South & Central America Mining Remanufacturing Components Market

No. of Pages: 107 | Report Code: BMIRE00030553 | Category: Manufacturing and Construction

No. of Pages: 107 | Report Code: BMIRE00030553 | Category: Manufacturing and Construction

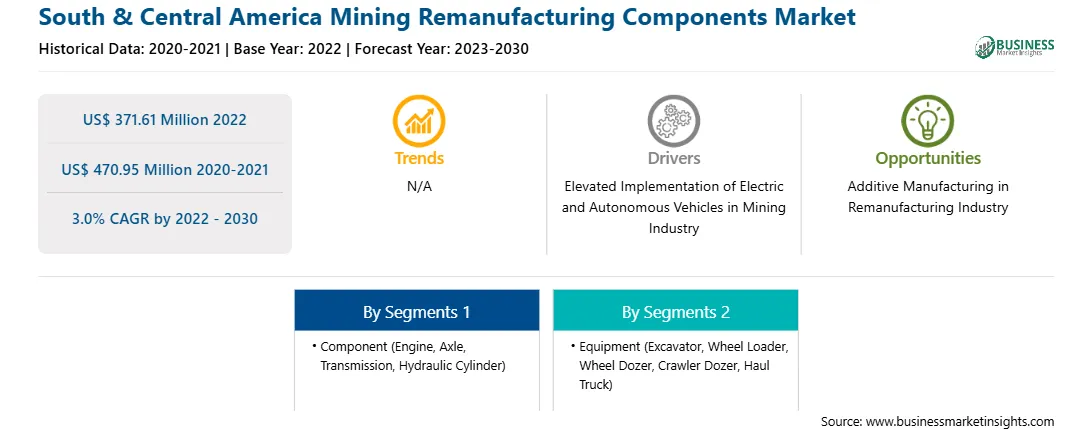

The South & Central America mining remanufacturing components market was valued at US$ 371.61 million in 2022 and is expected to reach US$ 470.95 million by 2030; it is estimated to register a CAGR of 3.0% from 2022 to 2030.

Rising Adoption of Electric and Autonomous Vehicles in Mining Industry Fuels South & Central America Mining Remanufacturing Components Market

The mining sector is beginning to profit from a new generation of low-emission "driverless" mine vehicles that are changing the industry's image and moving it toward decarbonization. Electric vehicles (EVs) are added to fleets for use in both open pit and underground operations by purchasing or refitting existing diesel engine vehicle fleets. Toyota Motor Corp. is at the forefront of developing these new mining vehicles. Toyota and Komatsu launched a cooperative effort in May 2023 to build an autonomous light vehicle (ALV) that will run on Komatsu's GPS-enabled Autonomous Haulage System (AHS). Cool Planet Group, a decarbonization solutions company, announced a US$ 54.2 million deal with a "leading global mining company" in May 2023 to convert 8,500 diesel mining trucks to electric vehicles over the next three years. According to the firm's CEO, up to 1 million diesel mining vehicles must be converted to electricity by 2030. The company is now collaborating with five or six of the world's major mining companies.

In 2023, at a mine in Brazil, U&M Mineração e Construção S/A and Hexagon implemented their OEM-agnostic AHS solution in combination with a plan to introduce two AHS-enabled modified Caterpillar 777 trucks to the project. In order to prepare the 100-ton class payload trucks for automation, U&M collaborated with them to do the necessary mechanical modifications without interfering with the OEM system.

The abovementioned activities by mining and truck manufacturing companies are projected to increase the adoption of electric trucks in the mining industry. This increased demand for electric trucks will directly boost the demand for the truck’s components, such as battery packs, motors, and transmissions, which is expected to create lucrative opportunities for the mining remanufacturing component market during the forecast period.

