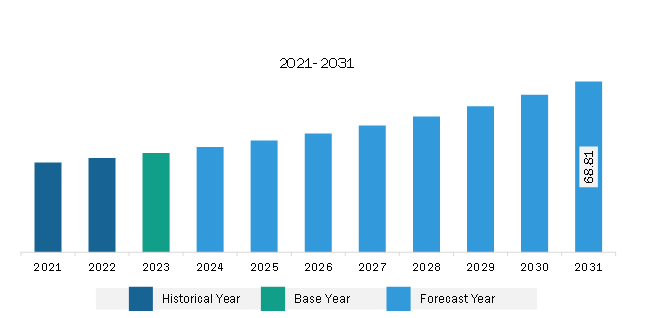

The South & Central America pharmacokinetics services market was valued at US$ 40.03 million in 2023 and is expected to reach US$ 68.81 million by 2031; it is estimated to register a CAGR of 7.0% from 2023 to 2031.

Outsourcing pharmacokinetics services to contract research organizations (CROs) offers several advantages to drug manufacturers and sponsors. They can operate cost-effectively by opting for these services. Moreover, they can focus on working flexibly and bringing scalability to their core operations, alongside achieving fast turnaround time. Outsourcing helps pharmaceutical companies to focus on product commercialization while implementing measures for capacity building, cost reduction, and data management. The drug discovery process is complex, and any error or false result can lead to significant costs and delay the process. CROs employ experienced scientists and researchers who hold expertise in pharmacokinetics and other fields. Thus, they provide pharma companies with access to their expertise, thereby eliminating the need to invest in hiring such skilled workforces or providing extra training to build them. Therefore, small companies with promising drug candidates but limited resources and large companies involved in diversifying their operations are opting for clinical research services provided by well-organized CROs, which bolsters the pharmacokinetics services market.

Brazil is a major destination for clinical trials. According to Clinical Trials Arena, in 2021, Brazil accounted for 1.7% of the global clinical trials activity. In July 2022, Boston CRO acquired Instituto Brasil de Pesquisa Clinica (IBPClin), based in Rio de Janeiro, as the first step toward the implementation of its decentralized clinical trial delivery model in Latin America. It claims to have conducted more than 160 industry-sponsored research studies, enrolling more than 7,000 participants across 12 Brazilian states. IBPClin is the largest research center in South America. In March 2020, the Fiocruz Foundation built a new hospital center with a commitment to invest in clinical trials supported by the World Health Organization (WHO). The new hospital was set to host the Solidarity clinical trial led by Fiocruz in Brazil, the initiative implemented in 18 hospitals in 12 states of Brazil with the support of the Department of Science and Technology of the Ministry of Health and coordinated by INI/Fiocruz. Thus, such initiatives taken for the development of clinical research boost the growth of pharmacokinetics services market in Brazil.

Strategic insights for the South & Central America Pharmacokinetics Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 40.03 Million |

| Market Size by 2031 | US$ 68.81 Million |

| Global CAGR (2023 - 2031) | 7.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Drug Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Pharmacokinetics Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the South & Central America Pharmacokinetics Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Pharmacokinetics Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Pharmacokinetics Services Strategic Insights

South & Central America Pharmacokinetics Services Report Scope

Report Attribute

Details

Market size in 2023

US$ 40.03 Million

Market Size by 2031

US$ 68.81 Million

Global CAGR (2023 - 2031)

7.0%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Drug Type

By Service Type

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Pharmacokinetics Services Regional Insights

The South & Central America pharmacokinetics services market is categorized into drug type, service type, therapeutic application, end user, and country.

Based on drug type, the South & Central America pharmacokinetics services market is segmented small molecule, large molecule, and vaccines. The small molecule segment held the largest market share in 2023.

In terms of service type, the South & Central America pharmacokinetics services market is categorized into pre-clinical ADME and human studies, PK/PD analysis and reporting, dosing simulations, risk analysis, and others. The pre-clinical ADME and human studies segment held the largest market share in 2023.

By therapeutic application, the South & Central America pharmacokinetics services market is segmented into oncology, infectious diseases, neurological disorders, autoimmune diseases, gynaecological disorders, cardiovascular diseases, respiratory disorders, and others. The oncology segment held the largest market share in 2023.

By end user, the South & Central America pharmacokinetics services market is segmented into pharmaceutical and biotechnology companies, contract research organization, and others. The contract research organization segment held the largest market share in 2023.

By country, the South & Central America pharmacokinetics services market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America pharmacokinetics services market share in 2023.

Charles River Laboratories International Inc; Eurofins Scientific SE; Certara Inc.; Parexel International Corp; Thermo Fisher Scientific Inc.; Allucent; PACIFIC BIOLABS; and SGS SA are some of the leading companies operating in the South & Central America pharmacokinetics services market.

The South & Central America Pharmacokinetics Services Market is valued at US$ 40.03 Million in 2023, it is projected to reach US$ 68.81 Million by 2031.

As per our report South & Central America Pharmacokinetics Services Market, the market size is valued at US$ 40.03 Million in 2023, projecting it to reach US$ 68.81 Million by 2031. This translates to a CAGR of approximately 7.0% during the forecast period.

The South & Central America Pharmacokinetics Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Pharmacokinetics Services Market report:

The South & Central America Pharmacokinetics Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Pharmacokinetics Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Pharmacokinetics Services Market value chain can benefit from the information contained in a comprehensive market report.