Construction is one of the most manual-intensive industries, with physical labor being the primary source of productivity. Robots do not yet play a substantial role in any stage of a building's lifecycle, whether it be new commercial construction, refurbishment, or deconstruction. However, with rising automation across all industries, the global construction sector is also experiencing a surge in investment in automated solutions, such as robots.

Several types of robots are being extensively adopted across the construction industry are 3D printing, demolition, and remote-controlled or autonomous vehicles. Since automation across the construction industry is in a very nascent stage, it is expected to propel over the coming years, thereby supporting the market. Due to these opportunities across the sector, several companies have invested heavily in developing advanced construction robots. These factors further fuel the adoption of robots across the construction industry, which is expected to contribute to the market's growth over the forecast period.

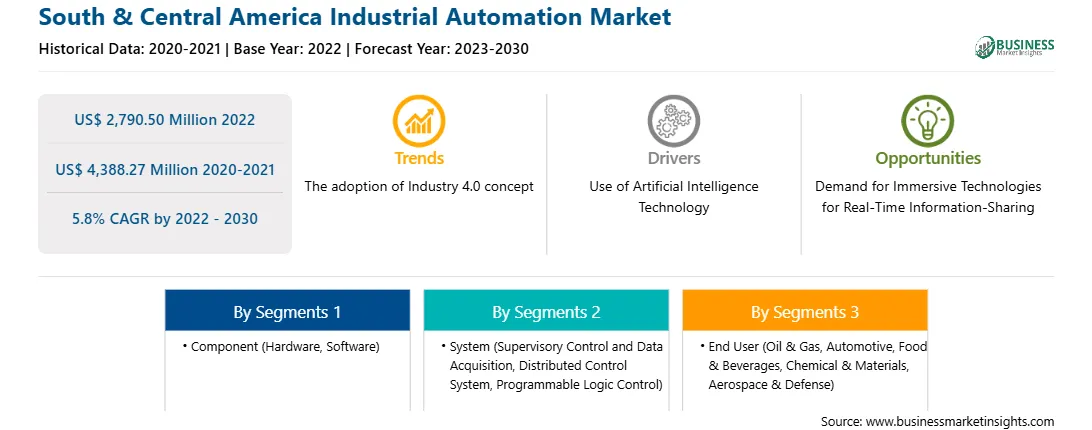

In SAM, the manufacturing sector is growing rapidly, and companies in this sector are increasingly adopting automation technologies to improve productivity, efficiency, and product quality. SAM is one of the fastest-growing adopters of Industry 4.0 technologies. The rise in Industry 4.0, or the fourth industrial revolution, is attributed to the use of artificial intelligence, robotics, big data analytics, and other advanced technologies in manufacturing.

Additionally, governments of various countries in SAM are providing support to boost the adoption of automation technologies through subsidies, tax breaks, and other incentives. The e-commerce sector is growing rapidly in SAM, and this is creating a demand for automation technologies in the logistics and warehousing sectors.

A few of the key players operating in the market include ABB, Siemens, Schneider Electric, Rockwell Automation, and Omron. These companies are innovating and developing new products and solutions to meet the rising demand for automation in SAM.

The South & Central America industrial automation market is segmented into component, system, end user, and country.

Based on component, the South & Central America industrial automation market is segmented into hardware and software. The hardware segment held a larger share of the South & Central America industrial automation market in 2022. The hardware is further sub segmented into motors and drives, robots, sensors, machine vision systems, and others.

Based on system, the South & Central America industrial automation market is segmented into supervisory control and data acquisition, distributed control system, programmable logic control, and other. The distributed control system segment held the largest share of the South & Central America industrial automation market in 2022.

Based on end user, the South & Central America industrial automation market is segmented into oil & gas, automotive, food & beverage, chemical & materials, aerospace & defense, and others. The automotive segment held the largest share of the South & Central America industrial automation market in 2022.

Based on country, the South & Central America industrial automation market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America industrial automation market in 2022.

ABB Ltd, Bosch Rexroth AG, Emerson Electric Co, Hitachi Ltd, Honeywell International Inc, Mitsubishi Electric Corp, OMRON Corp, Rockwell Automation Inc, Schneider Electric SE, and Siemens AG are some of the leading companies operating in the South & Central America industrial automation market.

Strategic insights for the South & Central America Industrial Automation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,790.50 Million |

| Market Size by 2030 | US$ 4,388.27 Million |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Industrial Automation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America Industrial Automation Market is valued at US$ 2,790.50 Million in 2022, it is projected to reach US$ 4,388.27 Million by 2030.

As per our report South & Central America Industrial Automation Market, the market size is valued at US$ 2,790.50 Million in 2022, projecting it to reach US$ 4,388.27 Million by 2030. This translates to a CAGR of approximately 5.8% during the forecast period.

The South & Central America Industrial Automation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Industrial Automation Market report:

The South & Central America Industrial Automation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Industrial Automation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Industrial Automation Market value chain can benefit from the information contained in a comprehensive market report.