Bio-based polymer matrices are environment-friendly and are the subject of extensive research in various fields. Bio-based matrices are also lightweight and exhibit long-term sustainability, which drives their use in commercial applications. Further, the easy availability of natural raw materials to produce bio-based resin is fueling its supply and demand. Bio-based matrices and biocomposites are employed in several secondary applications in aerospace, automobiles, packaging, electronics, and construction sectors. In the construction industry, biocomposites are generally used to produce doors, windows, terrace decking, insulation material, and acoustic components. According to the report from the Global Alliance for Building and Construction, construction is one of the most harmful sectors to the environment. The study conducted by the alliance at the end of 2019 stated that the construction sector is responsible for 39% of the carbon dioxide emissions dispersed in the environment, 36% of global energy consumption, and 50% of the extraction of raw materials. Conventional construction materials are highly resource- and energy-intensive. Hence, owing to the rising concern and awareness about the social and environmental impacts of conventional building materials, manufacturers of composites are shifting toward environment-friendly raw materials. Thus, the growing adoption of bio-based matrices or resins sourced from carbohydrates, vegetable fats and oils, starch, bacteria, and other biological materials, over petroleum-derived plastic matrices is expected to emerge as an important trend in the South & Central America Zhybrid composites market during the forecast period.

The automotive industry in South & Central America is witnessing rapid growth as the demand for commercial and personal vehicles is increasing across the region. According to the Brazilian Institute of Country and Statistics, the production of motor vehicles in Brazil accounted for 2.9 million in 2019. Further, the growth of the automotive carbon composite industry in Brazil is attributed to the large presence of small and large companies, including molding, fabrication, and material suppliers such as Elekeiroz, Embrapol, Cromitec, and Fiacbras. Also, the automotive sector in the region is witnessing increased private investments, which boosts the sector’s development.

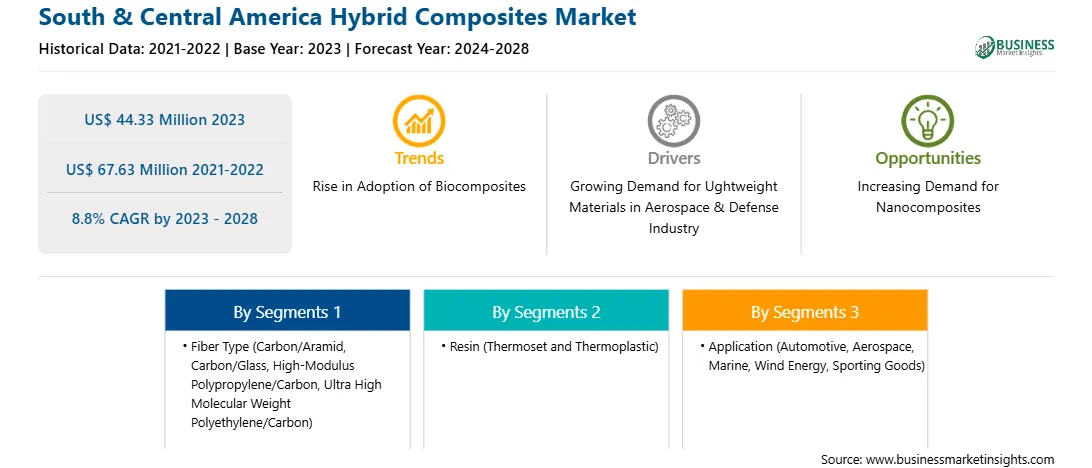

Strategic insights for the South & Central America Hybrid Composites provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Hybrid Composites refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Hybrid Composites Strategic Insights

South & Central America Hybrid Composites Report Scope

Report Attribute

Details

Market size in 2023

US$ 44.33 Million

Market Size by 2028

US$ 67.63 Million

Global CAGR (2023 - 2028)

8.8%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Fiber Type

By Resin

By Application

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Hybrid Composites Regional Insights

South & Central America Hybrid Composites Market Segmentation

The South & Central America hybrid composites market is segmented into fiber type, resin, application, and country.

Based on fiber type, the South & Central America hybrid composites market is segmented into carbon/aramid, carbon/glass, high-modulus polypropylene (HMPP)/carbon, ultra high molecular weight polyethylene (UHMWPE)/ carbon, and others. The carbon/aramid segment held the largest share of the South & Central America hybrid composites market in 2023.

Based on resin, the South & Central America hybrid composites market is segmented into thermoset and thermoplastic. The thermoset segment held a larger share of the South & Central America hybrid composites market in 2023.

Based on application, the South & Central America hybrid composites market is segmented into automotive, aerospace, marine, wind energy, sporting goods, and others. The automotive segment held the largest share of the South & Central America hybrid composites market in 2023.

Based on country, the South & Central America hybrid composites market is segmented into Brazil, Argentina, and the South & Central America. Brazil dominated the South & Central America hybrid composites market in 2023.

Avient Corp, Hexcel Corp, Lanxess AG, Mitsubishi Chemical Holdings Corp, SGL Carbon SE, Solvay SA, Teijin Ltd, and Toray Industries Inc are some of the leading companies operating in the South & Central America hybrid composites market.

The South & Central America Hybrid Composites Market is valued at US$ 44.33 Million in 2023, it is projected to reach US$ 67.63 Million by 2028.

As per our report South & Central America Hybrid Composites Market, the market size is valued at US$ 44.33 Million in 2023, projecting it to reach US$ 67.63 Million by 2028. This translates to a CAGR of approximately 8.8% during the forecast period.

The South & Central America Hybrid Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Hybrid Composites Market report:

The South & Central America Hybrid Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Hybrid Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Hybrid Composites Market value chain can benefit from the information contained in a comprehensive market report.