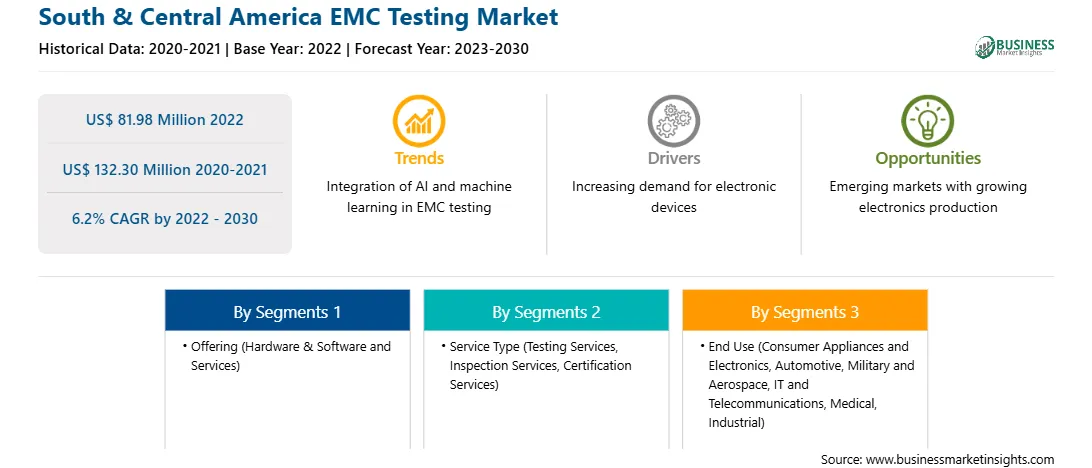

The South & Central America EMC testing market was valued at US$ 81.98 million in 2022 and is expected to reach US$ 132.30 million by 2030; it is estimated to grow at a CAGR of 6.2% from 2022 to 2030.

Battery-powered electric vehicles (BEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs) are the three primary forms of electric vehicles (EVs). Electric two-wheelers, three-wheelers, and buses are gaining significant traction owing to rising environmental concerns and government support. Power converters, shielded and unshielded cables, electric motors, wireless chargers, and batteries are the key typical electric drive system components. All these components are susceptible to EMI and electromagnetic radiation. In recent years, the popularity of wireless charging has increased in the electric vehicles market. Unlike automobiles powered by internal combustion engines, certain electric vehicles emit more electromagnetic waves when charging than when driving. The power required by the electric drive system is significantly higher than that required by the entire electric system in traditional automobiles. Other characteristics of an electric vehicle, including weight, size, and produced noise, need the use of specialist EMI shielding materials. As a result, the rise of the electric vehicle market is likely to open up significant opportunities for the South & Central America electromagnetic compatibility (EMC) testing market players in the coming years.

The growth of the South & Central America EMC testing market is driven by the increasing demand for comprehensive embedded systems. The region is characterized by a mixed growth scenario, with many countries having complex political and macroeconomic environments. Governments are striving to bring developments in various industries at a sustainable pace, thereby allowing economies to thrive. At present, several countries in SAM lack the infrastructure and resources required for establishing manufacturing units. With the slow but continuous recovery of the Brazilian market, the overall passenger car industry is also flourishing gradually, and it accounts for a substantial market share in terms of production, sales, and exports. Low interest rates on vehicle loans are encouraging the sales of passenger cars. A resultant rise in the production of the automotive sector across the region is expected to influence the market growth in the region. Many automotive players are significantly investing in the market in Brazil to attract customer. For instance, according to Volkswagen AG data from April 2023, the South America automotive market is projected to grow at rate of 11% by the end of 2030. The growth in the automotive industry in South America has encouraged the company to invest 40% of its capital in Brazil to launch 15 new electric and flex-fuel vehicle models by 2025. Moreover, the company also plans to invest US$ 1.05 billion by 2026 in the South America automotive market, which will increase the demand for EMC testing. EMC testing helps automotive manufacturers identify and address potential issues of the vehicle to limit unexpected electronic system failures and allows the smooth running of vehicles without compromising the safety of drivers and passengers, which is driving the market.

Brazil has a huge electronics manufacturing industry with the presence of manufacturing plants of a few of the largest electronics companies. The country imposes high taxes on imported products such as computers, telecommunications equipment, and appliances. However, foreign electronics that are manufactured in Brazil are levied with lower tax burdens. The country is witnessing a high demand for electronic products due to the rising middle-class population, which increases the adoption of EMC testing among electronic manufacturers. However, countries in South America are attracting huge FDIs in the manufacturing sector with the availability of cheap labor, low entry barriers, and low interest rates. A few of these countries have relaxed FDI regulations. For example, Argentina is attracting high FDIs by easing import restrictions and signing international bilateral agreements; it is also bringing relaxations in restrictions on foreign investments for the same purpose. Thus, a continuously growing manufacturing sector across the countries in South America is magnifying the demand for EMC testing across the region.

Strategic insights for the South & Central America EMC Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 81.98 Million |

| Market Size by 2030 | US$ 132.30 Million |

| Global CAGR (2022 - 2030) | 6.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America EMC Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America EMC testing market is segmented based on offering, service type, end use, and country. Based on offering, the South & Central America EMC testing market is bifurcated into hardware & software and services. The hardware & software segment held a larger market share in 2022.

In terms of service type, the South & Central America EMC testing market is segmented into testing services, inspection services, certification services, and others. The testing services held the largest market share in 2022.

By end use, the South & Central America EMC testing market is segmented into consumer appliances and electronics, automotive, military and aerospace, IT and telecommunications, medical, Industrial, and others. The consumer appliances and electronics held the largest market share in 2022.

Based on country, the South & Central America EMC testing market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America EMC testing market share in 2022.

Ametek Inc, Eurofins scientific SE, Intertek group PLC, SGS SA, TUV SUD AG, and UL LLC are some of the leading companies operating in the South & Central America EMC testing market.

1. Ametek Inc

2. Eurofins Scientific SE

3. Intertek Group PLC

4. SGS SA

5. TUV SUD AG

6. UL LLC

The South & Central America EMC Testing Market is valued at US$ 81.98 Million in 2022, it is projected to reach US$ 132.30 Million by 2030.

As per our report South & Central America EMC Testing Market, the market size is valued at US$ 81.98 Million in 2022, projecting it to reach US$ 132.30 Million by 2030. This translates to a CAGR of approximately 6.2% during the forecast period.

The South & Central America EMC Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America EMC Testing Market report:

The South & Central America EMC Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America EMC Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America EMC Testing Market value chain can benefit from the information contained in a comprehensive market report.