South & Central America Naphthalene Derivatives Market

No. of Pages: 101 | Report Code: BMIRE00031585 | Category: Chemicals and Materials

No. of Pages: 101 | Report Code: BMIRE00031585 | Category: Chemicals and Materials

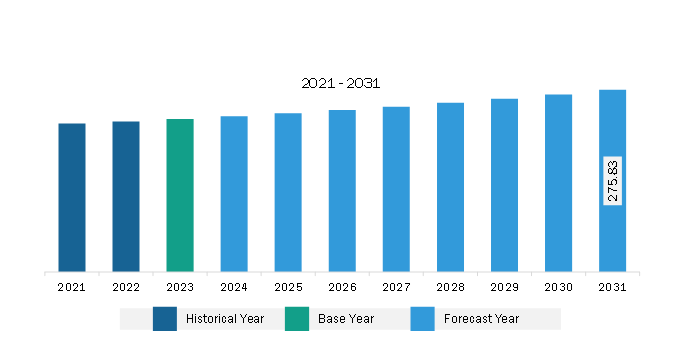

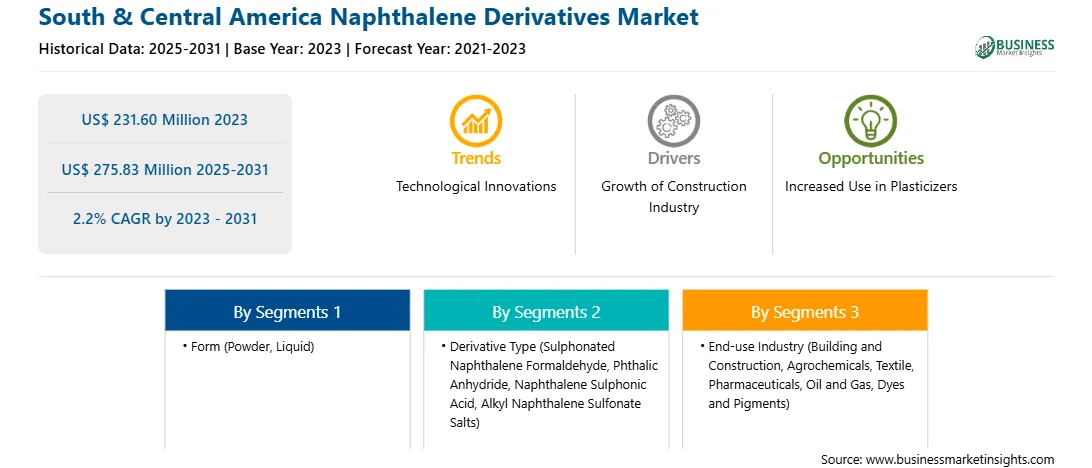

The South & Central America naphthalene derivatives market was valued at US$ 231.60 million in 2023 and is expected to reach US$ 275.83 million by 2031; it is estimated to register a CAGR of 2.2% from 2023 to 2031.

Traditional processes for synthesizing naphthalene derivatives can be energy-intensive and produce significant emissions. However, advancements in catalytic processes and biotechnological methods are leading to the development of environment-friendly production techniques. Innovations in catalysis revolve around the development of more selective and efficient catalysts, which aid in improved yield and purity of naphthalene derivatives. Aromatic hydrocarbons are capable of reversible hydrogenation–dehydrogenation reactions, and this capability is for regenerated hydrogen-containing compounds and hydrogen storage. Methyl derivatives and hydrogenated products of naphthalene have higher storage density (up to 7.3 wt%) than many other aromatic hydrocarbons, making them popular choices as liquid hydrogen carriers in research. In March 2024, researchers from the Russian Academy of Sciences and Lomonosov Moscow State University studied the hydrogenation of naphthalene and its derivatives for hydrogen storage application and to derive a comparative analysis of the role of noble and non-noble metal catalysts in the process. Thus, technological innovations related to the chemical synthesis of naphthalene derivatives are expected to bring significant trends in the market during the forecast period.

