The South and Central America operating tables market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. increasing healthcare expenditure in Brazil is driving the market growth. In South and Central America, Brazil is the largest healthcare market and spends 9.1% of its GDP on healthcare. It has around 6,500 hospitals; 70% are private. Apart from this, the increasing public-private partnership is expected to boost healthcare infrastructure in the country. For instance, in May 2020, IG4 Capital acquired two Brazilian hospitals through its recently formed OPY Health unit for R US$200m. IG4 is planning on expanding the number of beds in both hospitals. Furthermore, the hospital currently has 370 beds and 11 surgery rooms and a diagnostic imaging center. Therefore, incising healthcare expenditure and improving infrastructure is expected to offer lucrative opportunities for operating tables market in the region.

In South and Central America, Brazil reported a massive number of COVID-19 cases, which led to the discontinuation of several business operations, including operating table manufacturing activities. In South and Central America, the gross domestic product (GDP) and central government healthcare expenditure are significantly lower than in developed countries. In 2018, as per the United Nations and Economic Commission for Latin America (CEPAL), 16 South American countries invested less than 4% of their GDP in healthcare. The consequences of the lack of investment in public healthcare systems are reflecting during the pandemic. The COVID?19 pandemic is exacerbating these inequalities by threatening the infrastructure and capacity of state?owned healthcare systems. Thus, the factors mentioned above are negatively impacting the growth of the market in the region.

Strategic insights for the South and Central America Operating Tables provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

