South & Central America Encapsulated Gaskets and Seals Market

No. of Pages: 69 | Report Code: BMIRE00030801 | Category: Chemicals and Materials

No. of Pages: 69 | Report Code: BMIRE00030801 | Category: Chemicals and Materials

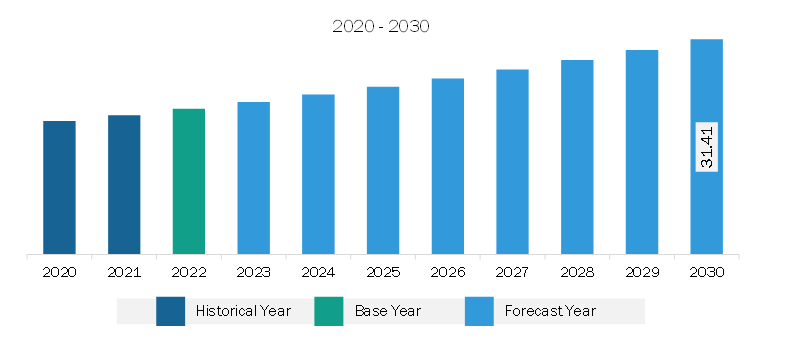

The South & Central America encapsulated gaskets and seals market was valued at US$ 21.27 million in 2022 and is expected to reach US$ 31.41 million by 2030; it is estimated to register a CAGR of 5.0% from 2022 to 2030.

Gaskets flexible at low temperatures ensure optimum sealing performance. The performance of o-rings intended for cryogenic applications is tested by standards to measure physical properties and material performance. A few tests intended for cryogenic application are brittleness (ASTM D2137), temperature recall (ASTM D1329), and compression kit (ASTM D395). Advancements in polymer engineering have led to the development of efficient encapsulated gaskets and seals with chemical resistance, mechanical properties, and pressure resistance at low-temperature operations.

FEP-encapsulated o-rings with steel flat round ribbon spring core is a promising approach for cryogenic applications. An FEP encapsulated gasket can handle low temperatures up to −420°F and pressures up to 3000 psi, as well as exposure to cryogenic media such as liquid oxygen, liquid nitrogen, and hydrogen. These encapsulated o-rings can be manufactured in both metric and US cross-sections with a wide range of diameters. Cryogenic o-rings are commonly used in the aerospace industry for tanks and rocket valve applications. They prevent the leakage of the gas mixture, which is responsible for propelling the rocket. In the oil & gas industry, gaskets are used in the transfer of liquefied natural gas and liquefied petroleum gas. Further, it is used in magnetic resonance imaging, cryogenic pumps, and radio astronomy, as well as in the production of special gases and aviation technologies. Thus, the adoption of FEP-encapsulated gaskets for cryogenic applications is expected to create lucrative opportunities in the encapsulated gaskets and seals market.

The upward trajectory of encapsulated gaskets and seals is propelled by the region's expanding industrialization, particularly in sectors such as oil & gas, automotive, and pharmaceuticals, where reliable sealing mechanisms are paramount. Key drivers of this market growth include the increasing awareness among industries about the critical role of high-quality sealing components in preventing leaks and optimizing operational efficiency. Major players in the market are responding to this demand by introducing innovative formulations and materials, contributing to a dynamic and competitive landscape in South & Central America. This trend is particularly evident as manufacturers strive to meet the diverse needs of applications ranging from aerospace to chemical processing. According to the International Organization of Motor Vehicle Manufacturers (OICA), the total number of vehicles manufactured in South & Central America grew from ~2.72 million in 2021 to ~2.96 million in 2022, registering an increase of 9%.

Major market players in the automotive sector have strategized the development and expansion of their operational capacities in South & Central America to tap the lucrative automotive market. In 2022, Audi AG invested US$ 19.2 million to restart production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year. The region's automotive industry, which relies mainly on import and export for revenue generation, considerably creates lucrative opportunities for encapsulated gaskets and seals. The rise in passenger car sales is the prime factor driving the encapsulated gaskets and seals market growth in the region.

As South & Central America continue to witness economic development, the encapsulated gaskets and seals market is poised for further expansion. The region's evolving manufacturing landscape and the ongoing modernization of industrial processes are expected to fuel sustained demand for advanced sealing solutions, positioning encapsulated gaskets and seals as a crucial component in ensuring the reliability and longevity of various systems across different sectors.

Strategic insights for the South & Central America Encapsulated Gaskets and Seals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 21.27 Million |

| Market Size by 2030 | US$ 31.41 Million |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Encapsulated Gaskets and Seals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America encapsulated gaskets and seals market is categorized into material, end use, and country.

Based on material, the South & Central America encapsulated gaskets and seals market is segmented into silicon, neoprene, Viton, Teflon, and others. The Viton segment held the largest market share in 2022.

Based on end use, the South & Central America encapsulated gaskets and seals market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The oil and gas segment held the largest market share in 2022.

By country, the South & Central America encapsulated gaskets and seals market is segmented into Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America encapsulated gaskets and seals market share in 2022.

AS Aston Seals SPA, Gasco Inc, Trelleborg AB, and VH Polymers are some of the leading companies operating in the South & Central America encapsulated gaskets and seals market.

The South & Central America Encapsulated Gaskets and Seals Market is valued at US$ 21.27 Million in 2022, it is projected to reach US$ 31.41 Million by 2030.

As per our report South & Central America Encapsulated Gaskets and Seals Market, the market size is valued at US$ 21.27 Million in 2022, projecting it to reach US$ 31.41 Million by 2030. This translates to a CAGR of approximately 5.0% during the forecast period.

The South & Central America Encapsulated Gaskets and Seals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Encapsulated Gaskets and Seals Market report:

The South & Central America Encapsulated Gaskets and Seals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Encapsulated Gaskets and Seals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Encapsulated Gaskets and Seals Market value chain can benefit from the information contained in a comprehensive market report.