South & Central America Power and Control Cable Market

No. of Pages: 70 | Report Code: BMIRE00029673 | Category: Electronics and Semiconductor

No. of Pages: 70 | Report Code: BMIRE00029673 | Category: Electronics and Semiconductor

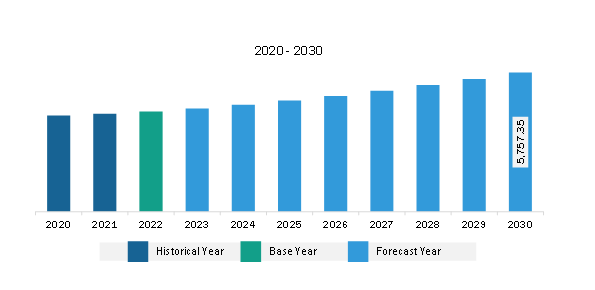

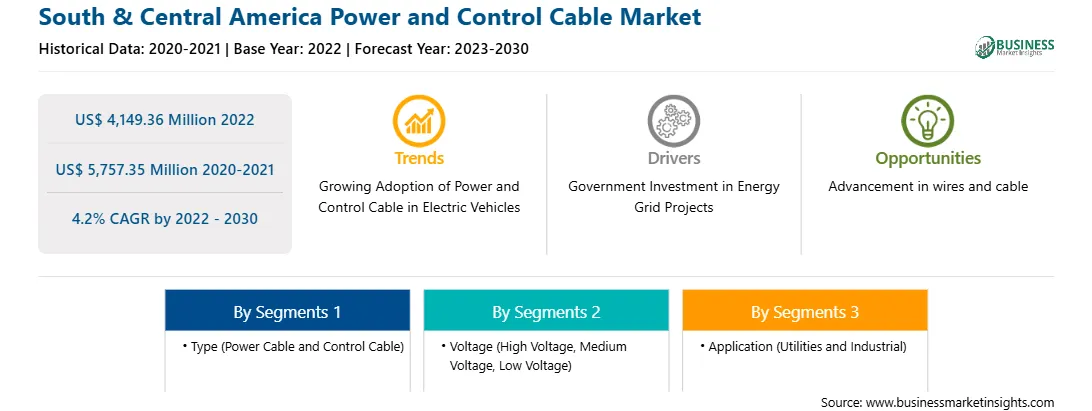

The South & Central America power and control cable market was valued at US$ 4,149.36 million in 2022 and is expected to reach US$ 5,757.35 million by 2030; it is estimated to grow at a CAGR of 4.2% from 2022 to 2030.

The growth of data centers and technology-driven industries propelled the need for power and control cables to ensure uninterrupted power supply and data transmission. The cables are crucial to maintain the functioning of critical infrastructure. As the demand for data storage and processing continues to rise, more data centers are being built. These facilities require extensive power and control cable systems to distribute electricity and manage various systems and equipment. Modern data centers are designed to accommodate high-power-density servers and equipment. This generates a huge scope for power cable systems capable of handling larger electrical loads safely and efficiently. Lately, several data centers have been installed. In 2023, Scala Data Centers has announced the opening of its first site in the Brazilian Southern Region, located in Porto Alegre. Part of the HyperEdge series, the SPOAPA01 data center has 4.8MW of IT and is set up to handle dispersed computing and connection demands. Additionally, a US$ 50 million Tier 3 data center in Lima has been opened by Claro Peru. This renewable energy-powered facility has the potential to completely transform Peru's digital infrastructure. Also, in 2022, Equinix, Inc. announced plans to expand into Chile and Peru by acquiring four data centers from prominent Chilean telecommunications provider Empresa Nacional De Telecomunicaciones S.A. ("Entel") for an estimated enterprise value of US$ 705 million. Therefore, the growing data center industry relies heavily on power and control cables to ensure reliable, efficient, and safe operations. As data centers evolve and expand, the demand for these cables is expected to increase significantly in the coming years.

Per IEA, SAM is anticipated to register a projected average annual growth rate of 2% in energy demand from 2022 to 2040. The region is strongly focusing on improving its energy production capacity in order to meet the rising demand for electricity. In April 2023, General Electric received a second order for its H-Class gas turbine technology from Eneva to expand the latter’s Azulão power plant and deliver an additional 590 MW of power. Eneva is one of the largest private natural gas operators in the country.

Integrating distributed renewable energy sources, digitalization, and smart meters present opportunities for the evolution of electricity grids. In February 2023, the Brazilian Power Trading Chamber (CCEE) announced that ~92% of the country's 2022 electricity production was generated from renewable energy sources. Additionally, several corporations are supporting the nation's transition to renewable energy. In September 2023, Petrobras, a Brazilian state-run oil and gas company, announced a partnership with WEG SA, an electrical equipment maker, to develop a US$ 26.2 million worth 7 MW onshore wind turbine. Petrobras had previously announced plans to develop up to 23 GW of offshore wind power in the country. The company also requested local environmental regulators to license ten areas off the Brazilian coast for the projects.

Argentina witnessed significant distributed power generation growth in 2021, including a ~190% growth in installed power and ~111% in the number of user-generators registered. It includes the incorporation of more than 5,900 kW of power. Apart from expanding distributed power generation capacity, the country is expanding the grid with projects such as the US$ 62 million transmission project in the Tucamán province, partly funded by the Inter-American Development Bank. This bank will provide a total loan of US$ 1.4 billion and include projects in Santa Fe, Entre Ríos, Tucumán, Catamarca, and La Pampa. The plan also includes expanding the El Bracho, Crespo-Viale, and Villa Quinteres lines.

Such factors promote the region’s demand for high, medium, and low voltage cables, which drives the South & Central America power and control cable market.

Strategic insights for the South & Central America Power and Control Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,149.36 Million |

| Market Size by 2030 | US$ 5,757.35 Million |

| Global CAGR (2022 - 2030) | 4.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Power and Control Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America power and control cable market is segmented based on type, voltage, application, and country.

Based on type, the South & Central America power and control cable market is bifurcated into power cable and control cable. The power cable segment held a larger share in 2022.

By voltage, the South & Central America power and control cable market is segmented into high voltage, medium voltage, and low voltage. The low voltage segment held the largest share in 2022.

By application, the South & Central America power and control cable market is segmented into utilities and industrial. The utilities segment held a larger share in 2022.

Based on country, the South & Central America power and control cable market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America power and control cable market in 2022.

Belden Inc; Furukawa Electric Co Ltd; HENGTONG GROUP CO., LTD.; LEONI AG, Nexans SA; Prysmian SpA; and Sumitomo Electric Industries Ltd are some of the leading companies operating in the South & Central America power and control cable market.

1. Belden Inc

2. Furukawa Electric Co Ltd

3. HENGTONG GROUP CO.,LTD.

4. LEONI AG

5. Nexans SA

6. Prysmian SpA

7. Sumitomo Electric Industries Ltd

The South & Central America Power and Control Cable Market is valued at US$ 4,149.36 Million in 2022, it is projected to reach US$ 5,757.35 Million by 2030.

As per our report South & Central America Power and Control Cable Market, the market size is valued at US$ 4,149.36 Million in 2022, projecting it to reach US$ 5,757.35 Million by 2030. This translates to a CAGR of approximately 4.2% during the forecast period.

The South & Central America Power and Control Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Power and Control Cable Market report:

The South & Central America Power and Control Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Power and Control Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Power and Control Cable Market value chain can benefit from the information contained in a comprehensive market report.