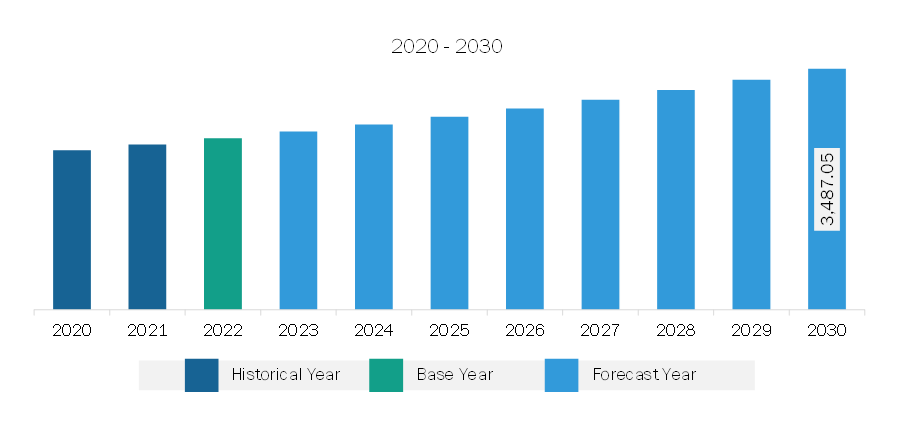

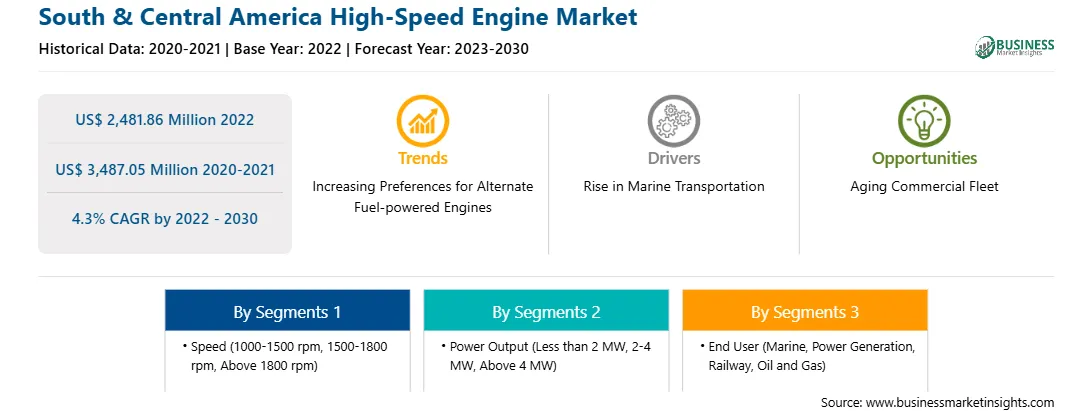

The South & Central America high-speed engine market was valued at US$ 2,481.86 million in 2022 and is expected to reach US$ 3,487.05 million by 2030; it is estimated to register a CAGR of 4.3% from 2022 to 2030.

The demand for alternative fuel powered engines is growing globally owing to a rising carbon footprint. As per the data published by the International Energy Agency in March 2024, the carbon emissions in 2023 witnessed a growth of 1.1% in emissions compared to 2022, reaching 35 billion metric tonnes of carbon emissions. To overcome this environmental issue, governments of many countries across the globe are taking initiatives to reduce their carbon emissions. There is an increased focus on the development and adoption of alternative fuel powered engines. The goal of IKI's Climate Neutral Alternative Fuels (ProQR) project in Brazil, which launched in 2017, is to use the power-to-liquid (PtL) fuel concept-a kind of SAF-to make the nation a global leader in the production of electric fuels, or e-fuels. With the rise in such government initiatives, the need for alternative fuel high-speed engines is also increasing. Hence, many high-speed engine manufacturers started manufacturing alternative fuel-powered engines. For instance, in March 2023, Man Energy Solution received formal approval for the 100% use of biofuel for its MAN 175D high-speed engine. In December 2023, The Department of Energy's Oak Ridge National Laboratory and Caterpillar Inc. signed a research and development agreement (CRADA) to examine using methanol as an alternate fuel source for four-stroke internal combustion marine engines. Thus, owing to the increasing preference for eco-friendly engines, the demand and adoption of alternative fuel-powered engines are projected to grow, which is expected to fuel the high-speed engine market growth in the coming years.

Brazil, Argentina, and Chile are among the key countries in the high-speed engine market in South America. Brazil is projected to acquire 63.21% of the South America high-speed engine market. Growing procurement of locomotives is one of the primary factors driving the high-speed engine market in the country. For instance, in February 2022, Wabtec introduced a new locomotive, ES44ACi diesel-electric, for freight transportation in Brazil. The ES44ACi locomotive is equipped with the Evolution Series diesel engine, which produces 4,500 horsepower with only 12 cylinders as its predecessor, the 16-cylinder FDL engine. The railway operators in Brazil are focusing on greater efficiency and reduced carbon emissions. As a result, the demand for dual-fuel engines is growing notably in Brazil. Further, the demand for high-speed engines in Argentina is mainly driven by the growing demand for cargo vessels, fishing boats, and tugboats, among others.

Strategic insights for the South & Central America High-Speed Engine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,481.86 Million |

| Market Size by 2030 | US$ 3,487.05 Million |

| Global CAGR (2022 - 2030) | 4.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Speed

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America High-Speed Engine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America high-speed engine market is categorized into speed, power output, end user, and country.

Based on speed, the South & Central America high-speed engine market is segmented into 1000-1500, 1500-1800, and above 1800. The 1500-1800 segment held the largest share of South & Central America high-speed engine market share in 2022.

In terms of power output, the South & Central America high-speed engine market is categorized into less than 2 MW, 2-4 MW, and above 4 MW. The less than 2 MW segment held the largest share of South & Central America high-speed engine market in 2022.

By end user, the South & Central America high-speed engine market is divided into marine, power generation, railway, and oil & gas. The marine segment held the largest share of South & Central America high-speed engine market in 2022.

Based on country, the South & Central America high-speed engine market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America high-speed engine market share in 2022.

AB Volvo; Caterpillar Inc.; MAN Energy Solutions SE; Mitsubishi Heavy Industries, Ltd.; Rolls-Royce Holdings Plc; Wartsila Corp; Weichai Heavy Machinery Co., Ltd.; YANMAR HOLDINGS Co, Ltd.; and Cummins Inc.; are some of the leading companies operating in the South & Central America high-speed engine market.

The South & Central America High-Speed Engine Market is valued at US$ 2,481.86 Million in 2022, it is projected to reach US$ 3,487.05 Million by 2030.

As per our report South & Central America High-Speed Engine Market, the market size is valued at US$ 2,481.86 Million in 2022, projecting it to reach US$ 3,487.05 Million by 2030. This translates to a CAGR of approximately 4.3% during the forecast period.

The South & Central America High-Speed Engine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America High-Speed Engine Market report:

The South & Central America High-Speed Engine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America High-Speed Engine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America High-Speed Engine Market value chain can benefit from the information contained in a comprehensive market report.