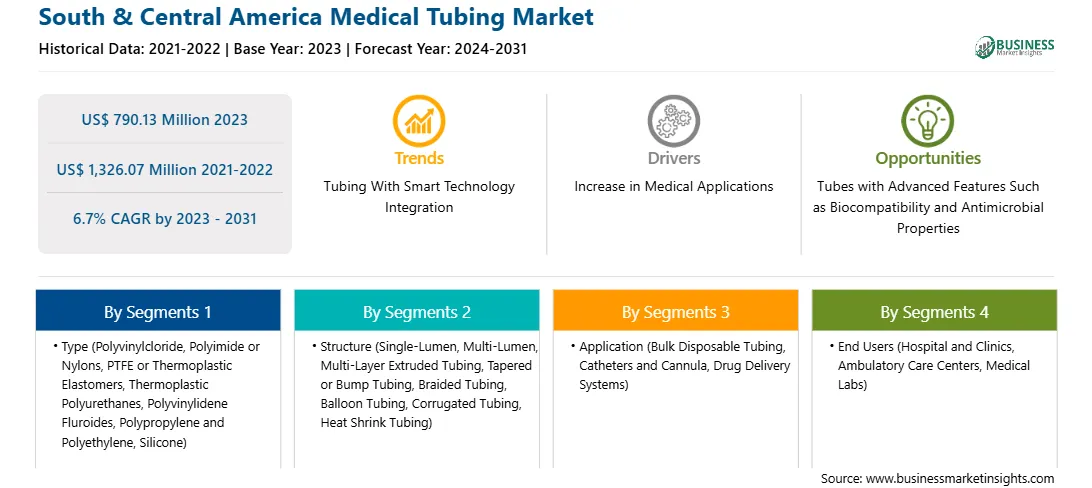

The South & Central America medical tubing market was valued at US$ 790.13 million in 2023 and is expected to reach US$ 1,326.07 million by 2031; it is estimated to register a CAGR of 6.7% from 2023 to 2031.

As healthcare evolves, the demand for advanced medical tubing solutions tailored to various applications is increasing. By creating tubing systems with enhanced features, such as antimicrobial properties or integrated drug delivery systems, the manufacturers can differentiate their innovations and meet the evolving consumer demands. Manufacturers are focusing on medical tubing made from advanced materials that enhance flexibility, durability, and biocompatibility. Biodegradable polymers and antimicrobial coatings help meet regulatory standards while improving patient outcomes. Companies such as Trelleborg Group, Medtronic, and Saint-Gobain offer antimicrobial tubing solutions. Fresenius Kabi offers antimicrobial medical tubing aimed at intravenous therapy and enteral feeding applications; this tubing is engineered to improve patient safety by reducing microbial contamination.

With the burgeoning complexity of medical procedures, the need for specialized tubing solutions is also rising in specific applications. Manufacturers can customize tubing for medical devices such as catheters, endoscopes, and infusion systems by collaborating with healthcare professionals, ultimately enhancing the functionality and effectiveness of end products. In January 2022, Otsuka Pharmaceutical Factory, Inc. introduced "Actreen," a single-use catheter with a tube and connector. It can be used by patients who have lost the urge to urinate or who opt for self-catheterization due to the difficulty faced during urinating. Thus, the creation of innovative products generates significant opportunities for manufacturers in the medical tubing market.

The South & Central America medical tubing market is segmented into Brazil, Argentina, and the Rest of South & Central America. The South & Central America medical tubing market is growing due to the increasing investment in the region's health sector and a rising demand for advanced medical equipment. With the increasing prevalence of chronic diseases, the requirement for developing innovative solutions in the form of advanced medical devices is rising. Government efforts to improve the health infrastructure are further adding to the growth. Additionally, expansion in local manufacturing capabilities promotes competitiveness, attracts foreign investments, and improves product availability.

Strategic insights for the South & Central America Medical Tubing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 790.13 Million |

| Market Size by 2031 | US$ 1,326.07 Million |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Medical Tubing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America medical tubing market is categorized into type, structure, application, end users, and country.

By type, the South & Central America medical tubing market is segmented into polyvinyl chloride (PVC), polyimide or nylons, PTFE or thermoplastic elastomers (TPES), thermoplastic polyurethanes (TPUS), polyvinylidene fluoride (PVDF), polypropylene and polyethylene, silicone, and others. The polyvinyl chloride (PVC) segment held the largest share of the South & Central America medical tubing market share in 2023.

In terms of structure, the South & Central America medical tubing market is segmented into single-lumen, multi-lumen, multi-layer extruded tubing, tapered or bump tubing, braided tubing, balloon tubing, corrugated tubing, heat shrink tubing, and others. The single-lumen segment held the largest share of the South & Central America medical tubing market share in 2023.

Based on application, the South & Central America medical tubing market is segmented into bulk disposable tubing, catheters and cannula, drug delivery systems, and others. The bulk disposable tubing segment held the largest share of the South & Central America medical tubing market share in 2023.

By end users, the South & Central America medical tubing market is segmented into hospital and clinics, ambulatory care centers, medical labs, and others. The hospital and clinics segment held the largest share of the South & Central America medical tubing market share in 2023.

Based on country, the South & Central America medical tubing market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil segment held the largest share of South & Central America medical tubing market in 2023.

Air Liquide Medical Systems; Armstrong Medical Ltd; Besmed Health Business Corp; BMC Medical Co Ltd; DeVilbiss Healthcare LLC; Dimar S.P.A.; Dragerwerk AG & Co KGaA; Fisher & Paykel Healthcare Corp Ltd; Hamilton Medical AG; Hangzhou Formed Medical Devices Co., Ltd; Intersurgical Ltd; Koninklijke Philips NV; Medline Industries LP; ResMed Inc; Sleepnet Corporation; SunMed Group Holdings LLC ( AirLife); and SURU INTERNATIONAL PVT. LTD. are some of the leading companies operating in the South & Central America medical tubing market.

The South & Central America Medical Tubing Market is valued at US$ 790.13 Million in 2023, it is projected to reach US$ 1,326.07 Million by 2031.

As per our report South & Central America Medical Tubing Market, the market size is valued at US$ 790.13 Million in 2023, projecting it to reach US$ 1,326.07 Million by 2031. This translates to a CAGR of approximately 6.7% during the forecast period.

The South & Central America Medical Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Medical Tubing Market report:

The South & Central America Medical Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Medical Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Medical Tubing Market value chain can benefit from the information contained in a comprehensive market report.