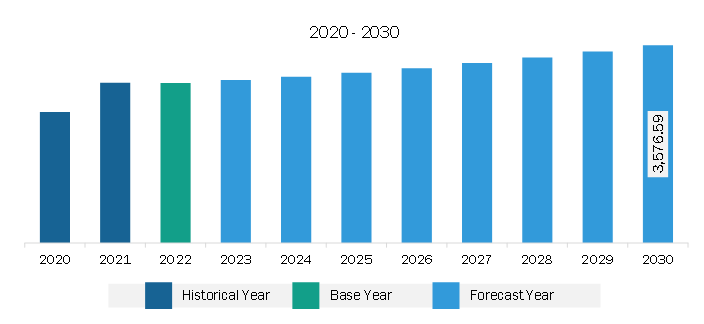

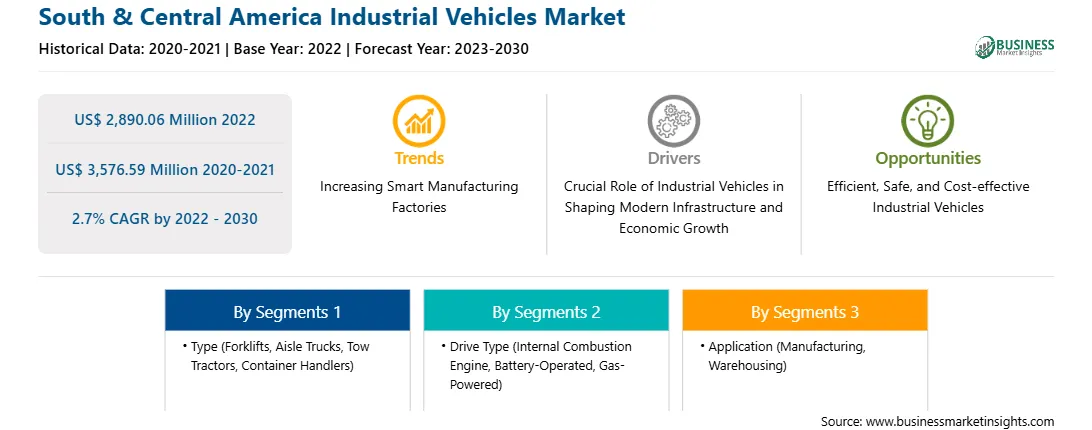

The South & Central America industrial vehicles market was valued at US$ 2,890.06 million in 2022 and is expected to reach US$ 3,576.59 million by 2030; it is estimated to register at a CAGR of 2.7% from 2022 to 2030.

Implementation of Stringent Anti-pollution Standards Fuels South & Central America Industrial Vehicles Market

Stringent anti-pollution standards, such as European (Stage V) and North American (Tier 4 Final), are being implemented for industrial purpose across the globe. These standards, introduced on January 1, 2019, place additional restrictions on nitrogen oxide (NOx) and particulate pollutant emissions from non-road vehicles—including those used in agriculture, construction sites, and industrial settings. The driving force behind these regulations is the urgent need to address public health concerns, improve air quality, and mitigate the impact of vehicle emissions on climate change. One of the notable responses to these environmental challenges is the accelerated electrification of industrial vehicles. This shift toward electrification is driven by the imperative to meet the emission targets set by these stringent standards. Electric and hybrid alternatives are increasingly preferred where various site vehicles are used in the construction industry, including excavators, mobile cranes, diggers, and bulldozers, as well as agricultural vehicles such as tractors and combine harvesters.

