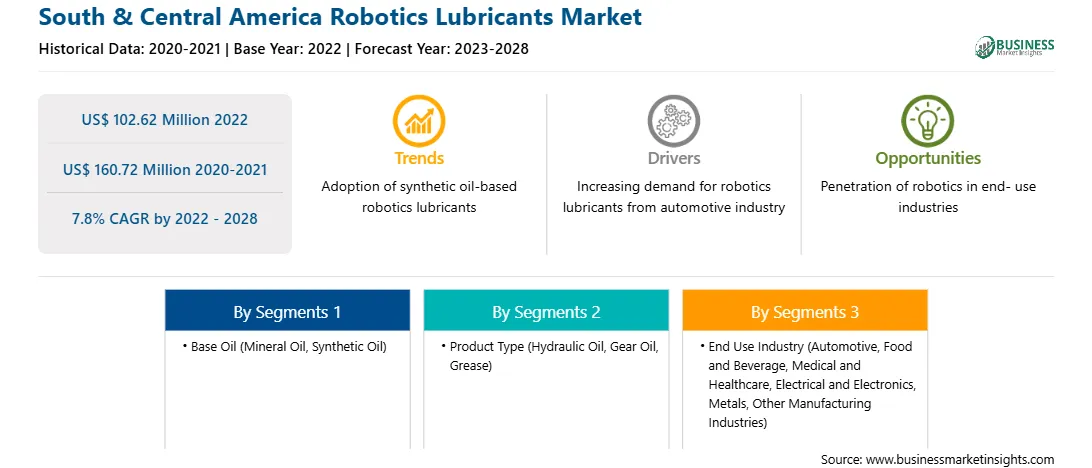

Synthetic oil-based robotics lubricants are widely used in industrial operations and the automotive sector, owing to their advantages. Polyalphaolefin lubricant is the most common synthetic oil utilized in robots in automotive and industrial sectors. It possesses optimum physical and chemical properties, such as high viscosity index, low volatility, low pour point, and thermal stability. The American Petroleum Institute (API) has categorized base oil into 5 groups. Group I, II and III are mineral oils, whereas group IV base oil is fully synthetic. Group IV base oils are high-quality oils used for high-performance applications and low-viscosity motor oils in technically advanced engines. Blending flexibility due to advancements in additive technology and growing fuel efficiency standards are some of the key factors that have the potential to boost sales of high-quality group III base synthetic lubricants. Synthetic lubricants are chemically modified and preferred over mineral oil. Robotics lubricant manufacturers prefer synthetic base oil to reduce dependency on nonrenewable resources such as petroleum and crude oil. Several robotics lubricant manufacturers are focused on research and development of synthetic lubricant formulations to provide improved oxidation stability. Further, advanced lubricants have a major role in reducing carbon emissions during the manufacturing process. In the past few years, end-use industries such as automotive and electrical & electronics have launched various initiatives and policies to reduce carbon footprint and carbon emissions, which is leading to the adoption of synthetic lubricants for robotics applications. Therefore, the adoption of synthetic oil-based robotic lubricants is expected to be a major trend in the South & Central America robotics lubricants market during the forecast period.

In the past few years, South & Central America has witnessed business potential for warehouse and manufacturing automation. For instance, in 2021, ABB Ltd announced its plan to develop SafeMove collaborative robot technology at the manufacturing facility of Nestle SA, Brazil. The company, in collaboration with Nestle SA’s engineering team, developed an ABB IRB 660 robot with SafeMove technology, aimed at improving productivity by 53%. According to the statistical yearbook released by the International Federation of Robotics 2022, robot installations in Brazil were registered at 1,702 units in 2021, with an average annual growth rate of 7% compared to 2016. Further, end-use industries prefer suitable lubrication systems to decrease the wear and tear of robotic components and reduce downtime. Thus, the key factors pertaining to the robotic industry in South & Central America are anticipated to boost the South & Central America robotics lubricants market during the forecast period.

Strategic insights for the South & Central America Robotics Lubricants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Robotics Lubricants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Robotics Lubricants Strategic Insights

South & Central America Robotics Lubricants Report Scope

Report Attribute

Details

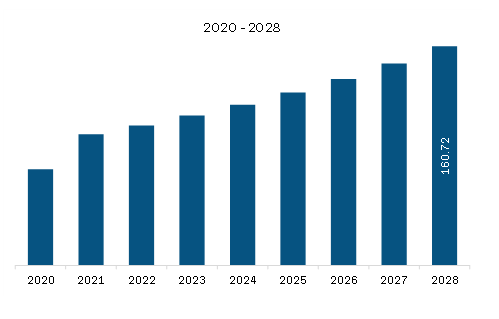

Market size in 2022

US$ 102.62 Million

Market Size by 2028

US$ 160.72 Million

Global CAGR (2022 - 2028)

7.8%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Base Oil

By Product Type

By End Use Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Robotics Lubricants Regional Insights

South & Central America Robotics Lubricants Market Segmentation

The South & Central America robotics lubricants market is segmented into base oil, product type, end use industry, and country.

Based on base oil, the South & Central America robotics lubricants market is segmented into mineral oil, synthetic oil, and others. In 2022, the mineral oil segment registered a largest share in the South & Central America robotics lubricants market.

Based on product type, the South & Central America robotics lubricants market is segmented into hydraulic oil, gear oil, and grease. In 2022, the grease segment registered a largest share in the South & Central America robotics lubricants market.

Based on end use industry, the South & Central America robotics lubricants market is segmented into automotive, food and beverage, medical and healthcare, electrical and electronics, metals, and other manufacturing industries. In 2022, the automotive segment registered a largest share in the South & Central America robotics lubricants market.

Based on country, the South & Central America robotics lubricants market is segmented into Brazil, Argentina, and the Rest of South & Central America. In 2022, Brazil segment registered a largest share in the South & Central America robotics lubricants market.

BP Plc, Fuchs Petrolub SE, Idemitsu Kosan Co Ltd, Kluber Lubrication GmbH & Co KG, Schaeffler Austria GmbH, and Shell Plc are the leading companies operating in the South & Central America robotics lubricants market.

The South & Central America Robotics Lubricants Market is valued at US$ 102.62 Million in 2022, it is projected to reach US$ 160.72 Million by 2028.

As per our report South & Central America Robotics Lubricants Market, the market size is valued at US$ 102.62 Million in 2022, projecting it to reach US$ 160.72 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The South & Central America Robotics Lubricants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Robotics Lubricants Market report:

The South & Central America Robotics Lubricants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Robotics Lubricants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Robotics Lubricants Market value chain can benefit from the information contained in a comprehensive market report.