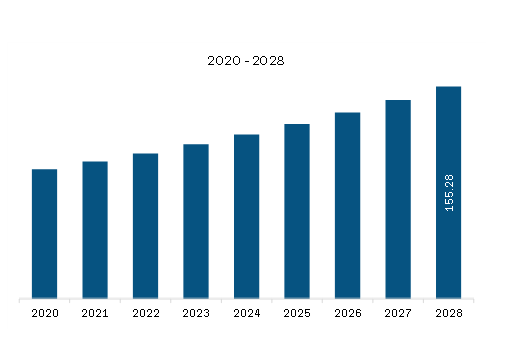

The non-alcoholic beverages market in South & Central America is expected to grow from US$ 106.12 million in 2022 to US$ 155.28 million by 2028. It is estimated to grow at a CAGR of 6.5% from 2022 to 2028.

Sustainable and Innovative Packaging to Appeal to Consumers

In recent times, consumers have become more aware of environmental sustainability. Regional population growth and urbanization are the primary causes of natural resource depletion, global warming, overflowing landfills, and infertile lands. Today, plastic waste is one of the biggest environmental problems causing significant harm to the overall ecosystem. The packaging industry accounts for the majority of plastic usage and plastic waste generation. According to Plastic Oceans International, the packaging industry is the largest end user of plastic, accounting for more than 40% of the total plastic usage. Due to the rising concerns regarding waste generation and landfills, the preference for sustainable and eco-friendly packaging has grown significantly. The manufacturers of non-alcoholic beverages are also launching products in sustainable packages to meet the changing consumer requirements and reduce their carbon footprints. PepsiCo, one of the prominent soft drink manufacturers, has partnered with Pulpex, a packaging technology company, to develop and scale the fully recyclable paper bottle. The paperboard used for developing the bottle is sustainably sourced and 100% recyclable. Moreover, the bottle is coated with a food-grade, water-based coating to prevent leaks. Before launching the bottle in the market, it will undergo extensive laboratory tests to evaluate its safety, recyclability, and performance. Such initiatives are expected to provide immense growth opportunities to the South & Central America non-alcoholic beverages market over the forecast period. Another sustainable packaging trend prevailing in the market is the increased use of post-consumer recycled (PCR) plastic. PCR plastics are made from previously used and recycled plastic bottles and other plastic items. PCR plastic supports consumer demand for sustainable packaging and reduces landfill waste from single-use plastics. The manufacturers of non-alcoholic beverages are also investing in innovative packaging to attract a large number of consumers. For instance, High Brew Coffee offers ready-to-drink coffee in self-heating cans. These cans are powered with HeatGen technology that heats the beverage within two minutes. Moreover, it has passive thermal controls that ensure the heat does not exceed the defined temperature. Such packages are projected to gain massive traction among tech-savvy consumers, opening significant growth opportunities in the South & Central America non-alcoholic beverages market.

Market Overview

Brazil, Argentina, and the Rest of South & Central America are the key contributors to the non-alcoholic beverages market in the South & Central America. The rising population and continuous improvement have positively affected the growth of the economy of Brazil and Argentina. The growing consumption of alcoholic beverages resulted in various health issues such as diabetes, obesity, skin diseases, eye problems, heart diseases, and cancer. The growing trend and rapidly increasing prevalence of such diseases have increased consumer health awareness. According to a survey conducted by Brazil’s Ministry of Health, more than half of the Brazilian adult population is overweight. This suggests new opportunities for non-alcoholic beverages such as fruit, functional, and the energy drinks market. As consumers in South & Central America are shifting towards healthy beverages burring, the demand for coconut water is presented as a strong base for the development because 48% of consumers use coconut water for based blurring. Thus, the recent trends and development in South & Central America are boosting the non-alcoholic beverage market. There is a high growth of e-commerce in South & Central America due to rising internet and smartphone penetration. The sales of non-alcoholic beverages through online platforms are also increasing due to the emerging e-commerce sector in the region. The market players are strengthening their presence on online platforms to boost their revenues. This factor is expected to drive the growth of the South & Central America non-alcoholic beverages market across the region.

Strategic insights for the South & Central America Non-Alcoholic Beverages provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Non-Alcoholic Beverages refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Non-Alcoholic Beverages Strategic Insights

South & Central America Non-Alcoholic Beverages Report Scope

Report Attribute

Details

Market size in 2022

US$ 106.12 Million

Market Size by 2028

US$ 155.28 Million

Global CAGR (2022 - 2028)

6.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Packaging Type

By Category

By Distribution Channel

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Non-Alcoholic Beverages Regional Insights

South & Central America Non-Alcoholic Beverages Market Segmentation

The South & Central America non-alcoholic beverages market is segmented into type, packaging type, category, distribution channel, and country.

Based on type, the market is segmented into carbonated soft drinks, juices & nectars, bottled waters, dairy-based beverages, dairy alternative beverages, RTD tea & coffee, and others. The carbonated soft drinks segment registered the largest market share in 2022.

Based on packaging type, the market is segmented into bottles, cartons, cans, and pouches. The bottles segment held the largest market share in 2022.

Based on category, the market is bifurcated into sugar-free and conventional. The conventional segment held a larger market share in 2022.

Based on distribution channel, the market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The supermarkets & hypermarkets segment held the largest market share in 2022.

Based on country, the market is segmented into Brazil, Argentina, and the Rest of South and Central America. The Rest of South and Central America dominated the market share in 2022.

Asahi Group Holdings, Ltd.; Bolthouse Farms, Inc.; Califia Farms, LLC; Danone S.A.; Keurig Dr Pepper, Inc.; Nestlé S.A.; PepsiCo Inc.; Red Bull; SUNTORY HOLDINGS LIMITED.; and The Coca-Cola Company are the leading companies operating in the non-alcoholic beverages market in the South & Central America region.

The South & Central America Non-Alcoholic Beverages Market is valued at US$ 106.12 Million in 2022, it is projected to reach US$ 155.28 Million by 2028.

As per our report South & Central America Non-Alcoholic Beverages Market, the market size is valued at US$ 106.12 Million in 2022, projecting it to reach US$ 155.28 Million by 2028. This translates to a CAGR of approximately 6.5% during the forecast period.

The South & Central America Non-Alcoholic Beverages Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Non-Alcoholic Beverages Market report:

The South & Central America Non-Alcoholic Beverages Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Non-Alcoholic Beverages Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Non-Alcoholic Beverages Market value chain can benefit from the information contained in a comprehensive market report.