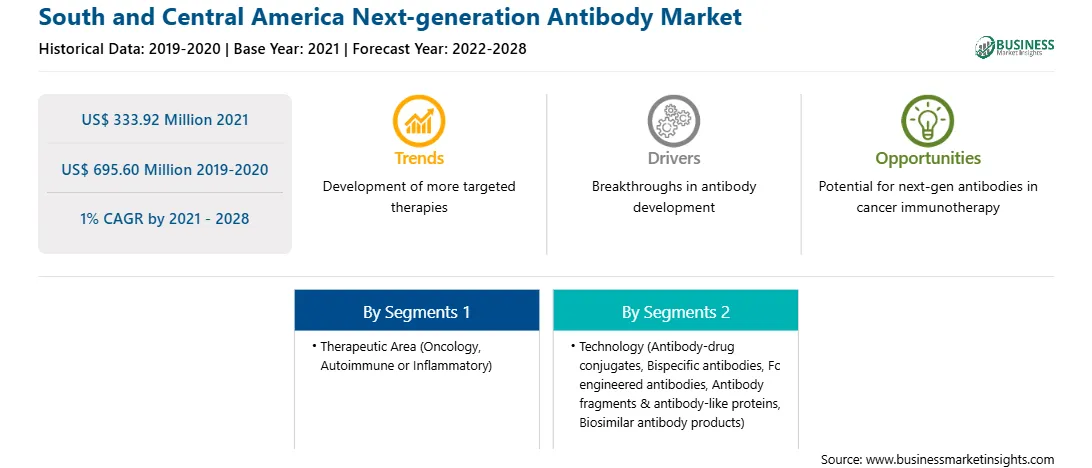

The growth of the market is due to are increasing prevalence of cancer and growing demand for next-generation antibody therapeutics. However, complications associated with the manufacturing and approvals of next-generation antibodies is expected to restrict the market growth during the forecast period.

Continuous medical science improvements and research & developments extend longevity and improve quality of life. Next-generation antibodies are majorly designed to treat various types of cancer. At the same time, new candidates are also being explored for other indications such as infectious diseases and central nervous system disorders. According to Genentech's Senior Vice President of Research Biology, next-generation antibodies have the potential to treat every condition. In addition, the Catalent Biologics Vice President and General Manager believe that the new modalities being incorporated into next-generation antibodies not only offer improved performance over their monoclonal counterparts but also help in offering the potential for new mechanisms of action, allowing access to multiple targets and multiple targeting within the same molecule.

Market players are innovating and advancing their technology to develop new products and therapies using next-generation antibodies and conjugates. For instance, in October 2021, Merck, a leading science and technology company, announced the launch of new technology and expanded the capacity of its Life Science business to produce advanced next-generation Antibody-Drug Conjugate (ADC) therapies. These initiatives underscore Merck's continued investment in novel modalities and support its efforts to double its ADC and high-potent active pharmaceutical ingredient (HPAPI) capacity in the near future. Additionally, in clinical trials, antibody therapies are increasingly being studied and approved, with over 570 therapies in various clinical stages, including 62 in late-stage clinical trials. Therefore, the developments mentioned above would result in significant trends in the next-generation antibody market during the forecast period.

South and Central America witnessed a massive number of COVID-19 cases. The increasing number of cases in Brazil, Peru, Chile, Ecuador, and Venezuela is expected to impact the market over the forecast period negatively.

A considerable number of countries in South America have very underdeveloped healthcare infrastructure. For instance, Peru has less than 1000 intensive care unit beds for its 32 million inhabitants. Furthermore, supply chain disruption caused due to congestion of ports and disturbances in other transport means had a substantial impact on the distribution of associated devices in the region. These factors are currently aiding the SCAM next-generation antibody market and are projected to continue supporting it over the forecast period.

Strategic insights for the South and Central America Next-generation Antibody provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 333.92 Million |

| Market Size by 2028 | US$ 695.60 Million |

| Global CAGR (2021 - 2028) | 1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Therapeutic Area

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South and Central America Next-generation Antibody refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

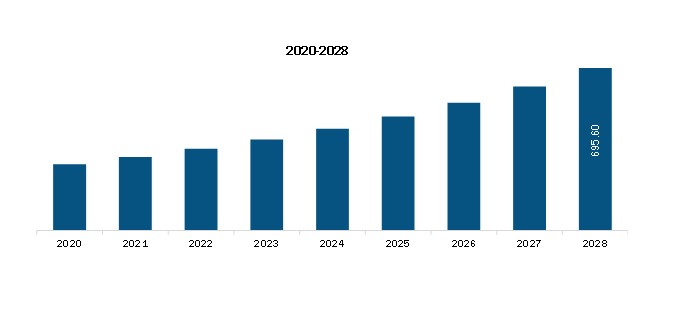

The South and Central America Next-generation Antibody Market is valued at US$ 333.92 Million in 2021, it is projected to reach US$ 695.60 Million by 2028.

As per our report South and Central America Next-generation Antibody Market, the market size is valued at US$ 333.92 Million in 2021, projecting it to reach US$ 695.60 Million by 2028. This translates to a CAGR of approximately 1% during the forecast period.

The South and Central America Next-generation Antibody Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Next-generation Antibody Market report:

The South and Central America Next-generation Antibody Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Next-generation Antibody Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Next-generation Antibody Market value chain can benefit from the information contained in a comprehensive market report.