Without an appropriate delivery system, the best new therapeutic entity in the world is of no benefit. Today, medicines including tablets, capsules, oral liquids, topical creams and gels, transdermal patches, injectable products, implants, eye products, nasal products, inhalers and suppositories, are available in many dosage forms. Pharmaceutical excipients are substances which are used in the form of a pharmaceutical dosage, not for their direct therapeutic action, but for the purpose of aiding the production process, protecting, supporting or enhancing stability, or for bioavailability or acceptability of patients. They also assist in the identification of products and improve the overall safety or function of the product during its storage or use.

Thus, a surge in the generics market are expected to create a significant demand for pharmaceutical excipients in the coming years, which is further anticipated to drive the pharmaceutical excipients market.

The growing fear of COVID-19 infection transmission has mandated the development of new guidelines and recommendations by health authorities. The economic crises that have hit different parts of Latin America in recent years have threatened the progress of the pharmaceutical industry in some of the countries. In Argentina, the Federal Government has reduced formalities for Governmental purchase of medicines, medical devices and medical supplies. Companies involved in the manufacture, distribution and commercialization of the key supplies have to increase production to their maximum capacity and report to the Sanitary Regulatory Authority and the Ministry of Production, production plans as well as the amount of goods produced and sold and identify the buyers. Besides, the Brazilian Federal Health Agency (ANVISA) has issued several regulations providing exceptions to regulatory requirements for pharmaceutical products, medical supplies and medical devices related to COVID-19. Requirements for corporate permits for sanitizers and certain medical drugs and devices, as well as for the extraordinary acceptance of importation of products that are not registered in Brazil, have been relaxed under certain conditions.

Strategic insights for the South and Central America Pharmaceutical Excipients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

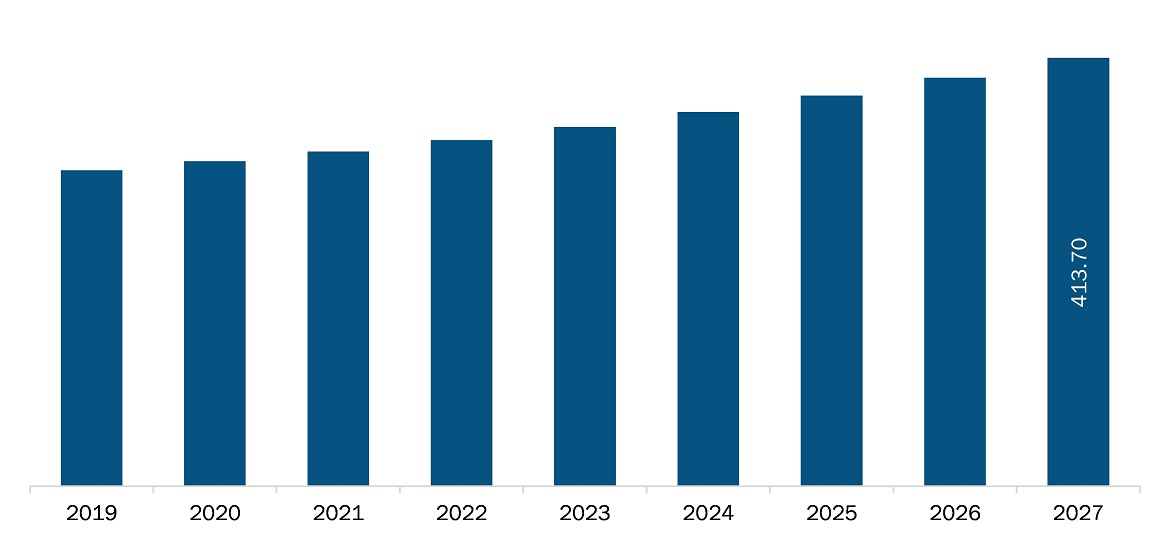

| Market size in 2019 | US$ 305.3 Million |

| Market Size by 2027 | US$ 413.7 Million |

| Global CAGR (2020 - 2027) | 4.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South and Central America Pharmaceutical Excipients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The pharmaceutical excipients market in South and Central America is expected to grow from US$ 305.3 million in 2019 to US$ 413.7 million by 2027; it is estimated to grow at a CAGR of 4.0% from 2020 to 2027. Many blockbuster drugs are on the brink of losing their patents. The patent cliff has resulted in billions dollars’ worth of brand drug sales losing patent protection. Generic drug companies are free to produce their own replicas when patents expire, which can cost up to 80% less than the originals, eventually resulting in a sharp and sudden loss of profits for the companies that developed them. Use of functionality excipients, allows pharmaceutical firms to extend patents. The need to cut prices, generic competition, and lack of innovation are weighing the pharmaceutical industry down. Excipients have become an integral element in the manufacturing of tablets as these provide improved functionality in pharmaceuticals and aid in drug development and innovation, which, in turn help improve patent life at a lower cost. Excipients play a significant role in helping pharmaceutical manufacturers by increasing treatment effectiveness and compliance. Thus, a surge in generics market is expected to drive the pharmaceutical excipients market.

In terms of product, the organic chemicals segment accounted for the largest share of the South and Central America pharmaceutical excipients market in 2019. In terms of functionality, the fillers and diluents segment held a larger market share of the pharmaceutical excipients market in 2019. In terms of type of formulation, the oral formulations segment held a larger market share of the pharmaceutical excipients market in 2019.

A few major primary and secondary sources referred to for preparing this report on the Pharmaceutical excipients market in South and Central America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are DuPont de Nemours, Inc.

By Product

By Functionality

By Type of Formulation

By Country

The South and Central America Pharmaceutical Excipients Market is valued at US$ 305.3 Million in 2019, it is projected to reach US$ 413.7 Million by 2027.

As per our report South and Central America Pharmaceutical Excipients Market, the market size is valued at US$ 305.3 Million in 2019, projecting it to reach US$ 413.7 Million by 2027. This translates to a CAGR of approximately 4.0% during the forecast period.

The South and Central America Pharmaceutical Excipients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Pharmaceutical Excipients Market report:

The South and Central America Pharmaceutical Excipients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Pharmaceutical Excipients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Pharmaceutical Excipients Market value chain can benefit from the information contained in a comprehensive market report.