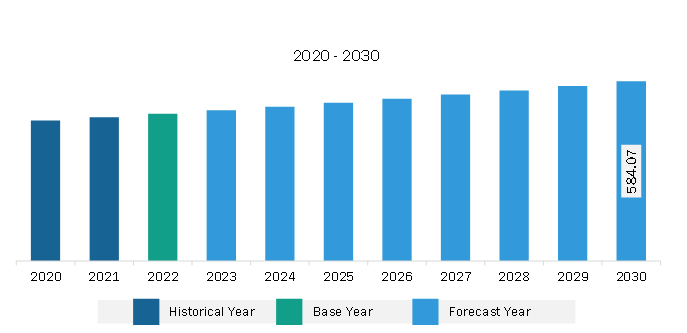

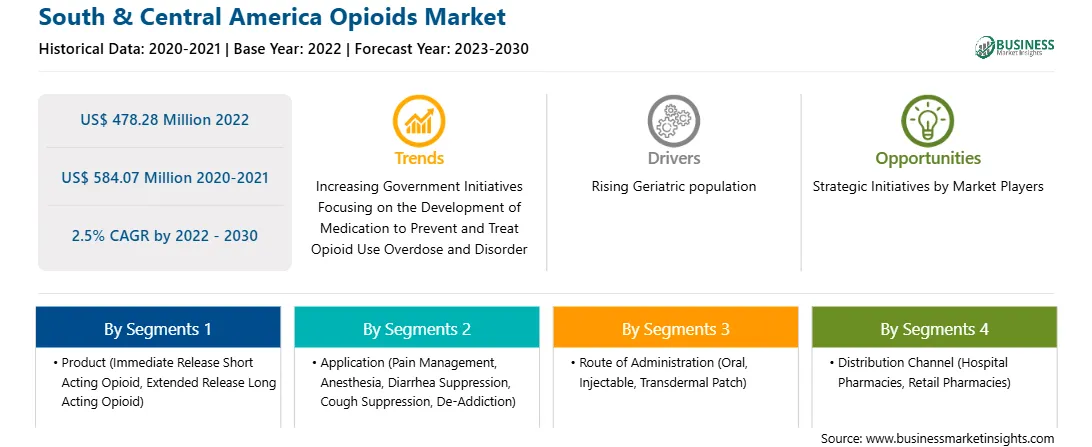

The South & Central America opioids market was valued at US$ 478.28 million in 2022 and is expected to reach US$ 584.07 million by 2030; it is estimated to register a CAGR of 2.5% from 2022 to 2030.

The majority of older people live with chronic pain, resulting in reduced strength to carry out their daily routine. The geriatric population widely suffers from bone and joint disorders, arthritis, cancer, and other chronic disorders causing pain. According to the World Health Organization (WHO) data from February 2018, the geriatric population is estimated to grow by 22% by 2050 compared with 12% in 2015. The data also stated that low- and middle-income countries would account for nearly 80% of this surge. A number of developed countries are also experiencing significant growth in the geriatric population, which is driven by improved healthcare facilities and better healthcare services; this has resulted in increased life expectancy in these regions. An aging population drives the opioid market primarily through increased demand for pain management solutions. Additionally, older adults often undergo surgeries and medical procedures that necessitate pain management. Thus, the growing geriatric population across the region drives the growth of the opioids market.

According to the data from the Pan American Health Organization (PAHO), more than 30 million people in Brazil are aged 60 and above, representing 13% of the country's population. By 2030, this count is expected to reach ~50 million, representing 24% of the Brazilian population. As per the Brazilian Institute of Geography and Statistics, the country's population aged 65 and above is expected to hold a 36% share of the total population of Brazil by 2050. Chronic pain is one of the most common conditions affecting older adults. People suffering from this condition prefer using opioid products, leading to increased opioid prescriptions.

According to The Brazilian Health Regulatory Agency (ANVISA) and Brazilian private hospital systems Brazil was severely affected by the onset of the COVID-19 pandemic, with 700,000 deaths as of April 2022. The health conditions of its citizens were worsened by delays in vaccine availability, leading to high rates of hospitalization and ventilation for severe cases that accelerated the demand for fentanyl, used as a sedative during intubation, according to The Brazilian Health Regulatory Agency (ANVISA) and Brazilian private hospital systems.

Further, according to data published in The Lancet Regional Health-Americas in April 2023, there has been an increase in prescription opioid use in Brazil in the past two decades, including for medical and non-medical purposes, which is driving the market in Brazil.

Strategic insights for the South & Central America Opioids provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 478.28 Million |

| Market Size by 2030 | US$ 584.07 Million |

| Global CAGR (2022 - 2030) | 2.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Opioids refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America opioids market is categorized into product, application, route of administration, distribution channel, and country.

Based on product, the South & Central America opioids market is segmented immediate release short acting opioid and extended release long acting opioid. The immediate release short acting opioid segment held a larger market share in 2022. The immediate release short acting opioid is further sub segmented into oxycodone, hydrocodone, tramadol, codeine, propoxyphene, and others. The extended release long acting opioid is further sub segmented into oxycodone, fentanyl, morphine, methadone, and others.

In terms of application, the South & Central America opioids market is categorized into pain management, anesthesia, diarrhea suppression, cough suppression, de-addiction, and others. The pain management segment held the largest market share in 2022.

By route of administration, the South & Central America opioids market is segmented into oral, injectable, and transdermal patch. The oral segment held the largest market share in 2022.

By distribution channel, the South & Central America opioids market is bifurcated into hospital pharmacies and retail pharmacies. The hospital pharmacies segment held a larger market share in 2022.

By country, the South & Central America opioids market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America opioids market share in 2022.

Endo International plc, Mallinckrodt Plc, Neuraxpharm Pharmaceuticals SL, Rusan Pharma Ltd, and Teva Pharmaceutical Industries Ltd are some of the leading companies operating in the South & Central America opioids market.

The South & Central America Opioids Market is valued at US$ 478.28 Million in 2022, it is projected to reach US$ 584.07 Million by 2030.

As per our report South & Central America Opioids Market, the market size is valued at US$ 478.28 Million in 2022, projecting it to reach US$ 584.07 Million by 2030. This translates to a CAGR of approximately 2.5% during the forecast period.

The South & Central America Opioids Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Opioids Market report:

The South & Central America Opioids Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Opioids Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Opioids Market value chain can benefit from the information contained in a comprehensive market report.