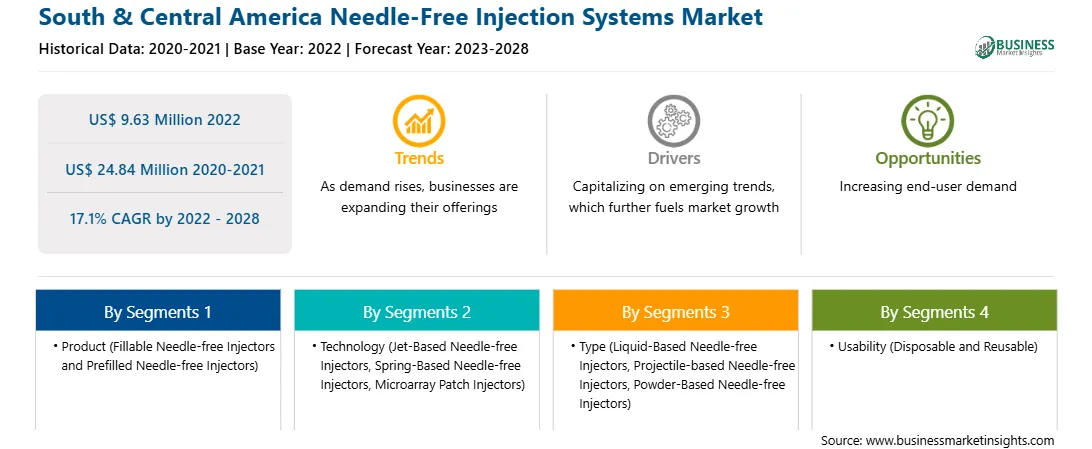

The South & Central America needle-free injection systems market is expected to grow from US$ 9.63 million in 2022 to US$ 24.84 million by 2028; it is estimated to grow at a CAGR of 17.1% from 2022 to 2028.

New Technologies for Needle-Free Injection Systems to Bolster South & Central America Needle-Free Injection Systems Market during Forecast Period

Parenteral is often considered the default drug delivery route but is also an implausible process. Increasing the use of innovative technologies such as the use of artificial intelligence (AI), bar code identification (BI), telecare, and e-prescription can help clinicians and pharmacists in many ways by allowing the storage of patient planned proceedings and patient records and smoothening the vaccination process. As a result, many pharmaceutical manufacturers have embraced IT technology owing to the various benefits of automated IT and provide painless and effective drug delivery systems that can benefit the patients. For instance, Nemera developed a customizable platform—Safe’n’Sound. It is an add-on passive safety device for a prefilled syringe that is aimed at preventing potential needlestick injuries by stimulating a feature that automatically activates at the end of the injection and simplifies the injection process. Healthcare workers had to deal with various challenges due to NSIs, but the burden of these injuries has reduced with the changing technology. A few of the key players operating in the needle-free injection systems market such as Portal Instruments and PharmaJet are focusing on developing innovative products such as micro-array patches, digital needle free injectors, and wearable needle free insulin injectors to deal with issues related to outmoded challenges related to breakage, leakage, and needlestick prevention. Thus, with the surge in new technologies, the demand for needle-free injection systems are expected to grow during the forecast period.

Market Overview

The South & Central America needle-free injection systems market is segmented into Brazil, Argentina, and the Rest of South & Central America. The region held the smallest portion of the market in the global analysis. The market growth in the region is mainly driven by the growing adoption of needle-free injectors that provide ease-of-use and painless solutions, the availability of technologically advanced & user-friendly products, and the rise in the prevalence of infectious diseases. The market is likely to propel in the forecast period owing to the recent technological developments, which directly impacted the economy of Brazil. Moreover, the advantage of cost savings and improved work efficiencies are a few major attracting reasons for manufacturing companies to establish bases in South America.

South & Central America Needle-Free Injection Systems Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the South & Central America Needle-Free Injection Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Needle-Free Injection Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Needle-Free Injection Systems Strategic Insights

South & Central America Needle-Free Injection Systems Report Scope

Report Attribute

Details

Market size in 2022

US$ 9.63 Million

Market Size by 2028

US$ 24.84 Million

Global CAGR (2022 - 2028)

17.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product

By Technology

By Type

By Usability

By Site of Delivery

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Needle-Free Injection Systems Regional Insights

South & Central America Needle-Free Injection Systems Market Segmentation

The South & Central America needle-free injection systems market is segmented on the basis of product, technology, type, durability, and country. Based on product, the South & Central America needle-free injection systems market is bifurcated into fillable needle-free injectors and prefilled needle-free injectors. The fillable needle-free injectors segment held a larger share of the market in 2022.

Based on technology, the South & Central America needle-free injection systems market is segmented into jet-based needle-free injectors, spring-based needle-free injectors, microarray patch injectors, and others. The jet-based needle-free injectors segment registered the largest share of the market in 2022.

Based on type, the South & Central America needle-free injection systems market is segmented into liquid-based needle-free injectors, projectile-based needle-free injectors, and powder-based needle-free injectors. The liquid-based needle-free injectors segment registered the largest share of the market in 2022.

Based on durability, the South & Central America needle-free injection systems market is bifurcated into disposable and reusable. The reusable segment held a larger share of the market in 2022.

Based on site of delivery, the South & Central America needle-free injection systems market is segmented into subcutaneous injectors, intramuscular injectors, and intradermal injectors. The subcutaneous injectors segment held the largest share of the market in 2022.

Based on application, the South & Central America needle-free injection systems market is segmented into vaccine delivery, insulin delivery, oncology, pain management, dermatology, and others. The vaccine delivery segment held the largest share of the market in 2022.

Based on end user, the South & Central America needle-free injection systems market is segmented into hospitals, home care settings, research laboratories, pharmaceutical and biotechnology companies, and others. The hospitals segment held the largest share of the market in 2022.

Based on country, the South & Central America needle-free injection systems market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the market in 2022.

Crossject, Ferring B.V., Medical International Technologies (MIT Canada) Inc, NuGen Medical Devices, and Zealand Pharma A/S are the leading companies operating in the needle-free injection systems market in South & Central America.

The South & Central America Needle-Free Injection Systems Market is valued at US$ 9.63 Million in 2022, it is projected to reach US$ 24.84 Million by 2028.

As per our report South & Central America Needle-Free Injection Systems Market, the market size is valued at US$ 9.63 Million in 2022, projecting it to reach US$ 24.84 Million by 2028. This translates to a CAGR of approximately 17.1% during the forecast period.

The South & Central America Needle-Free Injection Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Needle-Free Injection Systems Market report:

The South & Central America Needle-Free Injection Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Needle-Free Injection Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Needle-Free Injection Systems Market value chain can benefit from the information contained in a comprehensive market report.