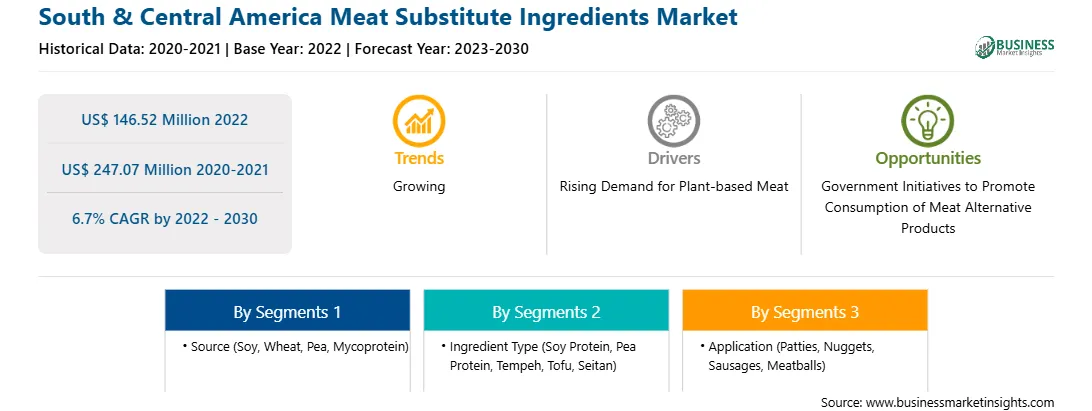

The South & Central America meat substitute ingredients market was valued at US$ 146.52 million in 2022 and is expected to reach US$ 247.07 million by 2030; it is estimated to record a CAGR of 6.7% from 2022 to 2030.

Government bodies across various countries are promoting the consumption of plant-based meat owing to the rising environmental concerns and health benefits offered by these products. Additionally, the governments are actively investing in R&D and new product launches of plant-based meat products.

The Biomes Program was established to provide funding for studies using natural species found in the Amazon and Cerrado biomes, with the goal of providing inputs for the industry of alternative proteins. By comprehending the possible applications of these biomes' natural species in the industry, we can expand the chances for local producing communities to make additional income. Furthermore, national inputs will be delivered to the industry, and these species will be valued higher than deforested ones. GFI Brazil signed for seven research projects in 2022 and foresees financing six more in 2023. The Biomes Program will provide 19 projects with more than US$ 1.2 million in funding overall.

Brazil's plant-based protein market is already more developed, and it is expanding. More than 80 new products were introduced to the market in 2022, a figure that suggests the years of industry growth have improved the selection of plant-based goods available to Brazilian consumers. With the collaborative and ongoing efforts of research institutions and universities, as well as advantageous regulatory policies and government incentives, the current standard of excellence is achievable.

These measures aim to enhance public health while reducing GHG emissions significantly. Such recommendations and the influence by government agencies further boost the demand for alternative meat products. Thus, the continuous investment and support by various government bodies are expected to offer lucrative growth opportunities to the market during the forecast period.

A shift in consumer lifestyle and dietary patterns in South & Central America is a major factor driving the growth of the meat substitute ingredients market. The rising population and continuous economic improvements in Brazil and Argentina aid in boosting the market share in the region. Implementing a vegetarian diet in daily life can help reduce cholesterol levels, thereby protecting consumers against several diseases, including cardiovascular diseases and cancer. According to World Bank data, Brazil was home to 8% of the world’s vegetarian population in 2020. Thus, the elevated per capita spending on meat substitute products is driving the growth of the meat substitute ingredients market in South & Central America.

The positive impact of a vegan and vegetarian diet on the environment is one of the significant reasons propelling the region's per capita spending on meat substitute products. According to an online study conducted by Mapa Veg in September 2022, Sao Paulo had a significant percentage of self-described vegetarians, vegans, and supporters in Brazil, with more than 4.2 thousand respondents. With ~2,000 inhabitants, Rio de Janeiro had the second-largest population. Thus, the demand for plant-based meat products is increasing with a rising inclination toward vegan and vegetarian diets. These factors influence the food manufacturers to invest in meat substitute products which boost the demand for meat substitute ingredients such as textured soy protein, pea protein, tofu, seitan, and tempeh.

Strategic insights for the South & Central America Meat Substitute Ingredients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 146.52 Million |

| Market Size by 2030 | US$ 247.07 Million |

| Global CAGR (2022 - 2030) | 6.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Meat Substitute Ingredients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America meat substitute ingredients market is categorized into source, ingredients type, application, and country.

Based on source, the South & Central America meat substitute ingredients market is segmented into Soy, wheat, pea, mycoprotein, and others. The soy segment held the largest market share in 2022.

Based on ingredients, the South & Central America meat substitute ingredients market is categorized into soy protein, pea protein, tempeh, tofu, seitan, and others. The soy protein segment held the largest market share in 2022.

In terms of application, the South & Central America meat substitute ingredients market is categorized into patties, nuggets, sausages, meatballs, and others. The others segment held the largest market share in 2022.

By country, the South & Central America meat substitute ingredients market is segmented into Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America meat substitute ingredients market share in 2022.

DuPont de Neumours Inc, Ingredion Inc, Archer Daniels Midland Co, Kerry Group Plc, and Roquette Freres SA are some of the leading companies operating in the South & Central America meat substitute ingredients market.

The South & Central America Meat Substitute Ingredients Market is valued at US$ 146.52 Million in 2022, it is projected to reach US$ 247.07 Million by 2030.

As per our report South & Central America Meat Substitute Ingredients Market, the market size is valued at US$ 146.52 Million in 2022, projecting it to reach US$ 247.07 Million by 2030. This translates to a CAGR of approximately 6.7% during the forecast period.

The South & Central America Meat Substitute Ingredients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Meat Substitute Ingredients Market report:

The South & Central America Meat Substitute Ingredients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Meat Substitute Ingredients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Meat Substitute Ingredients Market value chain can benefit from the information contained in a comprehensive market report.