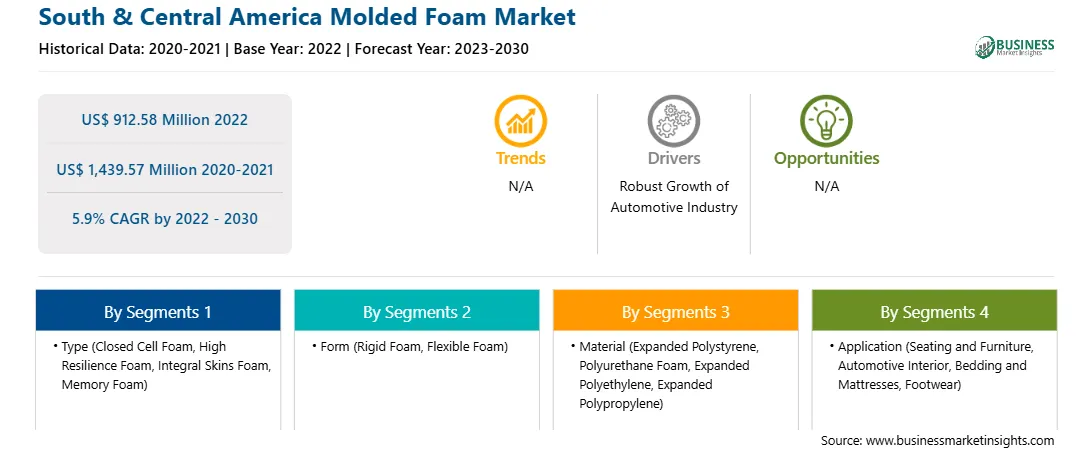

The South & Central America molded foam market was valued at US$ 912.58 million in 2022 and is expected to reach US$ 1,439.57 million by 2030; it is estimated to grow at a CAGR of 5.9% from 2022 to 2030.

In recent years, the footwear industry has grown gradually due to rising per capita income of consumers and growing popularity of different footwear products among consumers. Also, the increasing participation of people in different sport events is creating a demand for sports accessories such as clothing, sunglasses, and sports footwear. Further, the growth of the footwear industry is fueled by factors such as the transformation of footwear from a utilitarian item to a fashion statement, increasing penetration of exclusive brand outlets, and rising online sales of footwear products. In sport and safety shoe manufacturing, polyurethane foam is an essential material in making molded insoles, footbed, and sockliners. Closed cell polyurethane is a commonly used foam to make durable midsoles for hiking boots. Open cell polyurethane foam is most often used in sports shoe making. They are also used to make tongue and collar foams. Therefore, the growing footwear industry is expected to offer lucrative opportunities for the molded foam market over the coming years.

The molded foam market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America. The noticeable presence of automotive companies in Brazil and Argentina and the rise in sales of vehicles are propelling the sales of molded foam in the region. According to the International Organization of Motor Vehicle Manufacturers (OICA), the total number of vehicles manufactured in South & Central America grew from ~2.72 million in 2021 to ~2.96 million in 2022, registering an increase of 9%. In addition, rising car ownership due to increased spending power and higher living standards is expected to boost the market for automotive refinishes. Moreover, major market players in the automotive sector have strategized development and expansion of their operational capacities in South & Central America to tap the lucrative automotive market. In 2022, Audi AG invested US$ 19.2 million to resume production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year. This growing production of vehicles is boosting the demand for molded foam in the region.

Brazil is one of the strongest markets for aircraft manufacturing across the globe. Brazil-based Embraer is the fourth largest aircraft manufacturer in the world, after Airbus, Boeing, and Bombardier Aerospace. Furthermore, the region's rising number of air passengers supports the aircraft manufacturing industry. Regional manufacturers are investing in strategic initiatives such as product development, mergers, and acquisitions to gain a competitive position in the market. For instance, in September 2022, South American rotorcraft operator Ecocopter collaborated with Airbus on possible plans to launch urban air mobility (UAM) services with eVTOL aircraft in markets including Chile, Ecuador, and Peru. Under a memorandum of understanding signed in September 2021, the companies are working on possible use cases for air taxis and other eVTOL operations, including early-adopter markets in the three countries. Such initiatives by manufacturers and the rising number of air passengers are anticipated to increase aircraft production. As molded foam is used in manufacturing aerospace structures, this is expected to boost the molded foam market growth in the region.

Strategic insights for the South & Central America Molded Foam provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 912.58 Million |

| Market Size by 2030 | US$ 1,439.57 Million |

| Global CAGR (2022 - 2030) | 5.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Molded Foam refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America molded foam market is segmented based on type, form, material, application, and country.

Based on type, the South & Central America molded foam market is segmented into closed cell foam, high resilience foam, integral skins foam, memory foam, and others. The closed cell foam segment held the largest South & Central America molded foam market share in 2022.

In terms of form, the South & Central America molded foam market is bifurcated into rigid foam and flexible foam. The flexible foam segment held a larger South & Central America molded foam market share in 2022.

By material, the South & Central America molded foam market is segmented into expanded polystyrene, polyurethane foam, expanded polyethylene, expanded polypropylene, and others. The polyurethane foam segment held the largest South & Central America molded foam market share in 2022.

By application, the South & Central America molded foam market is segmented into seating and furniture, automotive interior, bedding and mattresses, footwear, and others. The bedding and mattresses segment held the largest South & Central America molded foam market share in 2022.

Based on country, the South & Central America molded foam market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America molded foam market in 2022.

Covestro AG, Dow, Hennecke GmbH, and Woodbridge are some of the leading companies operating in the South & Central America molded foam market.

1. Covestro AG

2. Dow

3. Hennecke GmbH

4. Woodbridge

The South & Central America Molded Foam Market is valued at US$ 912.58 Million in 2022, it is projected to reach US$ 1,439.57 Million by 2030.

As per our report South & Central America Molded Foam Market, the market size is valued at US$ 912.58 Million in 2022, projecting it to reach US$ 1,439.57 Million by 2030. This translates to a CAGR of approximately 5.9% during the forecast period.

The South & Central America Molded Foam Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Molded Foam Market report:

The South & Central America Molded Foam Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Molded Foam Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Molded Foam Market value chain can benefit from the information contained in a comprehensive market report.