Market Introduction

The South and Central America (SCAM) region includes Brazil, Argentina, and the rest of South and Central America. Brazil is one of the leading markets for poultry feed in this region. The Brazilian feed sector is one of the largest feed sectors in the world. The high amount of raw materials produced in this country and a large population base of meat consumers are the key factors behind the dominance of this country in the global feed industry. Brazil also exports a significant proportion of its poultry meat to the Netherlands and other European countries. In Chile, the demand for poultry products has been consistently rising. According to the Grain and Feed Annual report by the US Department of Agriculture (USDA), broiler meat production reached 669,014 MT in 2018, reporting a rise by 5.8 percent compared to 2017 in this country. Chicken is well-positioned to take advantage due to its healthier status and low-cost alternative to pork and beef in other countries in SAM, such as Columbia. In December 2018, Cargill, Incorporated purchased Campollo, a Colombian poultry and protein products producer. The company’s expansion into the region reflects its efforts to supplement established positions in commodity trading and animal nutrition with a greater focus on protein. Factors, such as high demand for poultry products, increasing poultry production, rising efforts from market players, are projected to propel the poultry feed market in South and Central America during the forecast period.

Due to travel restrictions and other measures adopted after the onset of the COVID-19 pandemic, there have been delays in shipping of raw materials and feed products in the South and Central America. Due to the economic crisis associated with the COVID-19 pandemic, Argentina's chicken export to numerous countries have decreased. According to the Poultry and Products Annual report by the US Department of Agriculture (USDA), chicken meat export increased by 1.9 % in Argentina in 2021.

Market Overview and Dynamics

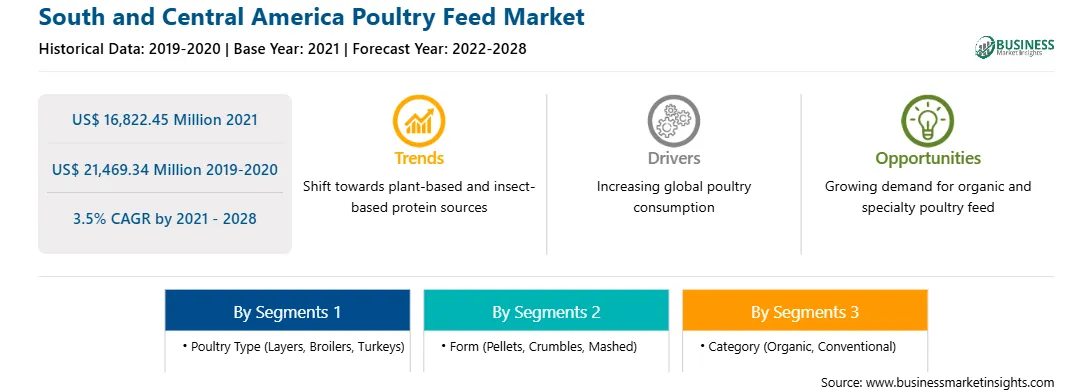

The poultry feed market in South and Central America is expected to grow from US$ 16,822.45 million in 2021 to US$ 21,469.34 million by 2028; it is estimated to grow at a CAGR of 3.5% from 2021 to 2028. Poultry feed products are fortified with optimal levels of calcium, phosphorus, minerals, and vitamins. Feed fortification will decrease mortality and increase bone strength. Feed fortification has a positive effect on bone strength which leads to a reduction of bone fractures. Probiotic fortification of a feed helps to improve growth performance, animal immunity, and overall poultry performance. The poultry feed is fortified with synthetic amino acids is to reduce the use of crude protein, such as soybean, meal in poultry diets. In addition to contributing to protein-rich feedstuff substitution, amino acids can also positively impact animal metabolism. There is an increase in interest in such dietary intervention that could address the protein deficit by lowering dependence on soybean. The import of soybean could be significantly reduced through the use of feed-grade amino acids. The fluctuation in soybean prices is also expected to boost the need for feed-grade amino acids in poultry feed. Hence, increasing demand for fortified poultry feed products would emerge as a trend in the South and Central America poultry feed market in the coming years.

Key Market Segments

Based on poultry type, the South and Central America poultry feed market is segmented into broilers, layers, turkeys, and others. In 2020, the broilers

segment accounted for the largest revenue share. Based on category, the South and Central America poultry feed market is segmented into organic and conventional. In 2020, the conventional segment accounted for the largest revenue share. Based on form, the South and Central America poultry feed market is segmented into pellets, crumbles, mashed, and others. In 2020, the pellets segment accounted for the largest revenue share.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the poultry feed market in South and Central America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; Alltech.; Cargill, Incorporated.; Charoen Pokphand Foods PCL; De Heus Animal Nutrition.; and SHV Holdings; among others.

Reasons to buy report

SOUTH AND CENTRAL AMERICA POULTRY FEED MARKET SEGMENTATION

By Country

Company Profiles

Strategic insights for the South and Central America Poultry Feed provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 16,822.45 Million |

| Market Size by 2028 | US$ 21,469.34 Million |

| Global CAGR (2021 - 2028) | 3.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Poultry Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South and Central America Poultry Feed refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South and Central America Poultry Feed Market is valued at US$ 16,822.45 Million in 2021, it is projected to reach US$ 21,469.34 Million by 2028.

As per our report South and Central America Poultry Feed Market, the market size is valued at US$ 16,822.45 Million in 2021, projecting it to reach US$ 21,469.34 Million by 2028. This translates to a CAGR of approximately 3.5% during the forecast period.

The South and Central America Poultry Feed Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Poultry Feed Market report:

The South and Central America Poultry Feed Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Poultry Feed Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Poultry Feed Market value chain can benefit from the information contained in a comprehensive market report.