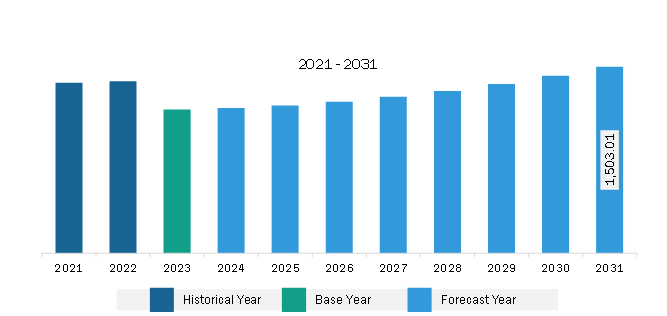

The South & Central America event logistics market was valued at US$ 1,157.69 million in 2023 and is expected to reach US$ 1,503.01 million by 2031; it is estimated to register a CAGR of 3.3% from 2023 to 2031.

Rise in Corporate Exhibition/Events in Growing Construction and Renewable Energy Industry Fuel South & Central America Event Logistics Market

Various renewable energy companies in several countries are raising spending on corporate events or exhibitions across the globe, which is boosting the number of such events. These events are focused on building relations with the community in various sectors, including solar, wind, geothermal, wave energy, bioenergy, and others. By participating exclusively in the top trade fairs of these industries, companies have the opportunity to increase their brand awareness and make a statement about their products and services in this highly growing renewable energy industry. In addition, trade shows are a robust platform that allows companies to showcase their entire business at one booth, raising company awareness among customers. A company can focus on products, services, as well as its work culture and values to ensure that potential customers visit its exhibition stand. As a result, there is a rise in spending on establishing such exhibition stands, which is expected to be the key future trend in driving the demand for event logistics services.

Events or trade shows in the construction industry are arranged each year with a focus on client engagement, product launches, and creating opportunities for business growth, among others. A few of the top construction trade shows include the Feicon Batimat, Latin American Construction Congress, ExpoCihac, and Latin American Mining Congress. For instance, Feicon Batimat is a major construction trade show held in São Paulo, Brazil, attracting around 50,000 visitors and over 700 exhibitors. The event spans approximately 70,000 square meters, showcasing a wide range of building materials, technologies, and services. It serves as a key platform for networking and discovering the latest trends in the construction industry.

Thus, the rise in corporate events or trade shows is anticipated to fuel the South & Central America event logistics market growth in the coming years.

Furthermore, renewable energy technologies such as solar, wind, geothermal, hydropower, ocean, and others are highly growing power generation technologies across the globe. Rise in awareness and investment towards generation of electricity sustainably through renewable sources is expected to grow in the future. To showcase or advertise the new and technologically advanced products in this industry, the companies or associations are arranging corporate events or trade exhibition/shows. This will benefit companies in creating business opportunities with other competitors in the market by adopting strategies such as partnership, collaboration, agreements, and others. According to EventsEye, there are more than 400 trade shows scheduled in the year 2024.

South & Central America Event Logistics Market Overview

South & Central America event logistics market is further categorized into Brazil, Argentina, and Rest of South & Central America. Brazil dominated the event logistics market in 2023 and is further expected to retain its dominance during the forecast period as well. Further, some of the major countries driving the growth for event logistics market in South & Central America region includes Brazil, Colombia, Argentina, Chile, and Peru. These countries are likely to host around 300 trade fairs in 2024 which is one of the major factors expected to drive the growth for event logistics in the South & Central America region. Further, the main industry that is likely to drive the market for event logistics is sports events sector.

South & Central America Event Logistics Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the South & Central America Event Logistics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Event Logistics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Event Logistics Strategic Insights

South & Central America Event Logistics Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,157.69 Million

Market Size by 2031

US$ 1,503.01 Million

Global CAGR (2023 - 2031)

3.3%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Event Logistics Regional Insights

South & Central America Event Logistics Market Segmentation

The South & Central America event logistics market is categorized into type, end user, and country.

Based on type, the South & Central America event logistics market is segmented inventory management, delivery management, freight forwarding, pallets and packaging services, and others. The freight forwarding segment held a larger market share in 2023.

In terms of end user, the South & Central America event logistics market is categorized into media and entertainment, sports events, corporate events and trade fairs, cultural events, and others. The corporate events and trade fairs segment held the largest market share in 2023.

By country, the South & Central America event logistics market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America event logistics market share in 2023.

C H Robinson Worldwide Inc, CEVA Logistics AG, DB Schenker, Deutsche Post AG, DSV AS, FedEx Corp, GEODIS SA, Kuehne + Nagel International AG, and United Parcel Service Inc are some of the leading companies operating in the South & Central America event logistics market.

The South & Central America Event Logistics Market is valued at US$ 1,157.69 Million in 2023, it is projected to reach US$ 1,503.01 Million by 2031.

As per our report South & Central America Event Logistics Market, the market size is valued at US$ 1,157.69 Million in 2023, projecting it to reach US$ 1,503.01 Million by 2031. This translates to a CAGR of approximately 3.3% during the forecast period.

The South & Central America Event Logistics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Event Logistics Market report:

The South & Central America Event Logistics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Event Logistics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Event Logistics Market value chain can benefit from the information contained in a comprehensive market report.