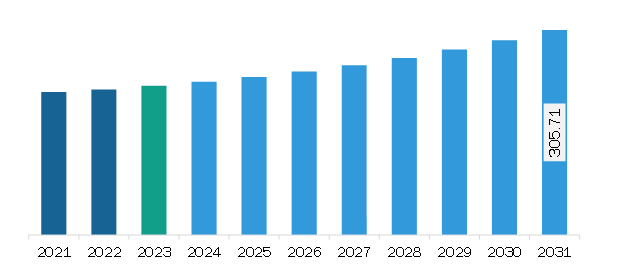

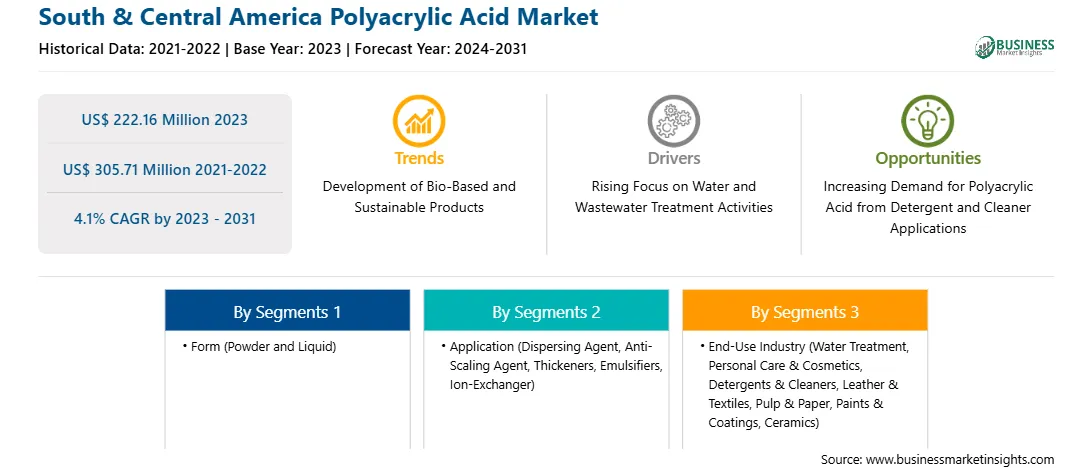

The South & Central America polyacrylic acid market was valued at US$ 222.16 million in 2023 and is expected to reach US$ 305.71 million by 2031; it is estimated to register a CAGR of 4.1% from 2023 to 2031.

Polyacrylic acids with cross-linkages are used in the manufacturing of household products such as floor cleaners. The ability of polyacrylic acid to act as a dispersing agent and chelating agent is a major factor for its widespread use in detergent and cleaner formulations. With rapid urbanization and modernization, there is a rising emphasis on maintaining clean and sanitized living environments. This increasing awareness about hygiene and cleanliness is particularly evident in urban areas where population density and shared living spaces amplify the risk of spreading germs and pathogens. As a result, consumers increasingly prioritize effective cleaning practices, including the regular use of detergents, to safeguard themselves and their families against illness and infection. Moreover, the COVID-19 pandemic raised awareness of hygiene and cleanliness across the world. The pandemic emphasized the importance of proper sanitation and hygiene practices in residential, commercial, and industrial places.

Further, the growing concern about enabling a healthier and hygienic environment is leading to increasing demand for industrial detergents and cleaners. Thus, the increasing demand for polyacrylic acid from detergent and cleaner applications is expected to provide lucrative opportunities for the polyacrylic acid market in the coming times.

Brazil, as one of the largest economies in South America, boasts a diverse industrial landscape spanning automotive, textiles, construction, and personal care sectors, all of which are significant consumers of polyacrylic acid-based products. The growth in urban population and a surge in the number of infrastructure development projects in the country have propelled demand for water treatment solutions, where polyacrylic acid finds extensive application due to its excellent flocculating and dispersing properties. According to data from the National Sanitation Information System, Brazil collected an average of 55.8% of the wastewater produced in the country, of which only 51.2% was treated. Furthermore, the growing awareness of environmental sustainability and stringent regulations governing water quality have spurred the adoption of polyacrylic acid in various industries as an eco-friendly alternative to traditional chemicals. Moreover, the market for cosmetics and personal care presents a lucrative opportunity for polyacrylic acid, as it is widely used in formulations such as hair styling gels, skin creams, and detergents. In 2022, Brazil exported over US$ 770 million worth of beauty and hygiene products. Additionally, government initiatives aimed at promoting industrial growth and innovation, coupled with investments in research and development, are expected to boost the market expansion in the coming years.

Strategic insights for the South & Central America Polyacrylic Acid provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Polyacrylic Acid refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Polyacrylic Acid Strategic Insights

South & Central America Polyacrylic Acid Report Scope

Report Attribute

Details

Market size in 2023

US$ 222.16 Million

Market Size by 2031

US$ 305.71 Million

Global CAGR (2023 - 2031)

4.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Form

By Application

By End-Use Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Polyacrylic Acid Regional Insights

The South & Central America polyacrylic acid market is categorized into form, application, end-use industry, and country.

By form, the South & Central America polyacrylic acid market is segmented into powder and liquid. The liquid segment held a larger share of the South & Central America polyacrylic acid market share in 2023.

In terms of application, the South & Central America polyacrylic acid market is segmented into dispersing agent, anti-scaling agent, thickeners, emulsifiers, ion-exchanger, and others. The anti-scaling agents segment held the largest share of the South & Central America polyacrylic acid market share in 2023.

Based on end-use industry, the South & Central America polyacrylic acid market is segmented into water treatment, personal care & cosmetics, detergents & cleaners, leather & textiles, pulp & paper, paints & coatings, ceramics, and others. The water treatment segment held the largest share of the South & Central America polyacrylic acid market share in 2023.

Based on country, the South & Central America polyacrylic acid market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil segment held the largest share of South & Central America polyacrylic acid market in 2023.

Arkema SA, Ashland Inc, BASF SE, Evonik Industries AG, The Dow Chemical Co, and The Lubrizol Corp are some of the leading companies operating in the South & Central America polyacrylic acid market.

The South & Central America Polyacrylic Acid Market is valued at US$ 222.16 Million in 2023, it is projected to reach US$ 305.71 Million by 2031.

As per our report South & Central America Polyacrylic Acid Market, the market size is valued at US$ 222.16 Million in 2023, projecting it to reach US$ 305.71 Million by 2031. This translates to a CAGR of approximately 4.1% during the forecast period.

The South & Central America Polyacrylic Acid Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Polyacrylic Acid Market report:

The South & Central America Polyacrylic Acid Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Polyacrylic Acid Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Polyacrylic Acid Market value chain can benefit from the information contained in a comprehensive market report.