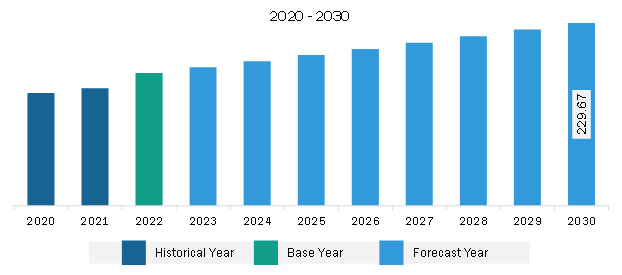

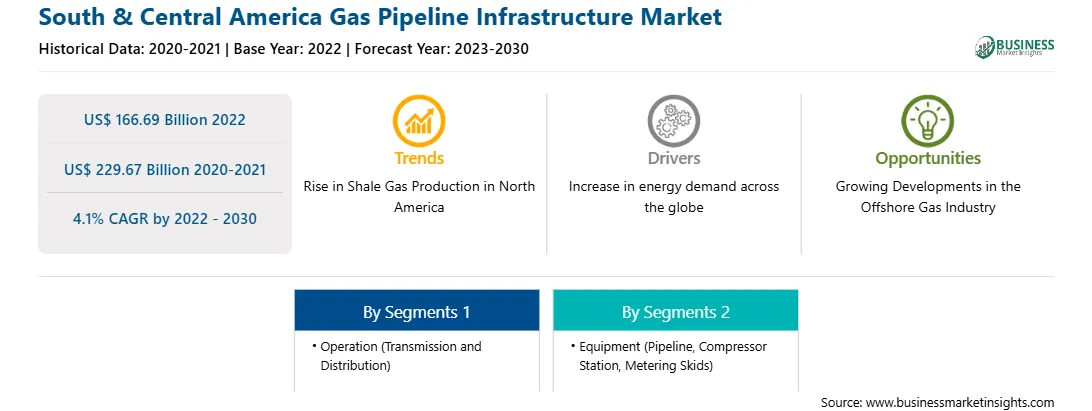

The South & Central America gas pipeline infrastructure market is expected to grow from US$ 166.69 billion in 2022 to US$ 229.67 billion by 2030. It is estimated to record a CAGR of 4.1% from 2022 to 2030. Growing Developments in the Offshore Gas Industry Fuel South & Central America Gas Pipeline Infrastructure Market

Investment and focus on offshore gas pipeline infrastructure development are growing across the globe. Brazil is anticipating spending over US$ 4.3 billion on exploratory efforts between 2023 and 2027, according to ANP (The Brazilian National Agency for Petroleum, Natural Gas, and Biofuels). This investment includes plans for 91 new wells, 63 onshore and 28 offshore. Further, Petrobras has made the largest investment in pre-salt projects, which present substantial prospects for American providers of offshore services and equipment. Most of the Brazil's oil and gas sector is focused on offshore production owing to a well-established supply chain and a number of foreign businesses operating in the market. Thus, growing investment for the development of offshore gas pipeline infrastructure is anticipated to fuel the growth of the gas pipeline infrastructure market during the forecast period.South & Central America Gas Pipeline Infrastructure Market Overview

Natural gas consumption in South America is anticipated to expand at an average annual rate of 0.6% in the coming years, adding ~5 bcm/year by 2025. The application of natural gas is projected to be boosted by the energy sector, driven by increasing electricity demand and a growing need for fuel switching. The rising energy demand in South America is attributed to population growth and industrialization, which fuels the need for increased gas production. As a result, the gas industry in South America attracts significant investments from domestic and foreign companies. Increasing focus on energy transition towards clean sources is increasing investment in natural gas pipeline infrastructure in South America. Substantial resources are assigned to extracting and processing plants, pipelines, distribution networks, and equipment. This investment is also taking place in South America, with major projects established in Argentina, Brazil, Bolivia, Chile, Colombia, Peru, Venezuela, and Uruguay. Argentina is one of the leading countries in shale gas production, owing to its huge reserves of alternative resources. Argentina has been financing the exploration of gas locations heavily. The growth of the shale gas reserves has also had an optimistic impact on Argentina's economy, generating jobs and attracting substantial foreign financing. As per Argentina's Ministry of Mines and Energy, it has the world's second-largest shale gas reserves after the US. The growing development related to natural gas reserves is one of the major driving factors for the market. In August 2023, the government granted permits to numerous companies for the development of new gas reservoirs and platforms.

Strategic insights for the South & Central America Gas Pipeline Infrastructure provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Gas Pipeline Infrastructure refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Gas Pipeline Infrastructure Market Revenue and Forecast to 2030 (US$ Billion)

South & Central America Gas Pipeline Infrastructure Strategic Insights

South & Central America Gas Pipeline Infrastructure Report Scope

Report Attribute

Details

Market size in 2022

US$ 166.69 Billion

Market Size by 2030

US$ 229.67 Billion

Global CAGR (2022 - 2030)

4.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Operation

By Equipment

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Gas Pipeline Infrastructure Regional Insights

South & Central America Gas Pipeline Infrastructure Market Segmentation

The South & Central America gas pipeline infrastructure market is segmented into operation, equipment, application, and country.

Based on operation, the South & Central America gas pipeline infrastructure market is bifurcated into transmission and distribution. The distribution segment held a larger share of South & Central America gas pipeline infrastructure market in 2022.

In terms of equipment, the South & Central America gas pipeline infrastructure market is categorized into pipeline, compressor station, metering skids, and valves. The pipeline segment held the largest share of South & Central America gas pipeline infrastructure market in 2022.

Based on application, the South & Central America gas pipeline infrastructure market is bifurcated into onshore and offshore. The onshore segment held a larger share of South & Central America gas pipeline infrastructure market in 2022.

Based on country, the South & Central America gas pipeline infrastructure market is segmented into Brazil, Argentina, and the Rest of South & Central America. Argentina dominated the South & Central America gas pipeline infrastructure market in 2022.

Enbridge Inc, Berkshire Hathaway Inc, Kinder Morgan Inc, and Saipem SpA are some of the leading companies operating in the South & Central America gas pipeline infrastructure market.

1. Enbridge Inc

2. Berkshire Hathaway Inc

3. Kinder Morgan Inc

4. Saipem SpA

The South & Central America Gas Pipeline Infrastructure Market is valued at US$ 166.69 Billion in 2022, it is projected to reach US$ 229.67 Billion by 2030.

As per our report South & Central America Gas Pipeline Infrastructure Market, the market size is valued at US$ 166.69 Billion in 2022, projecting it to reach US$ 229.67 Billion by 2030. This translates to a CAGR of approximately 4.1% during the forecast period.

The South & Central America Gas Pipeline Infrastructure Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Gas Pipeline Infrastructure Market report:

The South & Central America Gas Pipeline Infrastructure Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Gas Pipeline Infrastructure Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Gas Pipeline Infrastructure Market value chain can benefit from the information contained in a comprehensive market report.