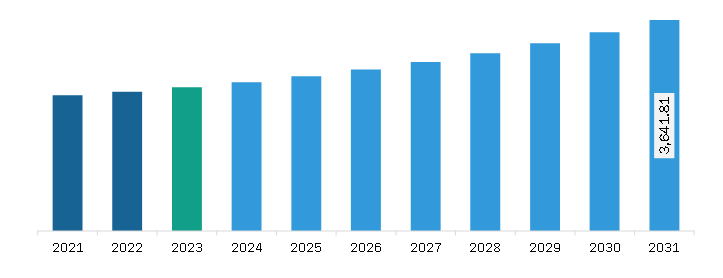

The South & Central America plastic pipes market was valued at US$ 2,479.15 million in 2023 and is projected to reach US$ 3,641.81 million by 2031; it is anticipated to register a CAGR of 4.9% from 2023 to 2031.

The plastic pipes market is witnessing several innovations in plastic formulations and production processes. These advancements are aimed at improving the performance, sustainability, and cost-efficiency of plastic pipes. The recent developments in technology and material science have paved the way for nanotechnology, integration of smart sensors, and additive manufacturing in the plastic pipes market. The integration of nanotechnology in plastic pipe manufacturing involves the utilization of nanocomposites for the improvement of the mechanical properties of materials. Researches are aimed at exploring the potential for incorporating nanomaterials in PVC pipes to improve their properties while preserving their inherent characteristics. This application of nanotechnology represents advancement as it addresses critical performance aspects of plastic pipes and diversifies their applications.

The integration of smart sensors in plastic pipes enables real-time monitoring and facilitates continuous data collection on major factors such as pressure and flow rates within the pipes. The advanced data analytics platforms utilized for real-time information provide data insights, thereby aiding in predictive maintenance strategies. The integration of smart sensors also helps in improving the overall efficiency of piping systems by minimizing the risk of operational failures through data analysis. The adoption of additive manufacturing in the plastic pipe industry offers the capability to produce custom pipes with unprecedented precision and intricate designs. The incorporation of additives and UV stabilizers in pipe formulations can improve their properties and enhance pipe resilience in extreme weather conditions. Adding UV stabilizers to pipes enhances their structural integrity under varying weather stresses. Thus, innovations in pipe formulations and production processes are expected to create lucrative opportunities in the plastic pipes market during the forecast period.

South & Central America Plastic Pipes Market Overview

According to a report by the International Trade Administration, in 2022, the Ministry of Finance and the banking system in Brazil issued credit lines for the construction of ~530,000 new residential units. According to data from the National Sanitation Information System, Brazil collected an average of 55.8% of the wastewater produced in the country, of which only 51.2% was treated. Furthermore, the growing awareness of environmental sustainability and stringent regulations governing water quality have spurred the development of wastewater management facilities. Thus, the advancements in various industries in Brazil drive the plastic pipes market growth.

South & Central America Plastic Pipes Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the South & Central America Plastic Pipes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Plastic Pipes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Plastic Pipes Strategic Insights

South & Central America Plastic Pipes Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,479.15 Million

Market Size by 2031

US$ 3,641.81 Million

Global CAGR (2023 - 2031)

4.9%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Material Type

By Application

By End-Use Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Plastic Pipes Regional Insights

South & Central America Plastic Pipes Market Segmentation

The South & Central America plastic pipes market is categorized into type, material type, application, end-use industry, and country.

Based on type, the South & Central America plastic pipes market is bifurcated into corrugated and smooth wall. The smooth wall segment held a larger market share in 2023.

By material type, the South & Central America plastic pipes market is divided into polyvinyl chloride, high-density polyethylene, polypropylene, and others. The polyvinyl chloride segment held the largest market share in 2023.

In the terms of application, the South & Central America plastic pipes market is segmented into water supply, sewage and drainage, irrigation, gas distribution, and others. The water supply segment held the largest market share in 2023.

Based on end-use industry, the South & Central America plastic pipes market is segmented into construction and infrastructure, water and wastewater management, oil and gas, and others. The construction and infrastructure segment held the largest market share in 2023.

By country, the South & Central America plastic pipes market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America plastic pipes market share in 2023.

Aliaxis Holdings SA, Georg Fischer Ltd, Advanced Drainage Systems Inc, Reboca, and Sekisui Chemical Co Ltd are some of the leading companies operating in the South & Central America plastic pipes market.

The South & Central America Plastic Pipes Market is valued at US$ 2,479.15 Million in 2023, it is projected to reach US$ 3,641.81 Million by 2031.

As per our report South & Central America Plastic Pipes Market, the market size is valued at US$ 2,479.15 Million in 2023, projecting it to reach US$ 3,641.81 Million by 2031. This translates to a CAGR of approximately 4.9% during the forecast period.

The South & Central America Plastic Pipes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Plastic Pipes Market report:

The South & Central America Plastic Pipes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Plastic Pipes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Plastic Pipes Market value chain can benefit from the information contained in a comprehensive market report.