South & Central America Mining Remanufacturing Components Market Overview

The mining remanufacturing components market in South & Central America is segmented into Brazil, Argentina, and Rest of South & Central America. The positive performance of the mining sector in Brazil is likely to create growth opportunities for various industries that support and serve the mining operations. One such industry is the mining remanufacturing component, as remanufacturing components are crucial equipment for handling bulk materials in mining operations, including the transportation of minerals like iron ore, gold, and copper.

Argentina holds a significant position in the gold production landscape of South America. As the fourth largest gold producer in the region, after Peru, Brazil, and Colombia, the country's gold mining activities contribute to its economy and provide opportunities for investors and industry players. Argentina has an impressive mining portfolio worth US$ 30 billion, comprising a diverse range of 113 projects. Currently, 19 projects are in production, and seven are under construction, demonstrating the country's commitment to expanding its mining industry. The remaining projects are at various stages of development, with six in feasibility, six in prefeasibility, 13 in pre-economic assessment, and 62 in advanced exploration status. Copper mining projects dominate Argentina's portfolio, accounting for over 50% of the total mining portfolio. The country also boasts significant deposits of other valuable minerals, including aluminum, boron, iron, molybdenum, potash, uranium, vanadium, and zinc. This mineral diversity highlights Argentina's potential to become a leading exporter in the mining sector. The abundance of valuable mineral resources in Argentina underscores the importance of the mining sector in the country's economy and its potential to drive economic growth and development. The exploitation and export of these minerals present opportunities for various industries, including those that provide equipment and solutions for mineral extraction and processing, such as mining remanufacturing components and other material handling equipment.

South & Central America Mining Remanufacturing Components Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the South & Central America Mining Remanufacturing Components provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Mining Remanufacturing Components refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Mining Remanufacturing Components Strategic Insights

South & Central America Mining Remanufacturing Components Report Scope

Report Attribute

Details

Market size in 2022

US$ 371.61 Million

Market Size by 2030

US$ 470.95 Million

Global CAGR (2022 - 2030)

3.0%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Equipment

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Mining Remanufacturing Components Regional Insights

South & Central America Mining Segmentation

The South & Central America mining is categorized into component, equipment, industry, and country.

Based on component, the South & Central America mining remanufacturing components market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest South & Central America mining remanufacturing components market share in 2022.

In terms of equipment, the South & Central America mining remanufacturing components market is segmented into excavator, wheel loader, wheel dozer, crawler dozer, haul truck, and others. The crawler dozers segment held the largest South & Central America mining remanufacturing components market share in 2022.

By industry, the South & Central America mining remanufacturing components market is divided into coal, metal, and others. The metal segment held the largest South & Central America mining remanufacturing components market share in 2022.

By country, the South & Central America mining remanufacturing components market is segmented into Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America mining remanufacturing components market share in 2022.

Atlas Copco AB, J C Bamford Excavators Ltd, Caterpillar Inc, Epiroc AB, Swanson Industries Inc, Komatsu Ltd, Liebherr-International AG, AB Volvo, and Hitachi Construction Machinery Co Ltd are some of the leading companies operating in the South & Central America mining remanufacturing components market.

1. Atlas Copco AB

2. J C Bamford Excavators Ltd

3. Caterpillar Inc.

4. Epiroc AB

5. Swanson Industries Inc

6. Komatsu Ltd

7. Liebherr-International AG

8. AB Volvo

9. Hitachi Construction Machinery Co Ltd

The South & Central America Mining Remanufacturing Components Market is valued at US$ 371.61 Million in 2022, it is projected to reach US$ 470.95 Million by 2030.

As per our report South & Central America Mining Remanufacturing Components Market, the market size is valued at US$ 371.61 Million in 2022, projecting it to reach US$ 470.95 Million by 2030. This translates to a CAGR of approximately 3.0% during the forecast period.

The South & Central America Mining Remanufacturing Components Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Mining Remanufacturing Components Market report:

The South & Central America Mining Remanufacturing Components Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Mining Remanufacturing Components Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Mining Remanufacturing Components Market value chain can benefit from the information contained in a comprehensive market report.