RFID technologies are used for various applications in many industries such as food, airline, and blockchain, due to technological advancements and rising awareness regarding their benefits. For instance, RFID tags can be attached to food products to track their movement throughout the supply chain. It helps improve inventory management, prevent food spoilage, and ensure food safety.

Additionally, in April 2021, Stora Enso launched its "world-first" recyclable RFID tag for microwave-safe use. The Eco Meal RFID tag is designed for item-level ready to eat meal tagging and tracking. Such application and product development propel RFID technology adoption in food industries.

In the airline industry, RFID tags can provide accurate information about the location and status of emergency equipment, aircraft systems, and passengers. It can help to improve decision-making during an emergency. Additionally, RFID can help airport authorities improve baggage handling by automating many manual processes, such as checking in bags, loading bags onto airplanes, and unloading bags from airplanes. It can help reduce the wait times for passengers in baggage handling. The benefits of the technology propel the adoption of RFID technologies in airline industries.

The South & Central America RFID market is further segmented into Brazil, Argentina, and the Rest of South & Central America. RFID tags can be attached to individual garments or other textile products, allowing for real-time inventory tracking. This can help prevent stockouts and ensure that products are always available when customers need them. The proliferating textile industries in South & Central American countries drive the adoption of RFID technologies. According to the estimations of the Brazilian Textile and Apparel Industry Association, Brazil’s textile output increased by 7.4% to reach 2 million tons in 2021. Such a rise in the textile industry would propel the adoption of RFID technologies in South & Central America.

Various retailers in South & Central American countries are using RFID technologies for inventory management. In April 2023, Lojas Renner deployed an RFID-based inventory intelligence solution from Sensormatic Solutions, a Johnson Controls company. After implementing the RFID solution across all its stores, Lojas Renner has recorded an 87% reduction in stockouts and a 64% increase in inventory accuracy. Lojas Renner has tagged over 500 million products with Sensormatic RFID technology, enabling over 4 million daily item-level readings.

Strategic insights for the South & Central America RFID provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America RFID refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America RFID Strategic Insights

South & Central America RFID Report Scope

Report Attribute

Details

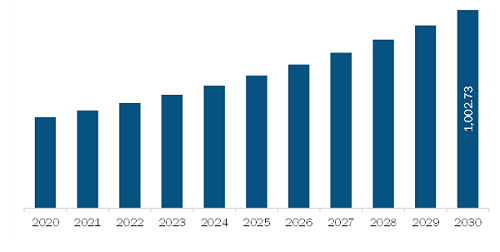

Market size in 2023

US$ 573.30 Million

Market Size by 2030

US$ 1,002.73 Million

Global CAGR (2023 - 2030)

8.3%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Frequency Band

By End User

By Product

By Offering

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America RFID Regional Insights

South & Central America RFID Market Segmentation

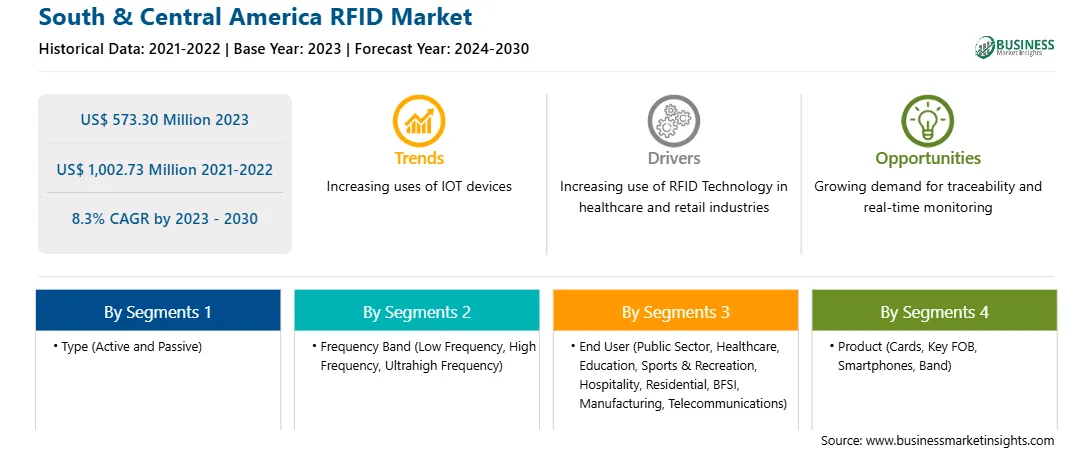

The South & Central America RFID market is segmented into type, frequency band, end user, product, offering, application, and country.

Based on type, the South & Central America RFID market is segmented into active and passive. The passive segment held the larger share of the South & Central America RFID market in 2023.

Based on frequency band, the South & Central America RFID market is segmented into low frequency, high frequency, and ultrahigh frequency. The high frequency segment held the largest share of the South & Central America RFID market in 2023.

Based on end user, the South & Central America RFID market is segmented into public sector, healthcare, education, sports & recreation, hospitality, residential, BFSI, manufacturing, telecommunications, and others. The hospitality segment held the largest share of the South & Central America RFID market in 2023.

Based on product, the South & Central America RFID market is segmented into cards, key fob, smartphones, band, and others. The cards segment held the largest share of the South & Central America RFID market in 2023.

Based on offering, the South & Central America RFID market is segmented into tags, readers, and software & services. The tags segment held the largest share of the South & Central America RFID market in 2023.

Based on application, the South & Central America RFID market is segmented into parcel & mailboxes, lockers, ticketing, and others. The others segment held the largest share of the South & Central America RFID market in 2023.

Based on country, the South & Central America RFID market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the share of the South & Central America RFID market in 2023.

Assa Abloy AB; dormakaba Holding AG; Honeywell International Inc; OMRON Corp; Siemens AG; and Zebra Technologies Corp are the leading companies operating in the South & Central America RFID market.

The South & Central America RFID Market is valued at US$ 573.30 Million in 2023, it is projected to reach US$ 1,002.73 Million by 2030.

As per our report South & Central America RFID Market, the market size is valued at US$ 573.30 Million in 2023, projecting it to reach US$ 1,002.73 Million by 2030. This translates to a CAGR of approximately 8.3% during the forecast period.

The South & Central America RFID Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America RFID Market report:

The South & Central America RFID Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America RFID Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America RFID Market value chain can benefit from the information contained in a comprehensive market report.