Electric and hybrid industrial vehicles help manufacturers and operators comply with stringent emission standards. These vehicles produce significantly lower levels of NOx and particulate pollutants, aligning with the regulations set by Stage V in Europe and Tier 4 Final in North America. The reduction of harmful emissions from industrial vehicles contributes to the improvement of air quality, positively impacting public health. As urbanization continues to grow, the deployment of cleaner and more sustainable industrial vehicles becomes crucial for mitigating the impact of vehicle emissions on densely populated areas. Also, the rising awareness of environmental issues and the increasing emphasis on sustainability drive the demand for cleaner and more efficient industrial vehicles. Companies that prioritize environmentally friendly practices and comply with emission standards are likely to attract a broader customer base and secure long-term market viability. The transition to electric and hybrid alternatives not only ensures compliance with regulations but also aligns with the broader goals of improving air quality, addressing climate change, and meeting consumer preferences for sustainable practices. Thus, the implementation of stringent anti-pollution standards associated with industrial vehicles drives the market.

South & Central America Industrial Vehicles Market Overview

The rising demand for the material handling equipment and vehicles around the globe across the manufacturing sector drives the South & Central America industrial vehicles market growth. According to the World Industrial Vehicle Statistics Association (WITS), more than 2.34 million material-handling vehicles and equipment sales were recorded during 2021. The material handling industry saw a 43.0% increase in orders in 2021 compared to the previous year, 2020. Among the 2.34 million material handling units, around 68.8%, that is 1.61 million units, were recorded as electric-powered forklifts. Electric forklift demand is increasing at a rapid pace with a surge in consumer popularity. With a surge in the number of orders, the demand for industrial vehicles such as forklifts, aisle trucks, and pallet trucks has increased.

South & Central America Industrial Vehicles Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the South & Central America Industrial Vehicles provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Industrial Vehicles refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Industrial Vehicles Strategic Insights

South & Central America Industrial Vehicles Report Scope

Report Attribute

Details

Market size in 2022

US$ 2,890.06 Million

Market Size by 2030

US$ 3,576.59 Million

Global CAGR (2022 - 2030)

2.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Drive Type

By Application

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Industrial Vehicles Regional Insights

South & Central America Industrial Vehicles Market Segmentation

The South & Central America industrial vehicles market is segmented based on type, drive type, level of autonomy, application, and country.

Based on type, the South & Central America industrial vehicles market is segmented into forklifts, aisle trucks, tow tractors, container handlers, and others. The forklifts segment held the largest share in 2022.

In terms of drive type, the South & Central America industrial vehicles market is segmented into internal combustion engine, battery-operated, and gas-powered. The battery-operated segment held the largest share in 2022.

By level of autonomy, the South & Central America industrial vehicles market is bifurcated into non/semi-autonomous and autonomous. The non/semi-autonomous segment held a larger share in 2022.

Based on application, the South & Central America industrial vehicles market is segmented into manufacturing, warehousing, and others. The manufacturing segment held the largest share in 2022.

Based on country, the South & Central America industrial vehicles market is categorized into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America industrial vehicles market in 2022.

Kion Group AG, Toyota Industries Corp, Mitsubishi Heavy Industries Ltd, Komatsu Ltd, Hyster-Yale Materials Handling Inc, Jungheinrich AG, Crown Equipment Corp, Konecranes Plc, and Anhui Heli Co Ltd are some of the leading companies operating in the South & Central America industrial vehicles market.

1. Kion Group AG

2. Toyota Industries Corp

3. Mitsubishi Heavy Industries Ltd

4. Komatsu Ltd

5. Hyster-Yale Materials Handling Inc

6. Jungheinrich AG

7. Crown Equipment Corp

8. Konecranes Plc

9. Anhui Heli Co Ltd

The South & Central America Industrial Vehicles Market is valued at US$ 2,890.06 Million in 2022, it is projected to reach US$ 3,576.59 Million by 2030.

As per our report South & Central America Industrial Vehicles Market, the market size is valued at US$ 2,890.06 Million in 2022, projecting it to reach US$ 3,576.59 Million by 2030. This translates to a CAGR of approximately 2.7% during the forecast period.

The South & Central America Industrial Vehicles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Industrial Vehicles Market report:

The South & Central America Industrial Vehicles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Industrial Vehicles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Industrial Vehicles Market value chain can benefit from the information contained in a comprehensive market report.