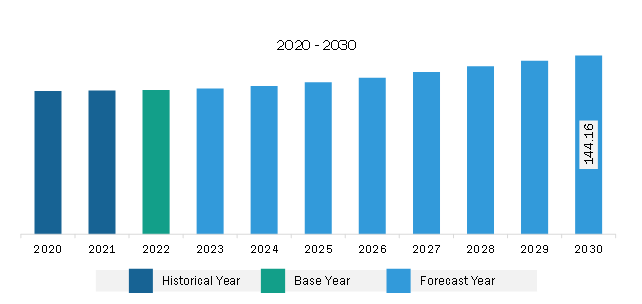

The South & Central America lubricating grease market was valued at US$ 116.30 million in 2022 and is expected to reach US$ 144.16 million by 2030; it is estimated to register a CAGR of 2.7% from 2022 to 2030.

The continuous advancements in grease development are transforming the landscape of lubrication solutions, offering improved performance, sustainability, and versatility. Advancements in grease development, particularly the utilization of innovative thickeners such as polyurea and calcium sulfonate, are playing a pivotal role in driving the lubricating grease market. Polyurea thickeners have gained prominence in recent years due to their exceptional properties. They offer high-temperature stability, water resistance, and mechanical stability, making them suitable for demanding applications in automotive, industrial manufacturing, and aerospace industries. Polyurea-thickened greases provide extended lubrication intervals, reducing maintenance frequency and increasing equipment operation efficiency. Calcium sulfonate thickeners represent another significant advancement in grease development. These thickeners exhibit excellent extreme pressure and anti-wear properties, which makes them suitable for heavy-duty applications in mining, construction, and steel manufacturing industries. Calcium sulfonate greases also provide enhanced corrosion protection, extending the life of components used in harsh operating conditions.

The versatility of calcium sulfonate and polyurea allows manufacturers to formulate greases that meet specific industry requirements. Polyurea-thickened greases, for example, excel in high-speed applications, where conventional greases might experience limitations. In contrast, calcium sulfonate greases are well-suited for extreme pressure and heavy-load conditions, making them indispensable in rugged industrial settings. Moreover, these advancements address environmental concerns and regulatory requirements. Polyurea and calcium sulfonate thickeners can be formulated to meet stringent environmental standards, including biodegradability and reduced toxicity. As sustainability becomes a key consideration across industries, the development of greases with environmentally friendly thickeners is expected to support the market growth. The adoption of these advanced thickeners also contributes to the expansion of niche markets. For instance, in the food processing industry, where strict hygiene standards are paramount, polyurea-based food-grade greases provide lubrication solutions that comply with industry regulations.

Similarly, calcium sulfonate greases find applications in marine environments due to their resistance to water washout and corrosion protection properties. Thus, the integration of innovative thickeners such as polyurea and calcium sulfonate is expected to drive the lubrication grease market growth. These advancements offer enhanced performance, extended lubrication intervals, and environmental sustainability, contributing to increased demand across diverse industrial sectors. Thus, the constant advancements in grease development are poised to fuel the market expansion.

The South & Central America lubricating grease market growth is attributed to the surging industrial activities across the region, ranging from manufacturing to mining, necessitating effective lubrication solutions to ensure the smooth operation and longevity of machinery and equipment. According to the International Organisation Internationale des Constructeurs d'Automobiles (OICA), the total number of vehicles manufactured in South & Central America grew from ~2.72 million in 2021 to ~2.96 million in 2022, registering an increase of 9%. In addition, rising car ownership due to increased spending power and higher living standards fuel the market for automotive maintenance. Moreover, major market players in the automotive sector have strategized development and expansion of their operational capacities in South & Central America to tap the lucrative automotive market. In 2022, Audi AG invested US$ 19.2 million to restart production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year. The region's automotive industry, which relies mainly on import and export revenue generation, considerably creates lucrative opportunities for lubricating grease. The rise in passenger car sales is the prime factor driving the lubricating grease market in the region. The diverse climates and geographical conditions in the region pose challenges to machinery maintenance. Lubricating grease becomes crucial in protecting against corrosion, rust, and extreme temperatures. Industries operating in sectors such as agriculture, where machinery is exposed to varied environmental conditions, rely on grease to ensure uninterrupted performance. In South & Central America, "Jubarte Offshore Oil Field Development" and "Pre-Salt Submarine Fiber Optic Cable Network" are a few of the major ongoing infrastructure projects. Governments of various countries in this region focus on supporting the development of more infrastructure projects to catch up with the pace of urbanization. Thus, constant infrastructure development efforts have surged the demand for construction machinery and equipment, thereby positively favoring the lubricating grease market.

Strategic insights for the South & Central America Lubricating Grease provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 116.30 Million |

| Market Size by 2030 | US$ 144.16 Million |

| Global CAGR (2022 - 2030) | 2.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Base Oil

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Lubricating Grease refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the South & Central America Lubricating Grease provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Lubricating Grease refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Lubricating Grease Strategic Insights

South & Central America Lubricating Grease Report Scope

Report Attribute

Details

Market size in 2022

US$ 116.30 Million

Market Size by 2030

US$ 144.16 Million

Global CAGR (2022 - 2030)

2.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Base Oil

By Thickener Type

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Lubricating Grease Regional Insights

The South & Central America lubricating grease market is categorized into base oil, thickener type, end-use industry, and country.

Based on base oil, the South & Central America lubricating grease market is segmented mineral oil, synthetic oil, and bio-based. The mineral oil segment held the largest market share in 2022. The synthetic oil segment is further sub segmented into polyalkylene glycol, polyalphaolefin, and esters.

In terms of thickener type, the South & Central America lubricating grease market is categorized into lithium, lithium complex, polyurea, calcium sulfonate, anhydrous calcium, aluminum complex, and others. The lithium segment held the largest market share in 2022.

By end-use industry, the South & Central America lubricating grease market is segmented into conventional vehicles, electric vehicles, building & construction, mining, marine, food, energy & power, and others. The conventional vehicles segment held the largest market share in 2022.

By country, the South & Central America lubricating grease market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America lubricating grease market share in 2022.

BP Plc, Chevron Corp, Exxon Mobil Corp, Fuchs SE, Kluber Lubrication GmbH & Co KG, Petroliam Nasional Bhd, Shell Plc, TotalEnergies SE, and Valvoline Inc are some of the leading companies operating in the South & Central America lubricating grease market.

The South & Central America Lubricating Grease Market is valued at US$ 116.30 Million in 2022, it is projected to reach US$ 144.16 Million by 2030.

As per our report South & Central America Lubricating Grease Market, the market size is valued at US$ 116.30 Million in 2022, projecting it to reach US$ 144.16 Million by 2030. This translates to a CAGR of approximately 2.7% during the forecast period.

The South & Central America Lubricating Grease Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Lubricating Grease Market report:

The South & Central America Lubricating Grease Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Lubricating Grease Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Lubricating Grease Market value chain can benefit from the information contained in a comprehensive market report.