According to the Association of Oil, Gas, and Renewable Energy Companies in Latin America and the Caribbean, countries such as Argentina, Brazil, Colombia, and Venezuela are the dominating oil & gas producers across the world. As per the US Energy Information Administration, offshore deepwater oil fields account for more than 90% of Brazil's oil output. Brazil has the second largest oil reserves (~13 billion barrels) in South & Central America, after Venezuela. The Energy Research Company (EPE), a division of the Brazilian Ministry of Energy, has published the Transport Gas Pipeline Plan 2022–2026 (PIG) as a proposal for investments in the construction of gas pipelines at a national level. Thus, the flourishing oil & gas industry is expected to drive the naphthalene derivatives market in South & Central America. The proliferating oil & gas industry serves as a vast source of heavy petroleum fractions, which can be used to produce naphthalene and its derivatives. As per BASF SE Report 2023, chemical production in South America is expected to grow by 1.3% due to rising demand from the consumer goods, agrochemicals, and automotive industries. Naphthalene derivatives such as phthalic anhydride and naphthalene sulfonates are widely used in the production of paints and coatings, plasticizers, and synthetic resins.

Strategic insights for the South & Central America Naphthalene Derivatives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Naphthalene Derivatives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Naphthalene Derivatives Strategic Insights

South & Central America Naphthalene Derivatives Report Scope

Report Attribute

Details

Market size in 2023

US$ 231.60 Million

Market Size by 2031

US$ 275.83 Million

Global CAGR (2023 - 2031)

2.2%

Historical Data

2025-2031

Forecast period

2021-2023

Segments Covered

By Form

By Derivative Type

By End-use Industry

Regions and Countries Covered

Middle East & Africa

Market leaders and key company profiles

South & Central America Naphthalene Derivatives Regional Insights

The South & Central America naphthalene derivatives market is categorized into form, derivative type, end-use industry, and country.

Based on form, the South & Central America naphthalene derivatives market is bifurcated into powder and liquid. The powder segment held a larger market share in 2023.

In terms of derivative type, the South & Central America naphthalene derivatives market is segmented into sulphonated naphthalene formaldehyde, phthalic anhydride, naphthalene sulphonic acid, alkyl naphthalene sulfonate salts, and others. The phthalic anhydride segment held the largest market share in 2023.

By end-use industry, the South & Central America naphthalene derivatives market is segmented into building and construction, agrochemicals, textile, pharmaceuticals, oil and gas, dyes and pigments, and others. The building and construction segment held the largest market share in 2023.

By country, the South & Central America naphthalene derivatives market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America naphthalene derivatives market share in 2023.

JFE holdings Inc; Stepan Co; Nouryon Chemicals Holding BV; Merck KGaA; Hefei TNJ Chemical Industry Co., Ltd.; Himadri Speciality Chemical Ltd; Chempro Group; Methanol Chemicals Co; MUHU (China) Construction Materials Co., Ltd.; PCC SE; Rain Industries Ltd; King Industries, Inc.; MP Biomedicals; Shandong Jufu Chemical Technology Co., Ltd.; and Nan Ya Plastics Corp are some of the leading companies operating in the South & Central America naphthalene derivatives market.

The South & Central America Naphthalene Derivatives Market is valued at US$ 231.60 Million in 2023, it is projected to reach US$ 275.83 Million by 2031.

As per our report South & Central America Naphthalene Derivatives Market, the market size is valued at US$ 231.60 Million in 2023, projecting it to reach US$ 275.83 Million by 2031. This translates to a CAGR of approximately 2.2% during the forecast period.

The South & Central America Naphthalene Derivatives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Naphthalene Derivatives Market report:

The South & Central America Naphthalene Derivatives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Naphthalene Derivatives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Naphthalene Derivatives Market value chain can benefit from the information contained in a comprehensive market report.