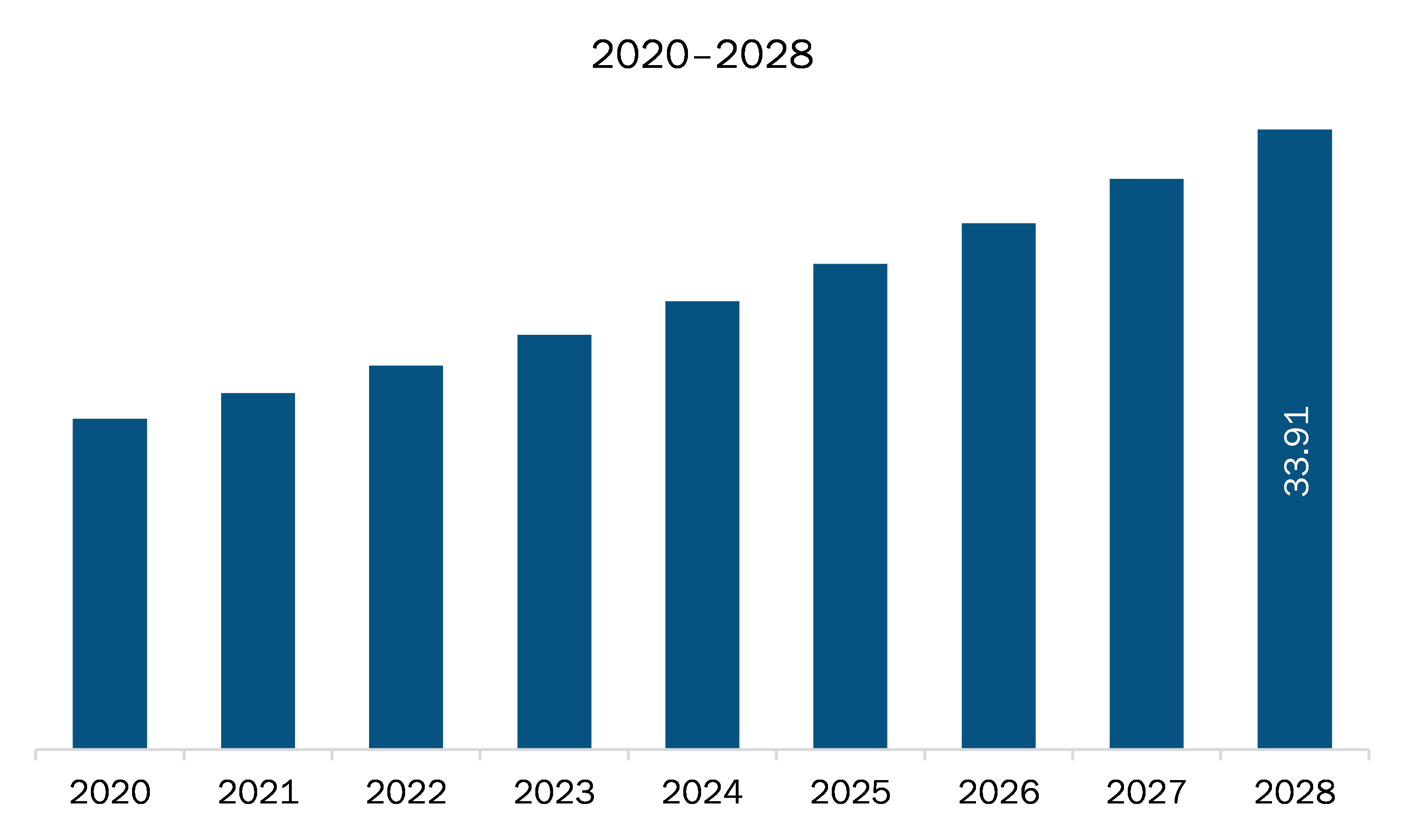

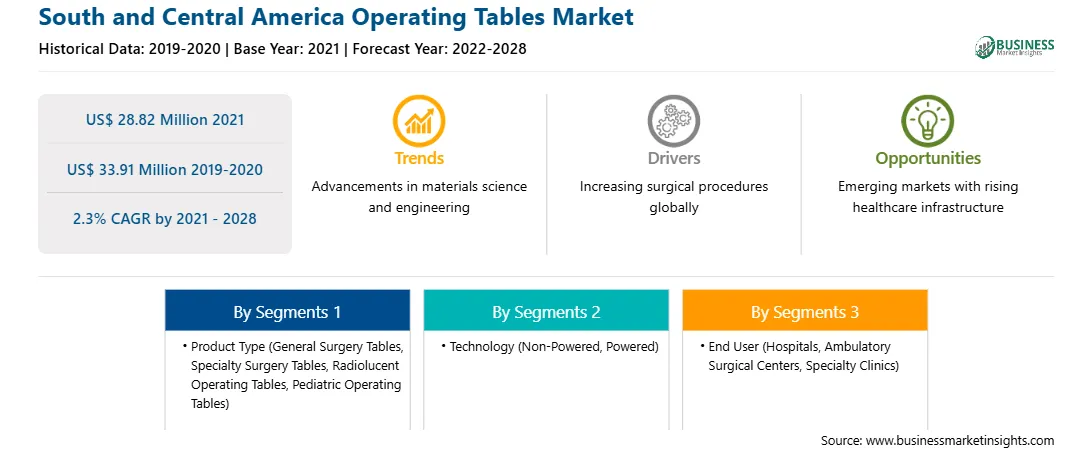

| Market size in 2021 | US$ 28.82 Million |

| Market Size by 2028 | US$ 33.91 Million |

| Global CAGR (2021 - 2028) | 2.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South and Central America Operating Tables refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The operating tables market in South and Central America is expected to grow from US$ 28.82 million in 2021 to US$ 33.91 million by 2028; it is estimated to grow at a CAGR of 2.3% from 2021 to 2028. The types of electric operating tables continue to increase, including five-section eccentric columns, built-in kidney bridges, C-arm carbon fiber catheter operating tables, etc., These types are convenient and safe, comprehensive functions, high control precision, and long service life. The power control source is used to operate various settings, such as table movement, table tilt, and height adjustment. It helps simplify the task of an operation without distracting the surgeon's attention. This feature can be used for electric operating tables. With the help of the remote control to assist the operation of the electric actuator, the movement of a table can be easily controlled. For example, the KME-1204 sliding top electric OT is suitable for various surgeries, such as general surgery; cardiovascular surgery; neurology, gynecology, urology, proctology, and traumatic surgery; plastic surgery; and laparoscopy. The table is equipped with remote control for easy height adjustment; side tilt; longitudinal sliding; and trendelenburg, flexion, and reflex positioning. Also, the nonreflecting surface is antibacterial and easy to clean. Owing to the plenty of power, smooth and quiet movement, multiple value-added features, and unlimited customization options (such as customized positioning), companies continue to add value to the electric adjustment of advanced operating tables. Therefore, it is expected that during the forecast period, a significant shift toward powered surgical tables will become a trend owing to the benefits offered by powered surgical tables.

Based on product type, the general surgery tables segment accounted for the largest share of the South and Central America operating tables market in 2021. Based on technology, the non-powered segment accounted for the largest share of the South and Central America operating tables market in 2021. Based on end user, the hospitals segment accounted for the largest share of the South and Central America operating tables market in 2021.

A few major primary and secondary sources referred to for preparing this report on the South and Central America operating tables market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Skytron, LLC; STERIS Plc; AGA Sanitätsartikel GmbH; ALVO; Getinge AB; Mizuho Medical Co, Ltd.; Merivaara; Stryker Corporation and Hill Rom Holding Inc.

The South and Central America Operating Tables Market is valued at US$ 28.82 Million in 2021, it is projected to reach US$ 33.91 Million by 2028.

As per our report South and Central America Operating Tables Market, the market size is valued at US$ 28.82 Million in 2021, projecting it to reach US$ 33.91 Million by 2028. This translates to a CAGR of approximately 2.3% during the forecast period.

The South and Central America Operating Tables Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Operating Tables Market report:

The South and Central America Operating Tables Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Operating Tables Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Operating Tables Market value chain can benefit from the information contained in a comprehensive market report.